While direct-to-consumer (DTC) is no longer seen as the marketing panacea it once was — especially during the peak pandemic period — the sales channel can still be useful to CPG marketers as part of an omnichannel strategy. That is the case for Mondelēz and its flagship cookie, Oreo.

“We approach DTC as a tool for creating closer connections to our consumers and learning from them. It enables us to test new products, marketing strategies, engagement tactics and pricing models,” said Kamila DeMaria, director and general manager of DTC at Mondelēz, via email.

To enhance its capabilities, Oreo this year chose digital commerce agency Goodness as its DTC agency partner. The partnership evolved out of Goodness’ previous work to migrate Oreo from Adobe’s Magento e-commerce platform to Shopify to improve efficiency and user experiences.

“Shopify, and the tools that it unlocks, lets a brand like Oreo behave more like a digitally native brand and compete on that level,” said Ethan Martin, strategy director at Goodness. “That’s what the Oreo team specifically was after, and what Mondelēz is hoping to unlock across the whole portfolio.”

Uniting DTC and equity

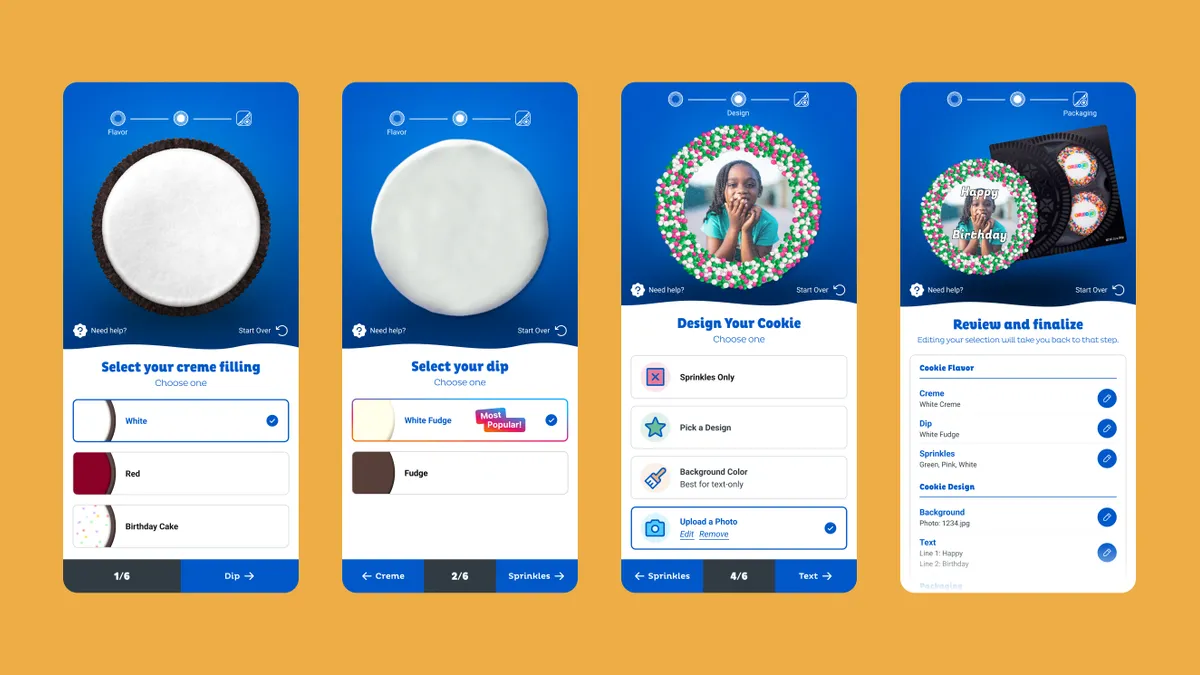

Goodness’ work was two-fold: building a new e-commerce system that could be scaled across Mondelēz’s portfolio that would be efficient enough to outweigh the high cost of going direct to consumer, and opening up new opportunities for the brand’s OreoID customization platform.

“[With OreoID] we really had our chance to optimize, make something that was more modern, fun, sleek and cool and that feels like a dashboard, and really try to greatly reduce customer service calls and greatly increase conversion rate for every step,” said Donald Fierros, chief operating officer at Goodness.

The work also allowed Oreo to sell retail packs and limited-edition flavors through its e-commerce shop for the first time, opened up the ability to better integrate brand campaigns and unlocked the possibility for a deeper partnership with Goodness.

“There was opportunity with Goodness’ skill sets and the match between DTC and equity sides of Oreo where their goals are different,” Fierros said.

Experimenting with data

Since coming on as an agency partner in Q2 of this year, Goodness has worked to connect internal systems that it hopes will eventually allow for Oreo to deploy fully personalized communications that enhance engagement and conversion for DTC. Nearly half a year into its relationship with Oreo, Goodness has iterated on OreoID and is working to connect ad, media and CRM data to the e-commerce site. And despite its legacy bona fides, Oreo sees itself as an innovator around data in the space.

“The advantage that Oreo has is that they have this massive pillar of retail sales that's the core of their business,” Martin said. “It gives them real room to experiment and leverage their DTC platform in a way that maybe a digital brand can’t.”

Building and experimenting with a more connected data infrastructure through DTC will be key to Oreo’s needs on the equity side of its business around how it captures zero- and first-party data at every consumer touch point. Those imperatives are likely to persist, no matter what Google’s plans for third-party cookies portend.

“Building direct relationships with consumers through compelling value exchanges is at the very core of Oreo’s marketing transformation agenda,” said Hamish Stacy, senior manager and U.S. Oreo consumer data lead, via email. “It sets the foundation for developing a sustainable competitive advantage when applied to empathy at scale across our paid and owned ecosystem.”

That data will also be key in training the company’s generative AI infrastructure, Stacy explained. Mondelēz International in September announced the launch of a new platform supported by Accenture and Publicis Groupe that seeks to better harness the emerging tech.

Understanding conversion

For marketers, collecting data is one thing. Making sure the data is valuable, understanding what has been collected and generating insights is a more complicated proposition. Goodness is helping the Mondelēz data team ensure that data flows in one direction, in the same funnel and into the same storage.

“That way, we don't have to rely on these big third-party tools to understand the data. We can understand the data on our own, and so can the teams at Mondelēz,” said Fierros.

CRM has increasingly become a focus for Oreo, as it has throughout the marketing industry. Goodness is helping Oreo think about what first-party data it can gain by asking customers about their favorite products, limited editions and campaigns. The agency is also supporting Oreo’s efforts to determine which zero-party data it can glean from its online platforms (e.g. which content themes best drive web traffic). If done correctly, all of this data can help inform media strategy.

“Our conversion metrics won't necessarily be sales. They will depend on the challenge, like list growth or data enrichment,” Fierros said. “We've got a few North Star metrics that we're driving to, but we do have to consistently look at attribution methods to make sure that each one of those North Star metrics is being tracked in a consistent way.”

For Oreo, building and operating a stronger data infrastructure will help it support its ambitious goals around acquisition, activation and analysis that Goodness can help it achieve, Oreo’s Stacy explained.

“To reach our ambition we heavily rely on the expertise of agency ecosystem partners and their ability to work collaboratively with each other and constantly challenge, break, and rebuild ways of working,” the executive said.