Dive Brief:

- DoorDash today (Oct. 17) revealed an expansion of its self-serve advertising offerings for CPG brands intended to better leverage the delivery service’s local commerce network, per information shared with Marketing Dive.

- New tools for CPGs include a self-service ad manager, third-party platform management and API integrations for in-house management. Additionally, the company is expanding its self-service sponsored listing to Canada and Australia.

- The rollout comes as delivery services, which thrived during the pandemic, search for ways to keep both advertisers and consumers engaged. DoorDash’s base of 25 million monthly active users may entice CPG companies looking to target shoppers.

Dive Insight:

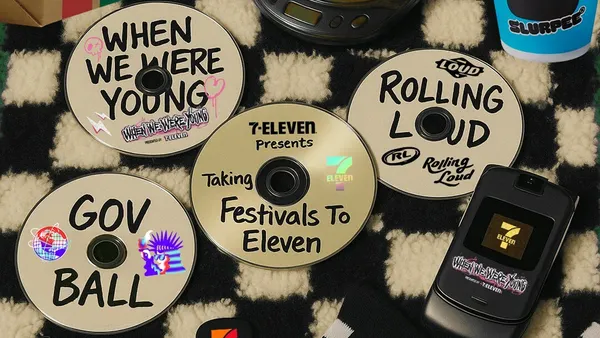

DoorDash’s advertising expansion comes one year after the launch of its advertising platform, which initially included self-service capabilities designed specifically for restaurants. However, as DoorDash expands beyond takeout into other categories such as grocery and convenience stores, widening the capabilities of its self-service ad platform makes sense.

CPG marketers appear open to embracing new ways to reach digital shoppers on DoorDash. PepsiCo, for example, is one of the first to integrate DoorDash’s API into its own proprietary ads management platform. For some brands, initial results suggest DoorDash is successfully supporting goals like reaching new customers, with half of the orders driven by a recent Clorox campaign having been made by first-time customers.

As part of the self-service platform, CPG marketers will be able to target users across three different formats: Collections, Categories and Search. With Collections, ads for a product will appear in curated aisles across multiple stores. Categories allows brands to boost themselves to the top of category results as users browse while Search enables products to appear at the top of searches.

In addition to these specific tools, DoorDash ads will also be available to CPGs through third-party platform management companies Pacvue and Flywheel.

These expanded services go beyond what the company unveiled for CPG brands in October of last year and are more inline with what is offered to restaurants. Previously, brands had access to banner placements and featured listings. According to DoorDash, the new tools are working and say that on average, more than 50% of orders generated by ads came from new customers.

Other delivery services such as Instacart have unveiled similar plans as digital ad networks become more common among platforms with first-party transactional data that can be leveraged to optimize campaigns. Capitalizing on such data was likely a driving reason behind Kroger’s purchase of Albertsons last week and underpins growing ad businesses from Amazon, Walmart and others.