Dive Brief:

- Spotify acquired Betty Labs, the creators of sports-focused live audio app Locker Room, per a press release. The deal values Betty Labs at around $50 million, and the value could climb closer to $80 million if certain targets are met, a person familiar with the transaction told The Wall Street Journal.

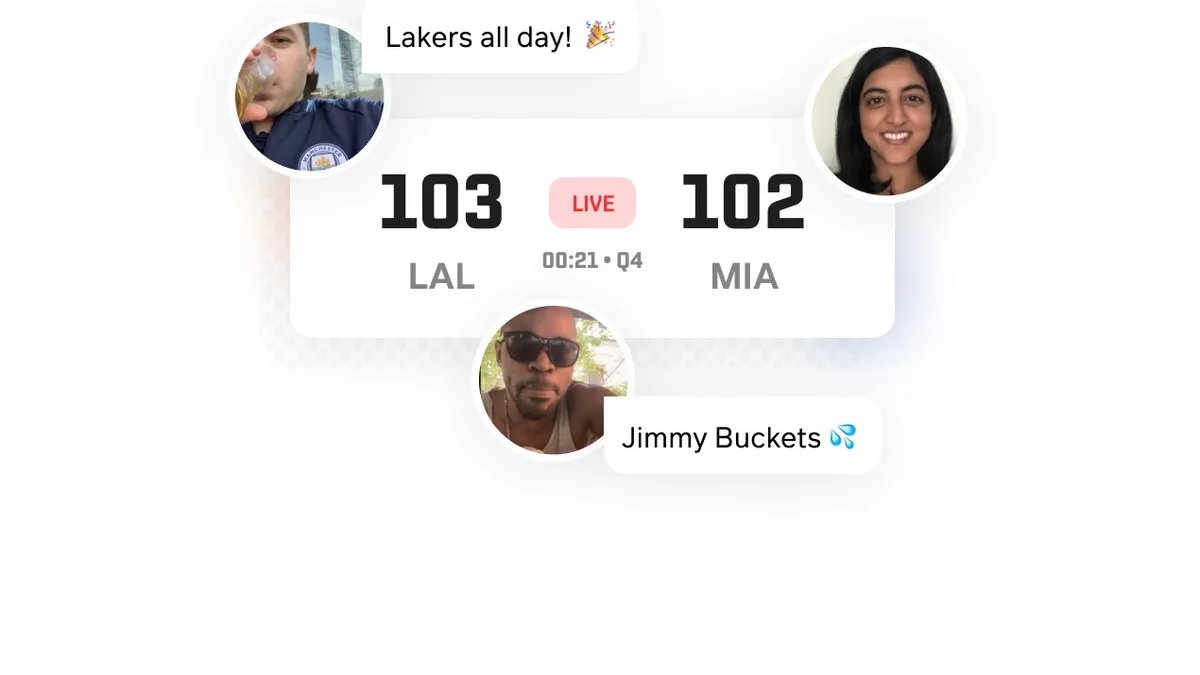

- Spotify plans to expand the Locker Room app's positioning to reach a wider range of creators and fans, offering a range of sports, music and cultural programming along with interactive features. The platform will give professional athletes, musicians, podcasters and other voices a range of audio experiences, per a blog post.

- Betty Labs was initially backed by Lightspeed Venture Partners and more recently by Google Ventures and Precursor Ventures. Its acquisition by Spotify allows the streaming platform to get in on the live audio space, which is quickly ramping up due to interest in apps like Clubhouse.

Dive Insight:

Spotify's acquisition of Betty Labs and its Locker Room app point to the "future formats of audio" that the platform is developing, per the company's blog post. Live audio apps like Locker Room and Clubhouse have quickly grown popular by offering an interactive alternative to podcasts and chat services. Compared to Clubhouse, which surged to 2 million users in January, Locker Room has seen about 19,000 installs since its October launch, per Sensor Tower data cited by the Journal, suggesting that Spotify is getting in on the ground floor of a burgeoning media platform.

As its name suggests, Locker Room has focused on sports at a time when fans are looking for additional ways to connect in lieu of in-person sporting events and gatherings at bars. While sports will remain a focus of Locker Room under Spotify, it seems the company sees Locker Room as a foundation for moving into live audio around a variety of topics and interests, promising the ability for people to host real-time discussions, debates, "ask me anything" sessions and more. However, the deal is also a small bet on a new format that is far from proven in terms of monetization potential.

"Maybe live is a revenue model, maybe it isn't," Gustav Söderström, Spotify's research and development chief, told the Journal. "It has potential, and it's our job to explore."

With the acquisition, Spotify joins Clubhouse, Twitter Spaces, Facebook's rumored Clubhouse rival and a just-announced LinkedIn offering, among others, in the quickly growing live audio space. Clubhouse is leading the way thanks to a reported $1 billion valuation and interest from tech figures like Elon Musk. It could also develop into a social media platform for marketers: Burger King parent company Restaurant Brands International last month hosted an hour-long chat with executives just a day after reporting its full year and fourth quarter 2020 earnings results.

Over the last year, Spotify has focused its acquisitions in the growing podcast space. It scooped up high-profile content providers in The Ringer and "The Joe Rogan Experience," and bought podcast advertising and publishing company Megaphone in a deal that valued the company at $235 million.