Dive Brief:

- A majority (58%) of CMOs are comfortable or very comfortable developing and executing a TV buying strategy in an increasingly complex video environment, according to a survey of marketers commissioned by The CMO Club and shopper intelligence provider Catalina.

- While some CMOs are comfortable with the landscape, 80% rely on media buying agencies and consultants for insights or guidance when developing a TV buying strategy, with 42% saying their agency team is primarily responsible for the strategy.

- In the next year, 44% plan to hire external partners or agencies in the next year to increase reach and effectiveness of TV dollars. The need for more partners comes as the shift from linear TV to connected TV (CTV) and addressable TV contribute to a fragmented ad landscape.

Dive Insight:

The shift to streaming has opened new opportunities for advertisers and driven an increase in ad spending — CTV ad spending is predicted to increase nearly 32% to more than $19 billion this year, per eMarketer — that has benefited many players in the ad industry. However, the shift has also fragmented the ad buying process and made it increasingly difficult for CMOs to manage on their own.

While about half of surveyed CMOs are comfortable with the changing landscape, most are relying on agency partners to share insights and guidance when shaping ad buying strategies, with 42% of agencies taking primary responsibility. Nearly half (44%) of CMOs will seek new agency partners this year as the push for increased ad reach and effectiveness continues, amid sustained pressure on the CMO position and changes to the data privacy and measurement landscapes.

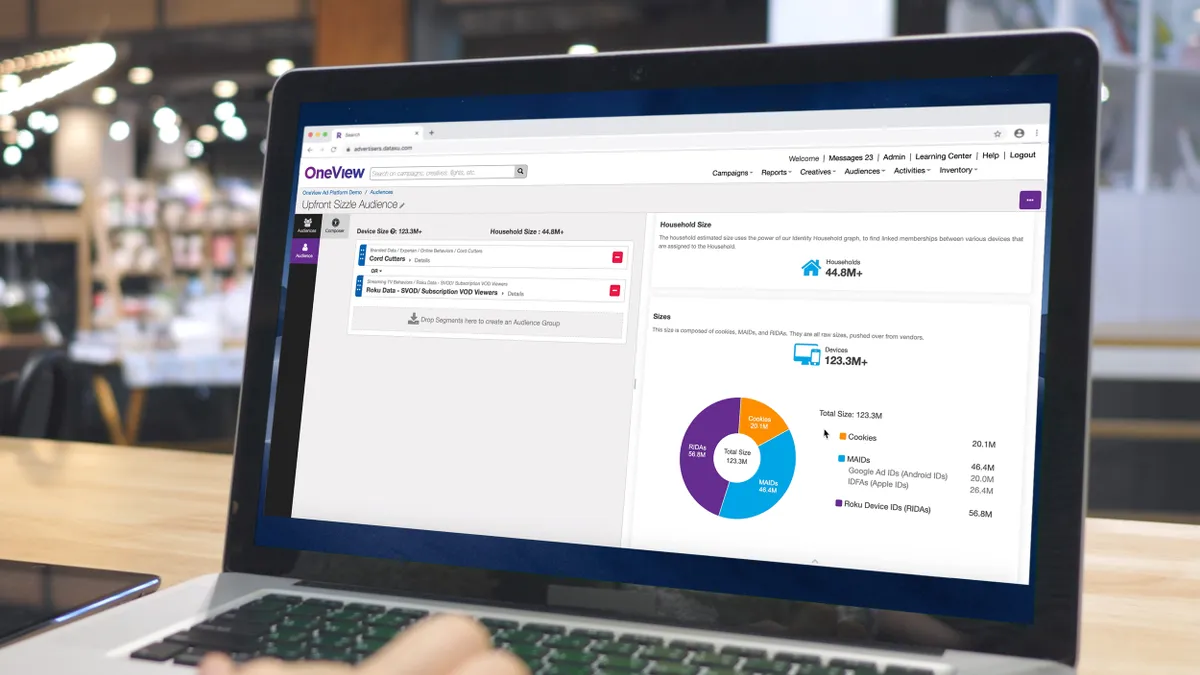

The video landscape — which spans traditional linear/broadcast TV, CTV on smart TVs, gaming consoles and connected devices, and addressable TV from cable, telecommunications and satellite providers — continues to evolve and present new challenges and opportunities for chief marketers. While linear still draws substantial spend, with a third of surveyed marketers dedicating 25% or more of their budget to it, 25% are looking to decrease their linear budgets over the next 12 months. At the same time, 52% will increase budgets on CTV and 34% will do the same for addressable TV.

"Today's marketers need to adopt an omni-channel strategy, and TV has only increased in value with more consumers cutting the cord and moving to streaming options during the pandemic. In fact, more than 1 in 4 households no longer have a cable box, so you cannot reach them with traditional linear TV buys," said Stacey Hawes, U.S. chief revenue officer at Catalina, in a press release.

Along with seeking new agency partners, marketers are also looking to adopt new strategies for targeting TV ad buys. Demographic targeting still leads (78%) but behavioral targeting (64%) is close behind, per the survey of more than 100 marketers across a range of B2B and B2C organizations.