Dive Brief:

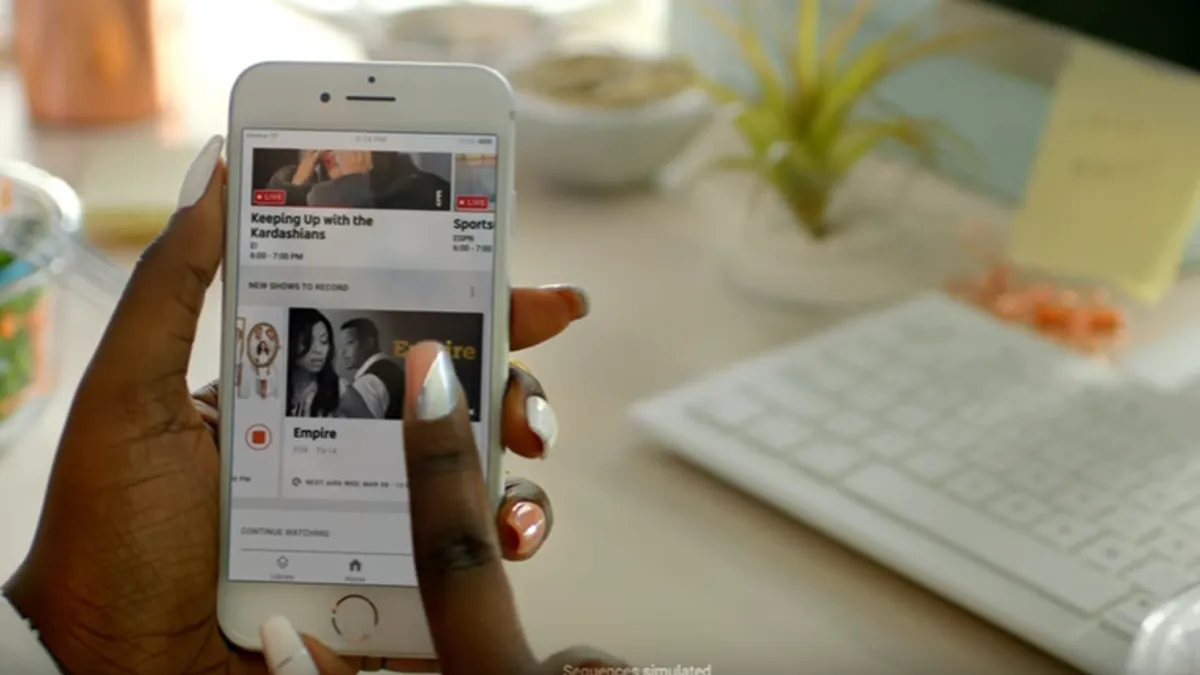

- YouTube TV, the video platform's live TV service, is now available in New York, Los Angeles, San Francisco, Chicago and Philadelphia, with a rollout in more U.S. markets to come soon, according to a YouTube blog post.

- The service, long-rumored but first officially announced in March, costs $35 per month. It offers a total of more than 50 channels, including all major TV broadcast networks, and comes packaged with YouTube Red Original programming as well as an unlimited cloud DVR.

- Subscribers can watch YouTube TV on smartphones, tablets or computers as well as streamed to TVs via Chromecast, and receive six accounts to share with family and friends.

Dive Insight:

YouTube TV is especially interesting for marketers because it's backed by Google. While Google has the power to potentially turn YouTube TV into a strong competitor given its budget, bent toward innovation and massive technology infrastructure, the company could also demand higher advertising rates as the service picks up traction.

Alphabet, Google's parent company, has put a sharper focus on YouTube as consumers demand more video content and turn more frequently to their mobile devices to view it. On a recent Alphabet earnings call, analysts suggested that YouTube could act as a sort of heir apparent to Google's search advertising business, which has been its key revenue driver for years.

However, Google is also currently navigating tough waters with YouTube, as major U.S. brand marketers including Verizon, AT&T and PepsiCo freeze their spend on the platform over issues with ads appearing next to offensive content, including terrorism- and hate speech-related videos. While YouTube TV is a different beast altogether, strictly streaming TV-like offerings advertisers would deem "safe," it launches in the midst of a particularly bad PR moment, which might hurt its early legs.

Overall, digital media continues to make inroads into the territory typically owned by linear TV with skinny bundles and over-the-top (OTT) services like YouTube's. The quickly expanding swath of digital TV-like alternatives seek to accommodate a growing trend toward cord-cutting, but it's also possible the space is getting overcrowded before it ever truly takes off. Certainly, the sheer number of current offerings is likely to be confusing for consumers.

This provides a challenge for marketers chasing cord-cutting, often young-skewing viewers, who once could be comfortably targeted on TV but are harder to find as the ecosystem becomes increasingly fragmented. At the same time, linear TV remains essentially as expensive as ever for ad buys despite a widespread drop in overall ratings.