Heading into a new year, restaurants are not only still feeling the effects of the pandemic, but are also grappling with labor, supply chain and inflationary issues that affect their marketing. While these pressures are being felt across industries, restaurants also face a set of unique challenges like increased competition from ghost kitchens and third-party platforms that are making it more important than ever to get digital right.

With cost crunches at every corner, brands are looking to merge with or acquire companies that can help them better meet the needs of consumers and the market. For restaurant marketers, 2022 will be a year of increased pressure to deliver results on a variety of chiefly digital fronts, spanning media, ordering and loyalty.

And even for chains that have been able to transition their business throughout the stages of the pandemic, marketing departments have suffered; in some cases, a 50-person department is now down to just a few, according to Robin Blanchette, CEO of Norton, a creative agency focused on the hospitality industry.

"When I look at the landscape in terms of how we market or what we use to market or what levers we pull, I think all of them are still important. It's just at what level and when and why you might be using it," she said.

Getting digital ordering right

Digital ordering is one of the myriad trends accelerated by the pandemic, and it remains top-of-mind for restaurants in 2022, although it has shifted from the only way to order during the first wave of the health crisis to perhaps the only way to stay in business as margins continue to tighten.

"Inflation and labor pressures are very real, and so marketers are going to be asked to really get aggressive about digital ordering," said Dennis Becker, CEO of mobile marketing provider Mobivity. "It's going to become a big priority for marketers."

Both Blanchette and Becker named Domino's as a restaurant chain that is staying on top of the shift to digital ordering. The pizza chain plans to modify its promotions to push digital ordering amid the labor crunch and what CEO Ritch Allison called "unprecedented increases" in food costs, CNBC reported. The chain is also working to drive some business to its own channels and away from third-party delivery services that further impact margins.

Before the pandemic, restaurant marketers had built out mobile apps that focused on loyalty programs. The pandemic-spurred shift to digital ordering proved to be a bigger technological lift than loyalty, and this year could be a time for restaurants to reassess their apps and digital capabilities to determine what's working and how much they're impacting business outcomes. They'll also have to determine if their digital offerings are attractive enough for consumers to download, use and stay engaged with their apps at a time when most people use less than 10 apps a day.

"There are a handful of brands that were doing this before the pandemic and then made out like bandits, like Sonic, Chipotle and Wingstop, that were already all-in on digital," Becker said. "And then, you had a bunch of other brands [that] had to build this airplane as you're flying off a cliff."

The bifurcation between early adopters and brands that rely on an entire industry of technology support is a pre-existing trend that could accelerate this year. While Yum Brands acquired the artificial intelligence (AI) unit of performance marketing firm Kvantum and conversational commerce developer Tictuk Technologies, McDonald's sold AI company Dynamic Yield (which it had acquired in 2019) to Mastercard, signaling that its bet on personalization-through-M&A didn't fully pay off.

Building relationships and getting data

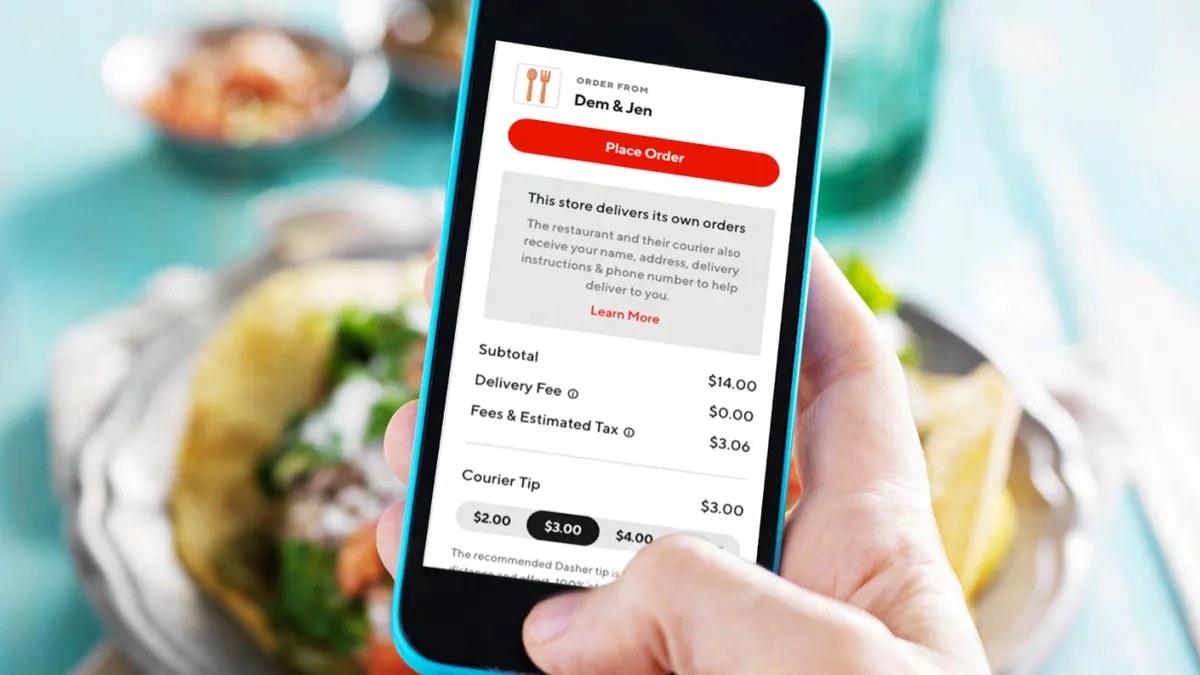

While digital ordering allows restaurants to cut costs and drive sales, it also is tied with another marketer priority with which restaurants face particular challenges: the need for first-party data. As the entire marketing landscape grapples with the loss of mobile identifiers and coming changes to third-party cookies that affect how they target and track ads, restaurant marketers also face a first-party data deficit due to the rise of third-party delivery services.

"The most difficult thing for this industry is owning their own data, because of the surge in third-party delivery over the past couple of years," Blanchette said. "We don't have access to it, and I think that's been a huge downside. I can't market to people if I don't know who they are."

"The most difficult thing for this industry is owning their own data, because of the surge in third-party delivery over the past couple of years."

Robin Blanchette

CEO, Norton

With this in mind, restaurant brands could get more aggressive about not just driving digital orders but acquiring users and building digital relationships that get consumers into first-party databases. As brands across industries work to build and use these databases, affinity marketing could increase as restaurants look to collaborate with platforms that have their own first-party data, especially around growing sectors like gaming.

The first stage of those relationships has already begun in the restaurant world, with Chipotle and McDonald's pursuing branding opportunities on platforms like Twitch and Roblox and with partners like FaZe Clan. Deeper integrations — where consumers could buy a sandwich in a virtual world and redeem at a restaurant — will likely follow, Becker explained.

"The next phase of all of this is earning your loyalty points at McDonald's while you're playing Candy Crush," he hypothesized.

Other pressures and big solutions

Along with pressures that are endemic to the entire economy, traditional restaurant marketers also face continued challenges from off-premise and third-party delivery services that want consumers to have a relationship with a platform and not a brand (Uber Eats wants consumers to buy burgers, not Five Guys burgers, for example).

"Even the bigger chains can't afford to market as much as some of these private-equity backed companies, because they're all trying to buy market share to get their next round of capital," Dan Rowe, CEO of franchise development company Fransmart. "It's a little different playing field."

Restaurant brands still face a sizable challenge in ghost kitchens, facilities that produce food with no customer facing areas that could be a $1 trillion global market by 2030. But the pitch by ghost kitchens at the beginning of the pandemic — that full-service and fast casual restaurants couldn't do off-premise dining well enough — resonates less as marketers like Panera continue to figure out digital and delivery, Rowe explained.

Still, the panoply of pressures — pandemic, labor, supply chain, inflation and third-party delivery — facing restaurants could make M&A more attractive for their parent companies. After seeing major acquisitions like Inspire Brands' $11.3 billion deal for Dunkin' and Restaurant Brands International's $1 billion deal for Firehouse Subs during the last few years, the industry could be at "the tip of the iceberg on consolidation," Mobivity's Becker said, with ramifications for marketers.

"Marketers are going to start thinking a lot more broadly about consumers," he said. "It used to be share-of-stomach, where you're competing against other brands… now that so many of these brands are going to sit under one parent owner, they might want to capitalize on that."

Alone or together, restaurant marketers have full plates in 2022 — an opportunity they might be particularly well-suited for.

"We are born out of waiting tables, washing the floor, making sure your hot food is hot and your cold food cold," Norton's Blanchette said. "As marketers in this industry, that's how folks are approaching us: let's meet the customer where they are, and try to be of service."