Dive Brief:

- WPP entered an agreement with Instacart that provides clients early access to the online grocery platform's latest ad formats and other perks, per an announcement from the agency.

- Through the deal, WPP serves as Instacart's first Analytics API partner with the ability to utilize special analytics and data integration tools, including basket analysis and insights around lifetime brand value. Additionally, clients will receive custom measurement and management indices to run more efficient campaigns.

- WPP and Instacart are also co-developing an Instacart Ads agency certification program to ensure the agency workforce is up to snuff navigating the platform's app and products. The goal is to eventually make it more widely available. WPP plans to have 1,000 employees program certified within the first six months of launch, a specialization that could grant a leg up as retail media services see growing demand.

Dive Insight:

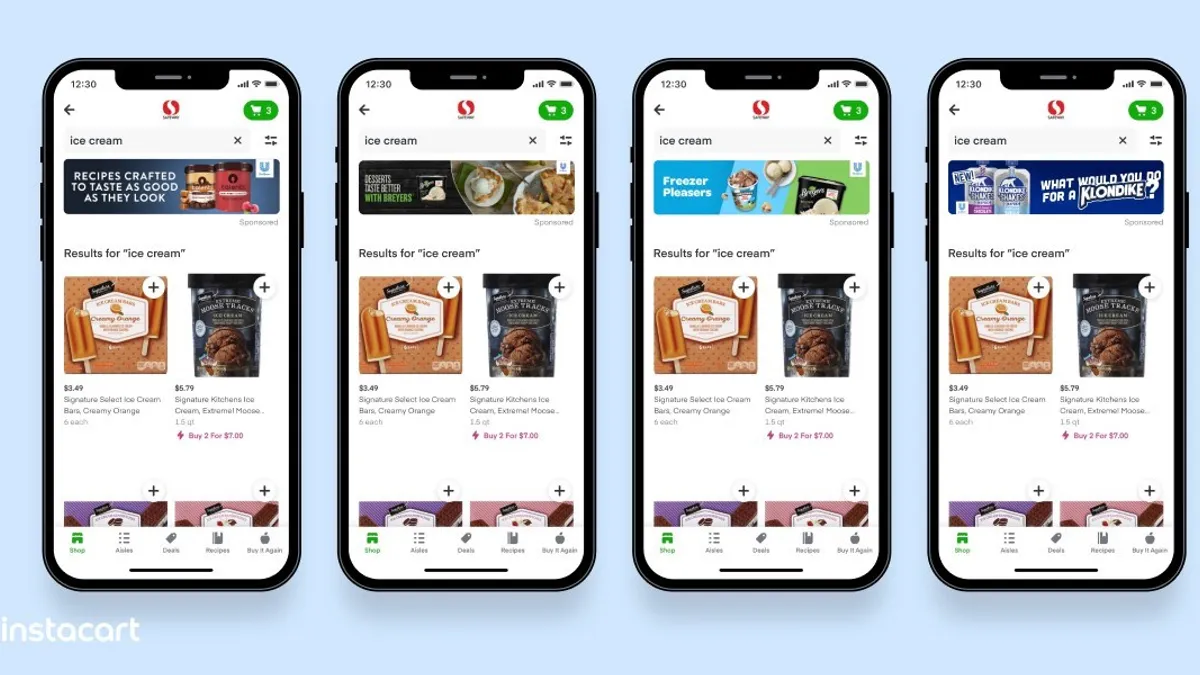

Agency holding company WPP is digging deeper into retail media through its partnership with Instacart, which operates a budding ad network to complement its core grocery delivery business. Instacart has recently made a more concentrated push to round out its tech offerings. Late in January, it introduced shoppable brand pages that allow a company to show off a product portfolio and tell a story using images and text, while driving traffic from ads placed on and off Instacart's site. Richer auction-based display units were also part of the announcement.

Retail media has benefited immensely from the pandemic as consumers rush to adopt e-commerce in greater numbers. Leveraging in-store and online shopper data for advertising purposes can be a powerful tool, and one that's grown more appealing as mainstay third-party targeting methods like cookies are deprecated, leaving CPGs that don't own the point of sale in a bind.

Founded in 2012, Instacart has risen to become one of the top online grocers in the U.S. so a bigger bet on ads now makes sense. But the company has also encountered setbacks regarding leadership. Last year, it brought on Carolyn Everson, a well-regarded Facebook advertising vet, as president in a sign that it was getting serious about retail media. But Everson left just a few months later and not long after Seth Dallaire, Instacart's former head of advertising, exited for a role at Walmart.

Linking with WPP potentially provides Instacart a more direct pipeline to massive CPG clients that are shifting more of their dollars online. WPP won the global account of Coca-Cola last year and works with fast-moving consumer goods stalwarts like Procter & Gamble and Unilever.

The agency holding group, for its part, gets in on the ground floor with new Instacart ad products and analytics tools that could give it an edge as rivals also ramp up investments in commerce and performance media. Publicis Groupe, which reported its fourth-quarter and full-year earnings last week, said it would pour an additional $450 million to $680 million in M&A this year to fortify capabilities around data and technology. Some of Publicis' larger deals of late have focused on retail media.

Specialty platform partnerships have become a bigger part of WPP's playbook as the group looks to prioritize innovation. It has recently struck deals with Snapchat owner Snap and TikTok that are similarly focused on giving clients early access to what's new in the product pipeline while training employees to better understand those services.