Brief:

- Zoom's revenue surged 169% to $328.2 million in Q1 from a year earlier as the coronavirus pandemic led millions of people to use the video calling service to stay in touch during lockdowns. The company raised its revenue forecast for the year to between $1.78 billion and $1.8 billion, nearly doubling prior projections between $905 million to $915 million, according to an announcement.

- Zoom's customer base of businesses with more than 10 employees — a significant benchmark for video calling usage — jumped 354% to 265,400 as more people started working remotely. The company's adjusted net income rose almost sixfold to $58.3 million, or 20 cents a share, to beat estimates of 9 cents, per data cited by CNBC.

- Costs also rose as Zoom added computing capacity from vendors like Amazon Web Services to cope with mounting demand, CNBC reported. The company expects to reduce its reliance on outside services and increase its internal capacity to reduce costs, CFO Kelly Steckelberg said in a call with analysts discussing the earnings results.

Insight:

Zoom's stellar Q1 growth shows how the coronavirus pandemic has disrupted the way people use technology to communicate, a change that appears likely to stick for the long term. While Zoom is a multichannel service, earlier research from Apptopia indicates that mobile usage has grown rapidly during the health crisis. Zoom derives its revenue from businesses that pay for its video calling services, helping them to meet virtually during lockdowns. The video calling industry is only getting more competitive, with Zoom's results outshining those of rival Slack, which reported disappointing growth.

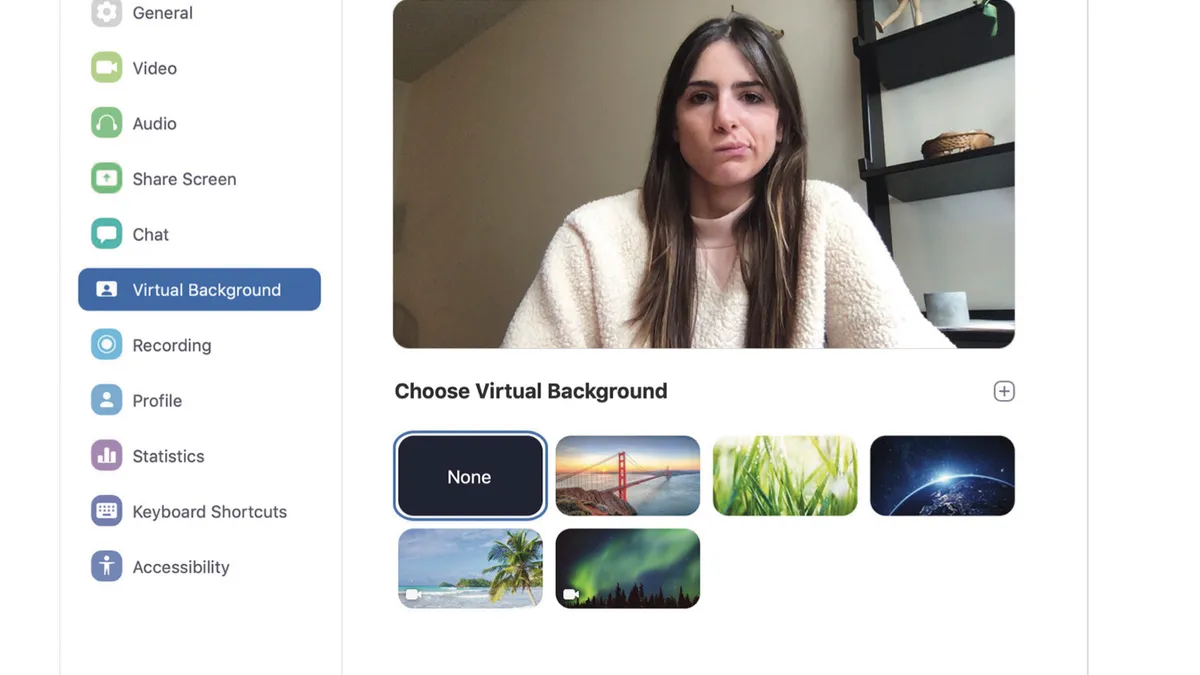

While video calling platforms like Zoom don't offer ad inventory in a traditional sense, they are increasingly used for other kinds of marketing activities that mobile marketers can capitalize on. The ability to swap out video conferencing backgrounds to custom filters has been one method of growing brand awareness that's taken hold during the pandemic.

Brands from the restaurant chain Red Lobster to Home Depot's Behr paint brand have created virtual wallpapers for Zoom that let users dress up their surroundings. Enabling community-building is another tactic that can be supported by platforms like Zoom.

Early in the pandemic, Chipotle Mexican Grill created "Chipotle Together" sessions that featured celebrity guests and as many as 3,000 participants at a time. The online gatherings drove 500 million impressions and 100 earned media stories, the company told Marketing Dive, a sister publication to Mobile Marketer. Aside from Chipotle's example, brands have tended to use social networks like Facebook and livestreaming platforms like Twitch for virtual events to reach target audiences, and are increasingly relying such functions and on platforms like Zoom to collaborate on campaigns internally as studio work remains shuttered.

Given Zoom's growth, analysts have speculated that the platform might eventually offer ads on its free version.

Zoom has faced criticism over privacy concerns amid reports of "Zoom bombing" that interfered with its video conferences and the ways the platform works with law enforcement. The company has reinforced security measures to help new users better understand its features and prevent nefarious activity. Such steps might help Zoom maintain growth in the video calling category, which is getting more crowded with rivals like Microsoft seeking to dominate the market, as reported by The Wall Street Journal.

An uptick in video calling has drawn interest from companies like Verizon as well, which in April acquired videoconferencing and event platform BlueJeans Network to expand its offering of immersive communications services. Many analysts expect the shift toward remote work could last after the pandemic, and several large tech companies, including Twitter and Facebook, have plans to allow employees to work-from-home permanently, suggesting that companies like Zoom will have future opportunities to continue to innovate their business.