Dive Brief:

- Amazon’s revenue derived from advertising rose 19% year over year to $14.33 billion in Q3, according to an earnings statement. The results were in line with analyst expectations but marked a deceleration in the rate of growth from the year-ago period.

- The e-commerce giant this year has focused on expanding its full-funnel marketing capabilities, introducing ads to Prime Video in January. The streaming service is in the midst of its first “broadcast season” after its upfronts, or period of advance negotiations with advertisers, in the spring.

- Like other digital ad platforms, Amazon has recently released a number of tools for advertisers that are powered by generative artificial intelligence (AI). AI development carries steep costs but could welcome more ad activity and draw a greater number of advertisers to Amazon.

Dive Insight:

Amazon’s ad sales segment remains a force to be reckoned with while not quite growing at the same clip it once did (26% YoY growth in Q3 2023 versus 19% YoY growth for the most recent financial period). The company’s advertising gains met Wall Street’s estimates following a rare miss in Q2.

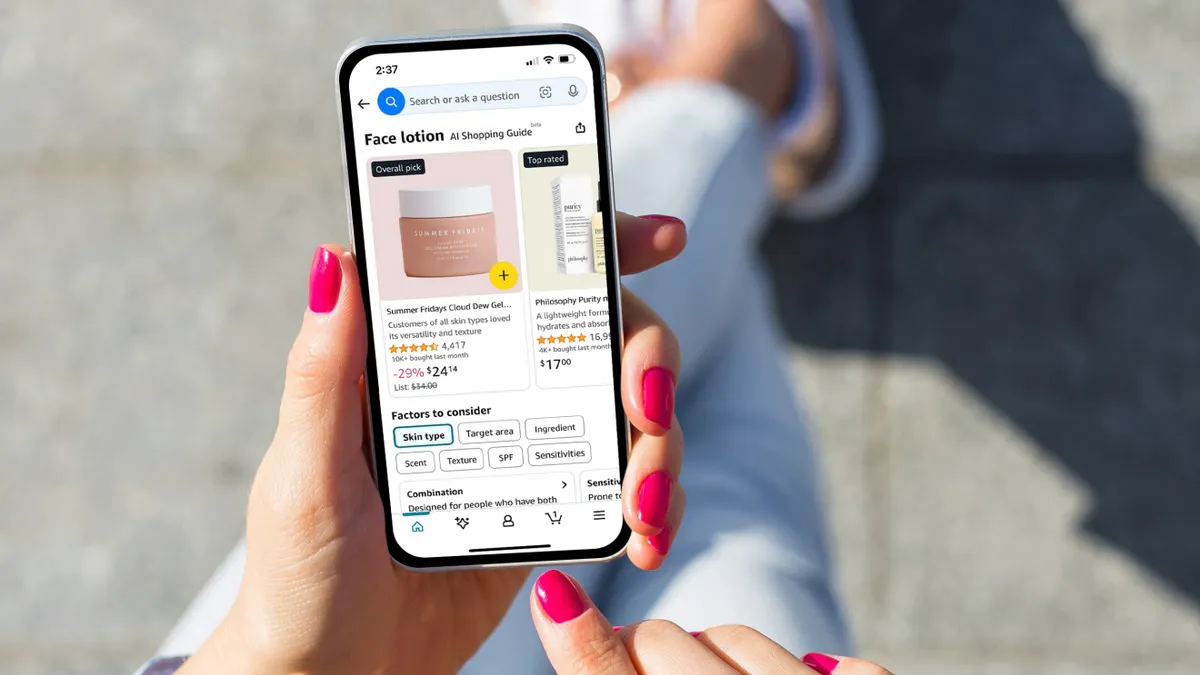

Retail media advertising, including sponsored product listings that surface on Amazon’s sprawling e-commerce marketplace, continue to be a growth driver thanks to a large advertiser pool. Amazon is working to improve ad relevancy and introduce additional optimization controls in this area, CEO Andy Jassy said on a call discussing the Q3 results with analysts.

Amazon’s Q3 earnings report overall impressed investors on earnings and revenue, though capital expenditures jumped a staggering 81% YoY to $22.6 billion, a hike underpinned by investments in generative AI.

Advertisers have received more bells and whistles as a result of the AI spending spree. Amazon in September debuted a tool that quickly converts product images into video ads with generative AI. Video is a costly and time-intensive advertising format to produce by hand, and the offering could gain traction with small- and mid-sized marketers that do not have deep pockets but rely on Amazon to drive transactions.

Amazon’s video generator follows an image generator released last year that can create a high volume of campaign assets with the click of a button. At its annual UnBoxed conference last month, the company also unveiled an AI-powered solution for generating audio ads that comes at no additional cost to U.S. advertisers using Amazon’s demand-side platform.

Amazon has united its AI ad products under a creative studio that aids with marketing efforts across platforms including Amazon.com, Prime Video and Twitch.

“[We’re] continuing to support brands of all sizes with our generative AI-powered creative tools across display, video and audio, including our video generator that uses a single product image to curate custom AI-generated videos,” said Jassy during yesterday’s call with investors. “While we’re generating a lot of advertising revenue today, there remains considerable upside.”

Other digital ad platforms are busy trumpeting their AI offerings for advertisers. Reporting its Q3 earnings earlier this week, Meta called out growing traction for generative AI image and text generators. More than 1 million advertisers have used such offerings to create more than 15 million ads in the past month, CEO Mark Zuckerberg said, echoing Jassy’s comments that there is “more upside” to come.

Amazon also continued to tout progress for its crack into advertising on Prime Video, a streaming service that hosts desirable live programming like NFL “Thursday Night Football,” along with original films and TV shows. Amazon earlier this year put on its first upfronts, a pitch to the advertising community to lock in deals around upcoming video content. The company surpassed its goal of securing $1.8 billion in advance commitments from advertisers, according to media reports.