Dive Brief:

- Instacart is pitching advertisers on Google Shopping ads enhanced by its own retail media data as part of a new pact with the search giant, per a press release.

- Early partners for Google Shopping ads powered by Instacart include Danone’s Oikos and Kraft Heinz’s Kraft, Lunchables, Oscar Mayer and Philadelphia brands, along with some of Publicis Media’s consumer packaged goods clients.

- The deal shows Instacart continuing to scale its off-site retail media offerings, with ad placements emphasizing same-day delivery convenience on Google Shopping pages. For Google, the move could drive more transactions in a category that has historically been dominated by rivals like Amazon.

Dive Insight:

Instacart is off to a busy start in 2024, with the Google tie-up the latest bid to round out its budding advertising business. The news, unveiled at the closely watched CES tech confab in Las Vegas, is indicative of how off-site channels are increasingly valuable for retail media networks as they look to scale faster and contend with saturated inventory on their owned properties. It also represents a bigger bet on retail media from Google, which is trying to nudge more people using its search engine toward purchases of everyday goods like groceries.

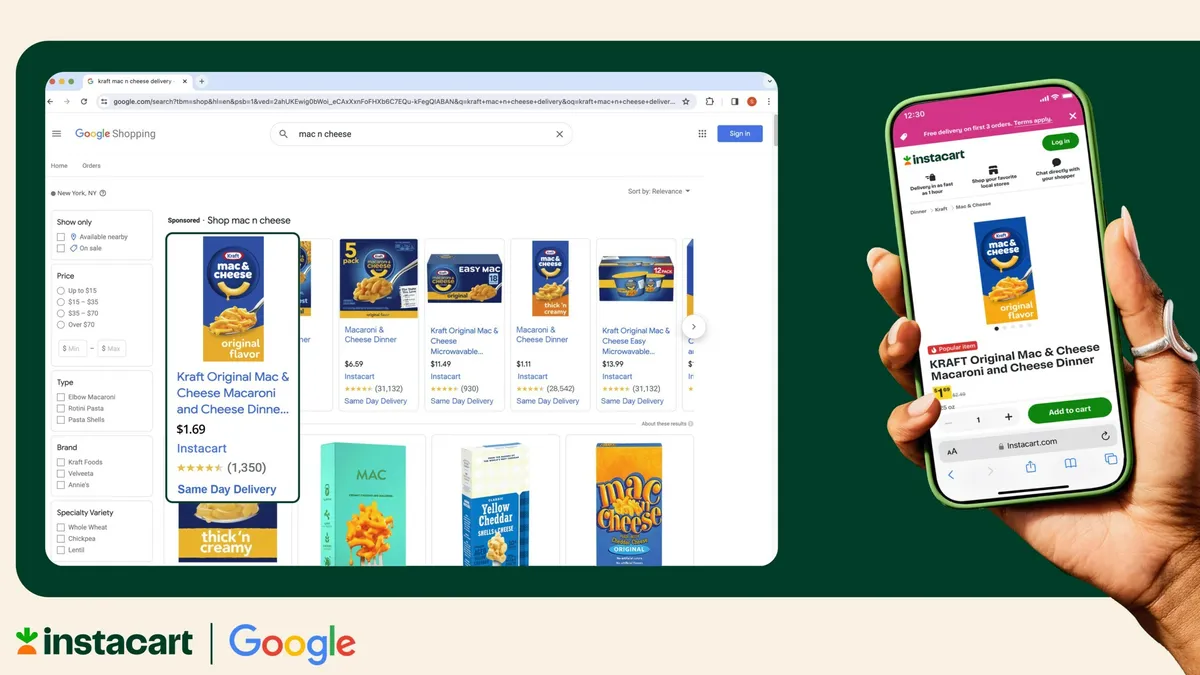

Advertisers testing the new Google Shopping tools can draw on Instacart data derived from a catalog of more than 1.4 billion products on 1,400 retail banners and track the results of their campaigns through the grocery technology firm’s closed-loop measurement capabilities. In an example highlighted in the release, a high-intent consumer querying for “mac n cheese” on Google Shopping is greeted by a row of sponsored display ads from Kraft linking out to Instacart and promoting same-day delivery.

Instacart sits in an interesting place in the retail media ecosystem, providing delivery and pickup orders that are sourced from other grocers, many of whom operate their own rival networks. Securing a stronger connection to Google, still the most-used search engine by a wide margin, could provide Instacart with an advantage as online platforms and retailers push to link e-commerce closer to advertising to get in on a lucrative media opportunity.

Several high-profile CPG marketers are already experimenting with Google Shopping ads enhanced by Instacart, such as Danone and Kraft Heinz. U.S. ad spending on digital retail media hit $46 billion in 2023, according to Insider Intelligence estimates cited by Instacart. That figure is expected to more than double by 2027 as marketers seek more first-party data-based solutions amid cookie deprecation and shifting consumer habits.

Instacart, which went public in September, has been quickly rolling out ad products to drive revenue and attract more advertisers into its network. Earlier this week, the company announced it would begin piloting ads on Caper Carts, its smart grocery shopping carts supported by artificial intelligence.