Dive Brief:

- E.l.f. Beauty’s heavier investments in marketing are winning over key young consumers and helping to grow sales, executives said when discussing fiscal Q4 and full-year earnings with investors.

- The beauty and cosmetics marketer increased marketing spending to 25% of net sales in fiscal 2024, a steep climb from 7% of net sales five years ago. Marketing and digital budgets in the most recent fiscal quarter were even higher at 34% of net sales.

- E.l.f. has recently ventured into partnerships, including a tie-up with sparkling water brand Liquid Death, and ran its first national Super Bowl spot in February. Looking at the year ahead, it plans to maintain similar marketing budgets to preserve a disruptive edge.

Dive Insight:

E.l.f., which stands for Eyes. Lips. Face., is reaping the benefits of a more aggressive marketing strategy at a time when many brands are watching their budgets closely. Executives credited a “disruptive marketing engine” as one of the three core growth drivers of the business, the other two being value proposition and innovation.

E.l.f. net sales jumped 77% year over year in fiscal 2024 to $1.02 billion, while sales for the period ended in March were up 71% YoY to $321 million. Fiscal Q4 represented the firm’s 21st consecutive quarter of net sales growth and market share gains.

E.l.f. has promoted itself aggressively on TikTok, a trend-setting platform for cosmetics, and also dipped into more unusual areas to build its name recognition. Its recent collaboration with beverage marketer Liquid Death on a goth-themed Corpse Paint product proved particularly popular. The makeup collection, which was boosted by influencers like Julia Fox, sold out in 45 minutes and resulted in a triple-digit lift in traffic to E.l.f.’s website, according to an investor presentation. Sixty-eight percent of Corpse Paint purchasers were new to the brand. E.l.f. has also been active on gaming platforms like Roblox that are not as popular with beauty rivals but represent an important way to reach cohorts like Gen Alpha.

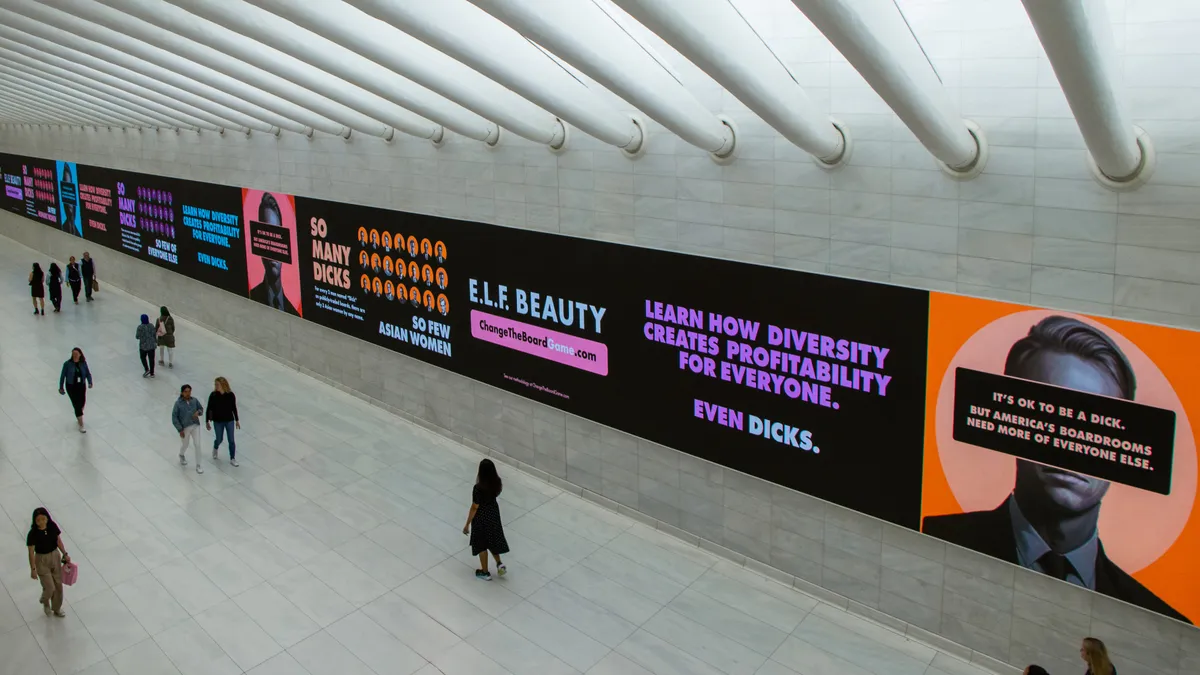

The skin cream and makeup purveyor has extended into traditional media arenas as well. E.l.f. ran its first national Super Bowl ad in February after a regional big-game buy in 2023. An out-of-home campaign that launched earlier in May embodies an in-your-face ethos. Outdoor ads appearing around Wall Street call out corporate America for being filled with “So Many Dicks,” a reference to the high number of men with the name Richard, Rick or Dick on the board of directors for publicly traded companies. The work is part of E.l.f.’s “Change The Board Game” initiative around improving corporate diversity.

E.l.f.’s positioning has seemed to resonate especially well with elusive young audiences like Gen Z. CEO Tarang Amin called out Piper Sandler research that found E.l.f. remains the number one cosmetic brand among teens, having grown market share by 16 points to 38% of the vertical. Unaided brand awareness for E.l.f. among U.S. consumers has also doubled since 2020 to 26%, helping close the gap with legacy rivals like L'Oréal, CoverGirl and Maybelline.

Looking ahead to fiscal 2025, E.l.f. is planning “a more balanced pace of marketing and digital spend,” CFO Mandy Fields said on the call with investors. Marketing and digital investment are expected to land between 24% to 26% of net sales.