The following is a guest post from Roey Franco, VP of product innovation at WPP's Xaxis. Opinions are the authors' own.

Marketers have new opportunities to reach consumers as restrictions on travel and commerce ease in states throughout the U.S.

In recent weeks, many major cities have seen double-digit lifts in movement outside the home compared to early April, according to data from location tracking company Ubimo. In some locales, traffic has returned to levels at or near what it was before the COVID crisis, the data shows. And as consumers emerge for more activities — including drinking, dining, grooming and some gym-going — it's an opportune moment to reach them.

"Today, as people take their purposeful trips there is less distraction and noise," Gilad Amitai, Ubimo's COO and co-founder, wrote on the blog of parent company Quotient. "Brands can reach consumers with little distraction in the critical moments before they make their purchasing decisions."

He noted that out-of-home advertising (OOH) gives marketers the chance to reach customers just before they go into a venue where they'll make a purchase.

As marketers reinvigorate OOH messaging, though, they also need to prepare for fast-changing circumstances. More than ever in recent memory, marketers need to target and message according to what's happening on the ground in near real time. Even in geographies where car and foot traffic is up, overall, trends fluctuate week-to-week as consumers watch the news and officials tighten or loosen the rules. Protests and curfews in dozens of cities have added new considerations to the mix.

Realistically, digital is one of the few ways to manage the complexity for OOH messaging. There are about 220,000 digital out-of-home advertising (DOOH) screens in America today, and the numbers may grow. DOOH can be activated in 72 hours or less, compared with weeks for traditional OOH, and in as little as 24 hours for the more than 10% of screens currently transacted via programmatic — another percentage that's growing.

Marketers using DOOH can move spend among geographies and also mix and match across mobile and other channels, using omnichannel data from them all to optimize as circumstances shift. They can deploy dynamic creative optimization (DCO) to hone in on the types of creative executions showing the most positive effects, changing based on traffic and weather patterns, for example. They can also underweight messaging where their products have become less available due to distribution glitches or spikes in demand.

DOOH just works

Even as consumer activity increases overall, people are staying relatively local, choosing to move about via cars, meaning highway signage may be especially effective in the coming months.

"A lot of budgets are going to shift to the roadside as a lot of Americans are going to choose to travel by car this summer," Anna Bager, president and CEO of the Out of Home Advertising Association of America, told Adweek.

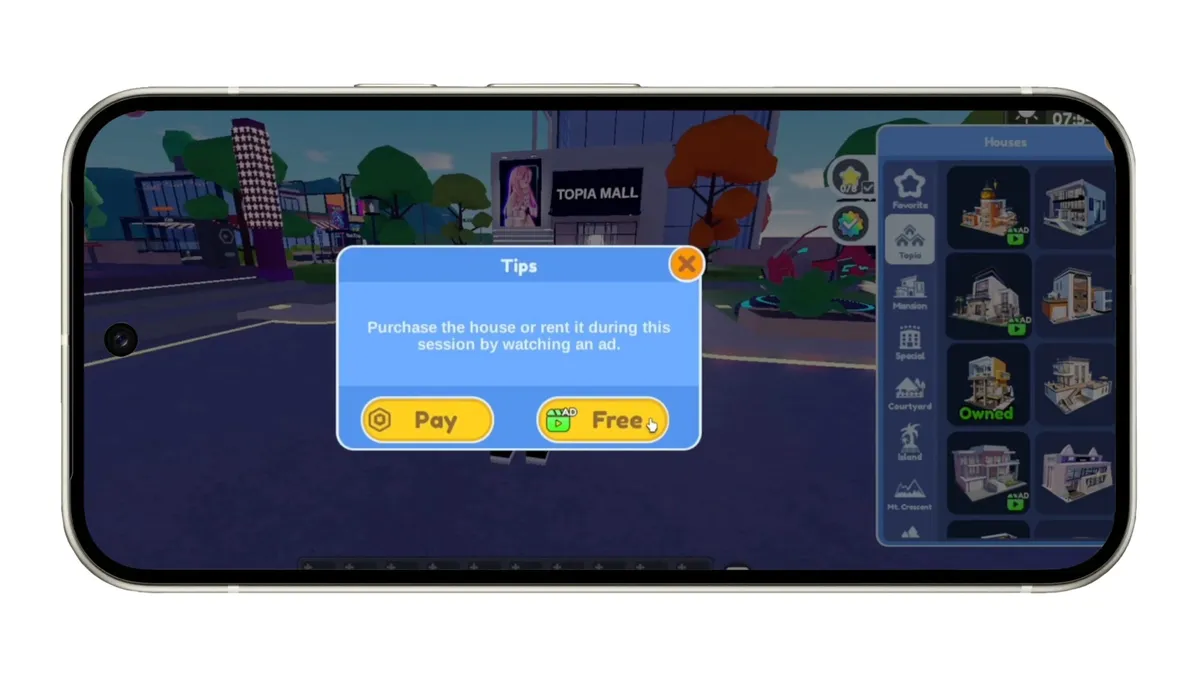

Recently, insights gathered by Sightline (Xaxis and Kinetic's joint DOOH product hub) shows activity near DOOH screens is picking up at locations such as gas stations, grocery stores, pharmacies, highways and, in some markets, gyms, malls and bars. DSPs that handle programmatic insertions for DOOH are showing more inventory available on the screens as well. Categories such as air travel, hotels and restaurants may also see more marketing spend as their sales start to grow.

Even during the shutdowns, six in 10 people were seeing OOH advertising on their way to buy groceries, according to Sightline. OOH has been proven effective at helping to drive intent to purchase and cement brand affinity, especially when combined with other channels that leverage the flexibility and data that DOOH can afford.

CPG especially capitalizes

Adding to the enticement of DOOH right now, brands can capitalize on both reduced prices and lessened competition from brands that aren't increasing their advertising. One category that's been especially well-served is consumer product goods.

Proctor & Gamble, which spends more on marketing than any other company, saw its sales rise 10% in Q1 from the previous quarter amid the COVID crisis, according to CFO Jon Moeller on an earnings call in April. P&G increased marketing spend $100 million even while cutting other overhead.

"There's big upside here in terms of reminding consumers of the benefits that they've experienced on our brands and how they've served their and their families' needs, which is why this is not a time to go off air," Moeller said on the call.

Analysts say that digital accounts for all the recent growth in OOH and will continue to increase its share of the market. By jumping in smartly now — targeting the right geographies in the right conditions and adjusting fast by leveraging data gathered across channels — brands can increase their effectiveness on screens, both large and small. They can gather data, gain important insights and use it to optimize now and into the future as more DOOH screens come online.