Dive Brief:

- Publicis Groupe will invest 300 million euros (about $325 million) over the next three years to better position its business around generative artificial intelligence (AI), one of the most significant agency bets on the technology to date, according to a press release.

- The investment will support an in-house platform called CoreAI that draws on troves of Publicis data, including 2.3 billion consumer profiles. CoreAI will aid in five service areas: insights, media, creative and production, software and operations.

- The first 100 million euro tranche will be deployed in 2024, with half used for upskilling and hiring and half intended for technology licensing, cloud infrastructure and software. Publicis enacting the latest chapter in its transformation comes as the network reported organic revenue growth of 6.3% in 2023, above prior guidance.

Dive Insight:

After a year of breathless hype, generative AI’s impact on marketing and advertising is coming into clearer focus. Publicis is experimenting with how the fast-emerging technology could reshape large parts of its marketing services behemoth, raising the stakes for rivals that have lagged on the performance front. In the announcement, executives positioned the move as yet another reinvention, with the goal of making Publicis “the industry’s first AI-powered Intelligent System.”

“Becoming an intelligent system will allow us, thanks to AI, to connect all of our enterprise knowledge,” said CEO Arthur Sadoun during a presentation to investors and the press. “Each individual within the group will have access to everything we know at Publicis, at every expertise and every geography … We are bringing together all of the data within each and every aspect of the group under one single entity.”

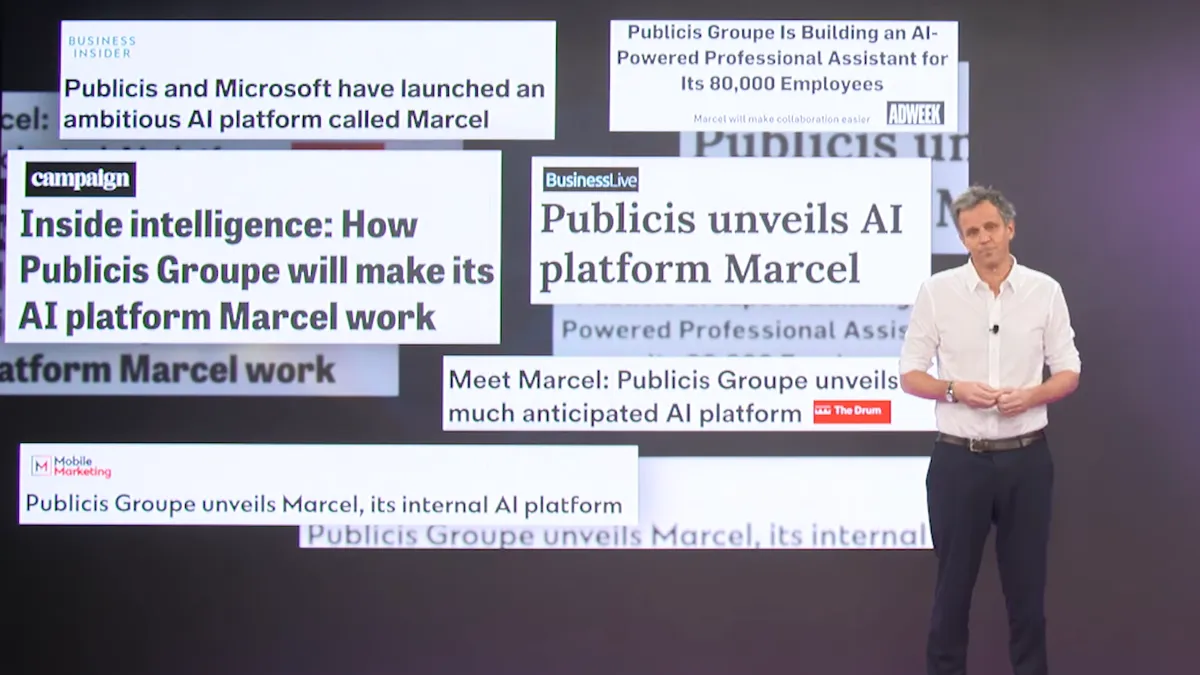

Publicis bills CoreAI, which started development last year, as the next step of a strategy that has seen the firm sometimes painfully try to distance itself from the cumbersome structures and stodginess associated with traditional agency networks. The journey to turning into a “platform” company has involved bigger bets on data, including a whopper deal for Epsilon in 2019 (a heftier investment than CoreAI by several orders of magnitude); shifting to a country-based model; and streamlining its operational backbone, including through an AI assistant named Marcel that debuted in 2018.

Marcel, the target of some mockery at launch, has seemed to be vindicated in the long run. Rivals are now racing to improve their AI know-how and services, while many in the industry are anxious to see how much of their work will be eliminated by automation. WPP last year struck a pact with Nvidia around the development of an AI-powered content engine and others, like Dentsu, have recently ramped up their bets in the sector.

“I don’t think AI will ever replace great creative minds,” said Sadoun during the presentation. “Having said that, there is no doubt that generative AI will help us push the boundaries of creativity even further.”

Publicis is promoting CoreAI as more sophisticated than rival offerings thanks to the strengths of the agency’s data sets. The group’s $4 billion purchase of Epsilon is another decision that initially invited skepticism but has helped Publicis drive growth as client demands for data-driven expertise mount amid the death of the cookie and other signal loss. Publicis’ data and tech segment accounted for a third of net revenue in Q4, with Epsilon experiencing double-digit growth over the period.

CoreAI will be trained on data from Epsilon, Publicis Sapient, CitrusAd, Profitero and Marcel. In total, the software has access to 2.3 billion consumer profiles and hundreds of thousands of attributes about those people, along with a window into some 650 impression bids that are made daily.

“Because we own this data, we have the clearest line of sight into the thousands attributes that describe these people,” said Sam Levine Archer, chief solutions officer at Publicis North America, drawing constrast with competitors who license their data.

AI’s threat to jobs and associated ethical concerns were addressed by Publicis leadership, who emphasized that they want to use the tech as an “opportunity for our people to grow.” Still, CoreAI’s applications are wide-ranging and it’s easy to imagine them disrupting some roles over the long term. Engineers currently account for roughly 40% of the agency’s workforce, executives stated.

In an example use case described during the presentation, an automaker is under pressure to sell 40,000 electric SUVs in a short time frame. A Publicis employee uses CoreAI’s insights function to digest the client brief quickly and extrapolate key data points, massively improving efficiency.

“Instead of having teams of data scientists working to clean and then to harmonize and then to analyze the data over the course of weeks, our strategists immediately respond with clear analysis of the opportunity,” said Archer.

A media planner then queries the platform’s chat feature to gauge how much investment would be needed to move that many EV units in a year while monitoring for specific trends at the dealership level. Creative tools could mass-produce assets and tailor them to specific platforms like TikTok, along with different languages and audience segments.

Publicis emphasized that implementing CoreAI will not be an overnight process. Alpha testing will begin in the first half of the year while the full organization might not have access until H2 or beyond. Regarding the potential effect of the investment on financial performance, Sadoun closed the presentation by offering an assuring message to investors.

“While increasing our competitiveness, this investment will have no dilutive impact on our operating margin in 2024,” said Sadoun.