Of the many consumer trends that accelerated during the first year under a pandemic, the migration of consumers from linear to streaming TV seems to be one of the most durable. And for TV platform Roku, that surge in streaming video viewership — especially as consumers have spent more time at home — has spurred record revenue.

As TV upfronts — where networks showcase content and make deals with ad buyers — get underway, Roku looks poised to build on the growth of last year, which saw its active accounts jump 39% year-over-year for a total of 51.2 million. It could be particularly attractive as advertisers will be looking to spend more on video, especially on connected TV (CTV) platforms that ensure brand safety and professionally produced content, among other guarantees. The IAB NewFronts, which first launched in 2008, focus on the digital content marketplace and will take place this year on May 3.

"We think that the TV upfront and TV landscape are changing permanently," said Dan Robbins, Roku's vice president of ad marketing and partner solutions. In the position, which he has held for nearly two years, Robbins is responsible for business marketing as well as the design, creative, events, research and performance analytics teams.

"If you're trying to use TV as a way to reach folks, traditional TV no longer cuts it," he said, noting that linear TV ratings have declined 39% over the past four years, and that the average age for broadcast networks has inched past 60 years old.

In an interview with Marketing Dive, Robbins explained how Roku's offerings capitalize on this landscape, how its recent partnership with Nielsen will make it even more useful to advertisers and more.

This interview has been edited for clarity and brevity.

MARKETING DIVE: How do you think the upfronts will be different this year?

DAN ROBBINS: We think three things — reach, tentpoles and performance — are going to be part-and-parcel to the way marketers think about their strategy this upfront. The focus in that shift to streaming is going to be on maximizing reach and taking advantage of finding cord-cutters and light TV viewers; going big for TV tentpoles and making sure you have the ability to reach folks in those key marketing moments like the Super Bowl, March Madness and award shows; and third, [focus] on performance, where TV is not just a brand-building vehicle. It's also like the digital world — a performance vehicle.

With that in mind, what is Roku focused on this year, for both upfronts and NewFronts?

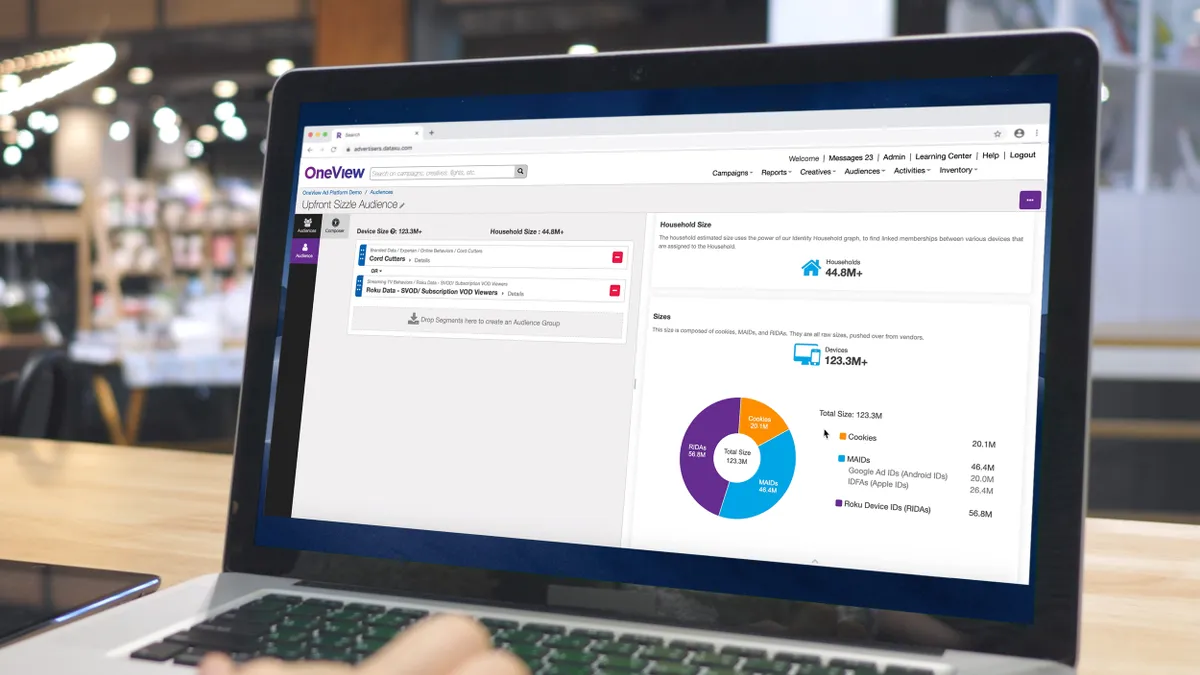

ROBBINS: We're actually going to be kicking off the NewFronts this year as the first presenter of the week, and we're shaping the strategy now with a few keys for us. The first is OneView, which is our ad-buying platform built for TV streaming, and our focus there is going to be helping marketers optimize their entire upfront across streaming and linear TV. So you can look at desktop, mobile, linear TV, and TV streaming and get "one view" of the entire buy.

The second focus is going to be the Roku Channel, which is our owned and operated channel, providing free movies and television to our streamers. It's grown about twice as fast as the overall platform in the last year. The third focus we're going to bring to the upfront is measurement. We recently announced a partnership with Nielsen, and we're going to focus on bringing transparent reach and frequency across every screen with Nielsen, as well as sales attribution — being able to actually measure whether an ad on TV screen drove a product sale or a sign-up.

We think the top line focus, though, is going to be something that one of the agency presidents shared with us, which is that they're going into this upfront to buy TV like you watch TV. And that's what our focus is going to be as well.

What does an advertising-based video on demand (AVOD) service like the Roku Channel offer to consumers, especially as they face subscription fatigue among the surge in subscription video on demand (SVOD) offerings?

ROBBINS: What we've seen is that streamers now have more content options than ever before. Our research tells us more than half of our consumers don't know what to watch next. So as we go into the upfront, we really think that scale is going to define the future of TV, that there will be streaming services that draw large, standalone audiences, but there's actually going to be hundreds of channels that thrive when it's easy for streamers to find their shows.

The genesis of our goal with launching the Roku Channel in 2017 was to bring great movies, TV and programming to the front of the home screen, and to make it really easy for consumers to find free movies and premium subscriptions. As for fatigue, we really think there's still a tremendous opportunity in streaming, and while more than a third of consumers don't have a pay TV subscription, there are increasingly folks who are cutting the cord and coming over to TV streaming. The opportunity for entertainment owners and content owners to still build their audience remains pretty large.

Can you detail how the Nielsen partnership will help advertisers?

ROBBINS: There are two key parts to our alliance with Nielsen. The first is that we've acquired their advanced video advertising business with the goal of working with TV programmers to accelerate dynamic ad insertion in linear TV. We want to take all of the benefits of TV streaming — advertising, the one-to-one relationship, the data, the measurement and the attribution — and bring it to the traditional TV screen. In the same way you can make sure your ad is going to the right home in the digital world, a broadcast linear network can now do that same real-time ad replacement in traditional TV. It brings the precision and the efficiency that linear TV historically hasn't had.

The second thing is our strategic alliance around measurement, and we'll have more to share there in the coming weeks. The two real focuses are going to be one providing holistic duplicated reach and frequency measurement across desktop, mobile and TV streaming, so advertisers can understand the age and gender of who they're reaching, no matter where they're buying. The second key is attribution: bringing the same cost-per-acquisition and performance advertising metrics that exists in the digital world to the TV screen.

How can an advertiser use Roku in a way different from other platforms?

ROBBINS: When you're already running as a marketer on TV streaming, the question we pose is, why stop with a 15- or 30-second video? We want to make it easy to go beyond that. The Walmart example [on our earning call] was built around a holiday campaign where Walmart wanted to reach millennials 18 to 34, who are shopping during the holiday season, and so they ran targeted video ads. What they did on top of it was launch an interactive Roku TV sweepstakes from the Roku home screen. So a streamer could actually enter those sweepstakes just with a click of their remote. What we found was that 80% of streamers who were exposed to that campaign had not seen a Walmart ad on traditional TV, and that brand favorability for Walmart increased about 65% in that 18-34 demographic. So it was actually those cord-cutters and younger folks who are not on traditional cable.

As we move into the upfront, we're really focusing on tentpole events like sports. This year, the Super Bowl saw a massive shift in viewership: linear TV reach declined about 15%, while streaming on Roku increased 44%. These tentpole and cultural events are vitally important to marketers as they've helped build brands for decades, and audiences are moving to streaming. So the sponsorship in the ad experience that goes beyond the 30-second ad in linear TV will move to streaming as well. In the upfront, you'll see us unveil a lot about how to make the most of those big tentpole moments.

Does the changing data privacy landscape make platforms like Roku more attractive for advertisers?

ROBBINS: Roku has put a focus on helping the industry move on identity solutions that are specific for TV streaming. We are not a cookie-based platform, we are not a platform that has Apple IDFA or Android/Google Ad IDs. We launched our Roku ID for Advertisers that is available just like a mobile ad ID. It enables nearly two dozen data and measurement providers to deliver better targeting and attribution in TV streaming. Our partnership with Nielsen is actually built on that. OneView is built on our identity solutions, and then expanding them across all of the ad inventory — not just on Roku, but anywhere marketers can buy.

Where we think the market is ultimately going is toward platforms that have a direct consumer relationship. Any universal ID without identity is like a passport without a name or address. If an app platform doesn't have that direct consumer relationship, they're left guessing about consumer identity. And in turn, advertisers are left guessing about performance. Where we think the market is going is ultimately toward delivering the best possible identity solutions for partners, and TV streaming is actually a really good place to do that because of the way it's endemically set up.