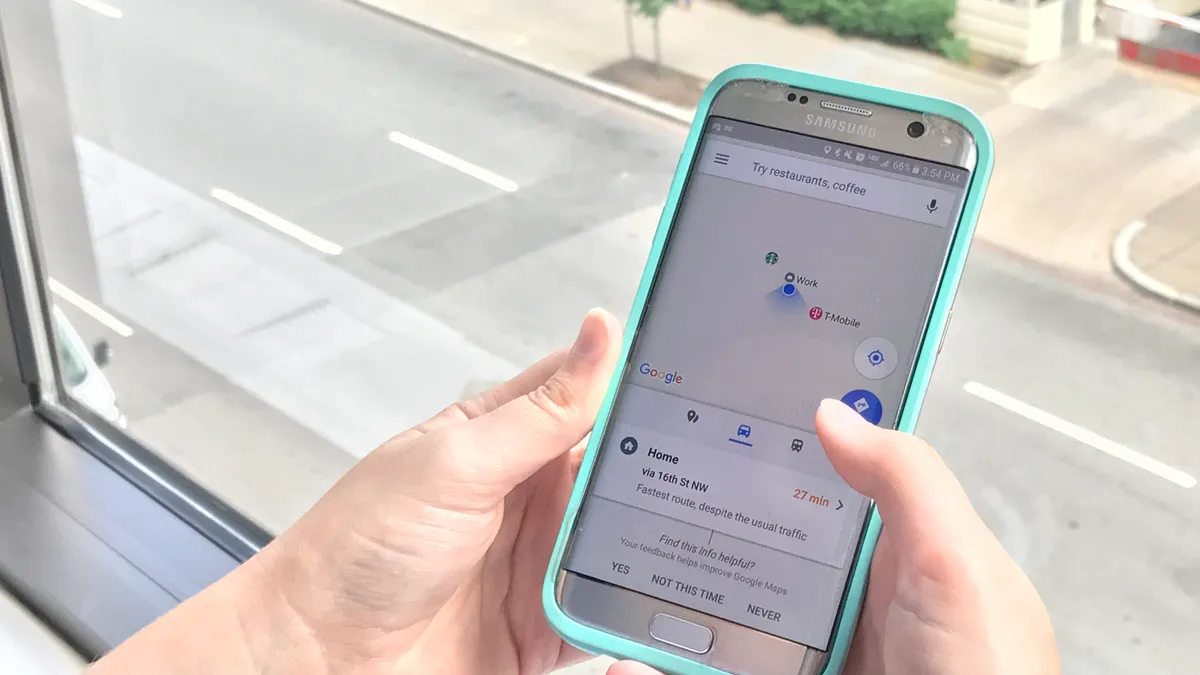

The use of location-based marketing is on the rise in the U.S., driven by data and technology improvements, though the ecosystem has been consolidating as it matures while the impending deadline for the European Union’s new GDPR regulations has raised questions for vendors and marketers.

Despite the uncertainty, industry experts see location-based marketing as a big growth market over the next few years. BIA Advisory Services told Mobile Marketer that location targeting drove $17.1 billion in ad spend in 2017, accounting for 38% of the $44.8 billion spent in mobile. That number will double by 2022 to $38.7 billion, the company forecasted. But as the industry takes off in the U.S., companies operating in the EU are struggling to figure out how the new GDPR rules will affect them and U.S. firms like Verve and Drawbridge recently decided to quit the EU market. Location-based marketing firm Gimbal later acquired Drawbridge’s adtech business and location intelligence company Cuebiq recently raised $27 million in growth capital, suggesting investors still see an upside for the market.

“In the short run there is a lot of disruption and confusion both on consumer and business side but over time, it will sort itself out and get back to a new equilibrium,” Rick Ducey, managing director at BIA Advisory Services, told Mobile Marketer.

GDPR will slow growth potential in the EU

According to the new GDPR rules, marketers can no longer rely on a passive opt-in to track a consumer’s personal data. While in the past companies tended to add opt-ins in the fine print of coupon giveaways or app downloads, now they must get explicit consent. In addition, a consumer has to positively opt-in for a specific period of time, and opt-in again after that time expires. Under GDPR, location data is considered personally identifiable data, meaning the same opt-in rules apply as for other sensitive data.

The GDPR’s tight rules are open to some interpretation but also come with hefty fines, which is leaving many marketers nervous about how to proceed.

While some marketing services and adtech companies are simply backing out of the EU market, others are starting over from scratch by dumping all of their previous data and seeking new affirmative permission from consumers. Some are trying to mitigate and rebuild what they have got. Some companies are looking at their data sets and trying to determine which data has affirmative permission and are asking for permission again if the data seems questionable.

These moves add expense, time and complications, but there could be opportunity around the corner given how location data can help marketers reach mobile users at the right time with the right offer and gain valuable insights that can help streamline their marketing.

“Marketers are finding that location intelligence is very meaningful for identifying and targeting useful consumer segments, and that drives engagement and hopefully conversion, which is a good thing,” Ducey said. “And location data is becoming more available and more useful with advances in data technology and machine learning.”

Quality data will improve U.S. market’s efficiency

While the location-based opportunity is driving growth in the U.S., the market is not without its own challenges. Ducey estimates that of all the location data transferred through exchanges, a mere 9% is quality data, which means 91% is somewhere between noisy to very noisy, confusing the messaging rather than adding value.

“It is great if we can get clean location data and map it to identity, but getting good clean location data on a timely basis is a challenge and hard to pull off,” he said.

The quality of location data is improving, according to Brian Handley, CEO of Reveal Mobile. Location-based data used to come from cell tower triangulation, but nowadays data is coming through GPS tracking on smartphones which is more efficient, he explained.

“It used to be that most of the location data you got was bid stream. You could get scale, but the effectiveness of those ads were not what they should be,” Handley told Mobile Marketer. “But now that you have a ton of GPS longitudinal and latitudinal data, you can get pretty granular at scale. The proliferation of smartphones means there is much more accurate data to really show that the user was at your store versus being near your store.”

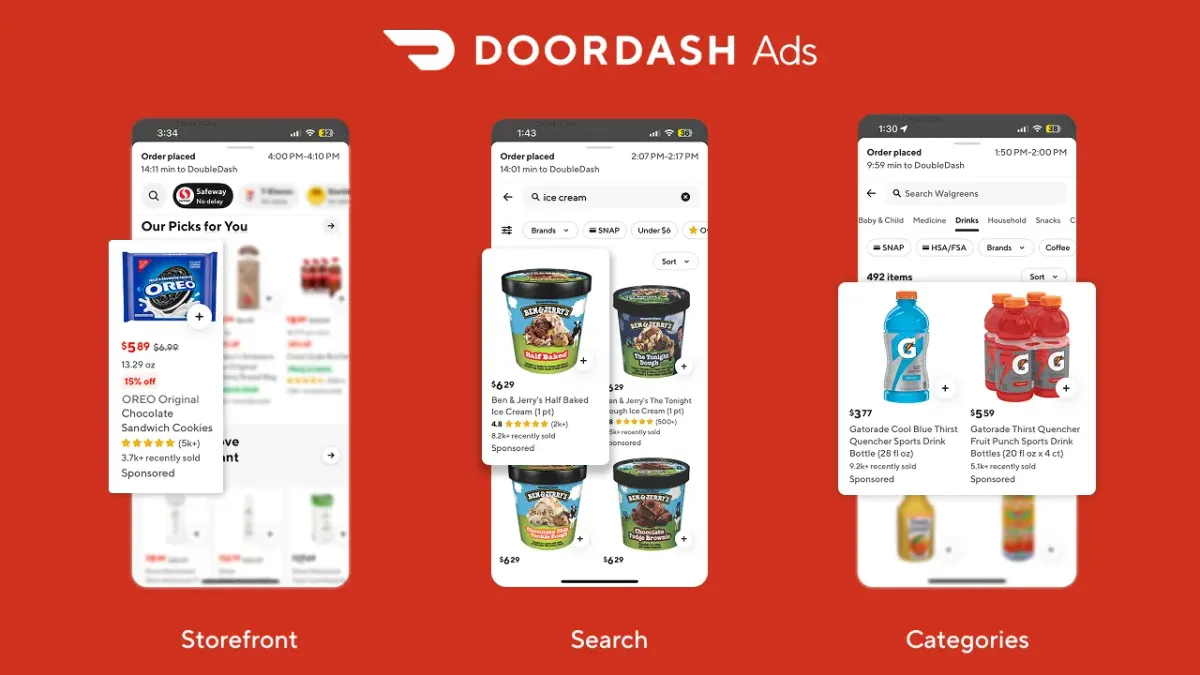

As the industry matures, there could be more types of location-based campaigns using geoconquesting, geo fencing and proximity ads. Marketers can start to build segments using data and then map this at household level using mobile towers, fencing and PII. A marketer can determine things like where a person works or lives based on mobile device user identify authentication that happens regularly between specific hours like 9-5 or 8-8. Marketers can map this to behavioral data and track how consumers go about their day.

“The location resolution gets down to the consumer went into Starbucks and was there for 20 minutes, then went from Starbucks to CVS, which is a valuable piece of information for marketers,” said BIA Advisory Services’ Ducey. “Those kind of location signals help build consumer profiles and help brands determine where they show up physically.”

New opportunities emerge

There is also the potential for brands to track TV ads using location data. For instance, a car company could track the effectiveness of a TV ad that promotes test drives by looking at mobile user data for the days following the broadcast message, in order to find out how many people went into dealers in that region after a campaign and comparing it to what happened before the campaign ran.

“There is a lot of potential to map location data to an offline channel like TV to improve tracking,” said Ducey.

Location targeting, once reserved for big brands, is increasingly being adopted by small- and medium-size businesses. Reveal Mobile has seen local auto dealerships, BBQ sauce companies, state fairs and mattress retailers target customers using location-based data.

“Nowadays you can truly get local-based marketing data at a national scale,” said Handley.

As location-based targeting matures, marketers are realizing that it’s no longer just about real-time messaging but also about getting to know customers and building relationships over time. In fact, it could be more important to know where a person has been than where they are right now. Some industry insiders expect to see more retargeting based on location history as the industry expands.

“When it started it was about in the moment messaging,” said Handley. “While there is value there, if you are in the grocery store and I send you a $5 off coupon, I may have just cut $5 from your order since you are already there.

“But if I can get you to go to the grocery store more often or go to a different grocery store based on the data, then that is a potential big win for me in terms of the lifetime value of a customer.”