Things did not look good for sustainability in marketing at the outset of the coronavirus pandemic. People were panic-buying and pantry-loading en masse, snapping up whatever products were left on the shelf. In the frenzy, loyalty started to slip, while a volatile economy put strains on consumers' wallets that may have impacted their willingness to pay a premium for environmentally conscious brands.

Yet, research indicates that the appetite for sustainability marketed products — a once niche sector that achieved greater mainstream recognition through the mid-to-late-2010s — has remained resilient despite the trials of COVID-19. Such goods outperformed their conventional counterparts across 36 categories in 2020, according to a report conducted between IRI and the NYU Stern Center for Sustainable Business. The vertical overall notched a 0.7 percentage-point increase to reach 16.8% of total purchases in a banner year for CPG sales.

"Sustainability marketed products not only held their own, but actually outgrew CPG as a total," said Randi Kronthal-Sacco, senior scholar of marketing and corporate outreach at the NYU Stern Center for Sustainable Business and an author of the report. "Sustainably marketed products did, in fact, survive the pandemic, and thrive in many instances."

Why is the sector so buoyant despite facing clear challenges? One way of understanding the trend is to break with conventional ways of thinking around CPG. Sustainability marketed products tend to be inelastic and less sensitive to price fluctuations than conventional fast-moving consumer goods, which are currently contending with rising inflation, according to Kronthal-Sacco. It's potentially more instructive to view sustainability labels as acting like luxury industries, where people are willing to shell out more and buy in lower volumes. That's especially true of millennial, upper-income, college-educated and urban cohorts when it comes to sustainability, the IRI and NYU Stern report found — although older age brackets, like baby boomers and Gen Xers, account for the "bulk of sustainable dollars spent."

"Sustainably marketed products did, in fact, survive the pandemic, and thrive in many instances."

Randi Kronthal-Sacco

Senior scholar of marketing and corporate outreach, NYU Stern Center for Sustainable Business

"Generational differences can be seen in sustainability definitions, attitudes and purchase behaviors," wrote Larry Levin, executive vice president of consumer and shopper marketing at IRI, in the research. "Brands and retailers must be able to optimize packaging, labeling, websites and messaging to reach sustainably focused audiences most effectively."

At the same time, demand for sustainable goods is climbing as consumers seek out everyday ways of lowering their impact on the environment. Last summer brought record heat waves, raging wildfires and intense flooding, making the disastrous effects of climate change harder to ignore. Brands, too, are feeling the pressure to take bigger steps to address the crisis — recent months have brought a deluge of pledges to rethink everything from packaging design to agricultural practices — and could make their solutions a larger part of consumer-facing marketing as mandates specific to the pandemic continue to recede.

"People being impacted by climate personally and climate change in the broad sense has definitely risen to one of the top problems that individuals recognize," said Kronthal-Sacco. "For that reason, I believe that there has been a large uptick in interest by consumers and a large uptick in interest by manufacturers and retailers to deliver more sustainable supply chains and more sustainable products.

"If they don't, it's kind of adapt or perish," she added.

Educating the population

Marketers with a clear stake in the purpose arena have long made sustainability a part of their messaging to the public. Kronthal-Sacco pointed to Unilever as a continued leader in the CPG space. But the scale and number of initiatives have felt more voluminous in a grim period for climate forecasting.

"I do think [sustainability] is the next agenda choice for CPG and retailers," said Kronthal-Sacco.

"As we are preparing the 2022 report, we find an increasing number of new products incorporating sustainability claims, as sustainability becomes table stakes in a number of categories," she wrote in a follow-up email.

That's true of both product design and larger corporate strategies. Mars earlier in October announced it would try to achieve net-zero greenhouse gas emissions across its value chain by 2050, a target derived from the goals of the Paris climate agreement. The Skittles marketer previously stated it would shoot for net-zero emissions in its direct operations by 2040. PepsiCo, a competitor, unveiled a wide-ranging pep+ initiative in September that includes pledges to reach net-zero emissions by 2040 and become net water positive by 2030, along with cutting use of virgin plastic in its portfolio.

Marketing is an increasingly important part of the formula. The pep+ announcement was complemented by a Pepsi campaign that enlisted NFL stars — the beverage is a league sponsor — to explain the benefits of recycling to football fans. The American Beverage Association, an industry group that represents The Coca-Cola Company, PepsiCo and Keurig Dr Pepper, is currently promoting an "Every Bottle Back" platform in conjunction with World Wildlife Fund, The Recycling Partnership and Closed Loop Partners that tries to educate the public on the value of recyclables with videos on platforms like Twitter.

"It's quite significant," said Kronthal-Sacco of the volume of such sustainability campaigns. "Particularly in social media, you're seeing what had been a dearth of communication become an abundance of communication around sustainability and how brands are incorporating a sustainable agenda into their offerings. I expect that to explode in the coming year."

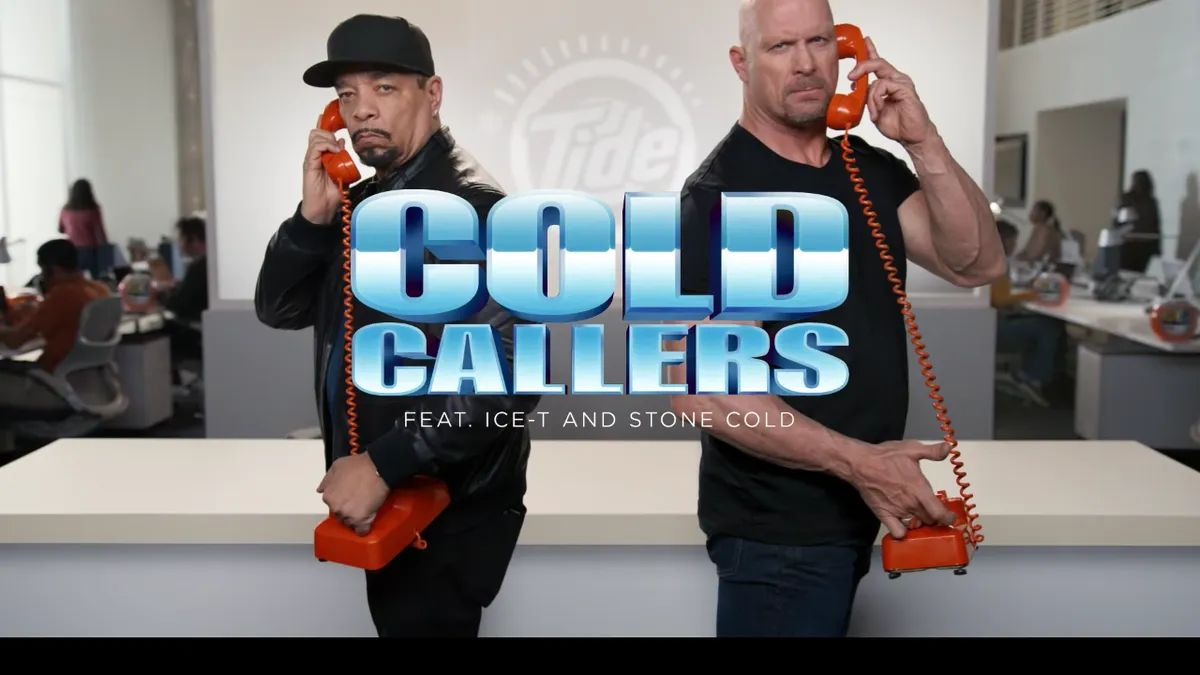

Other campaigns have tried to steer consumers to adopt better habits. Procter & Gamble's Tide this spring touted the environmental benefits of washing clothes in cold water with a push starring rapper Ice-T and wrestler "Stone Cold" Steve Austin, who played "cold callers" that ring up other celebrities to espouse the practice. Samsung recently enlisted Vanilla Ice for an effort that encouraged people to turn the temperature on their freezers down, complete with a reimagined version of the artist's hit single "Ice Ice Baby."

Still, other marketers are hesitant to put sustainability front-and-center in their messaging, even as they adopt more sustainable practices in their operations. Kronthal-Sacco suggested that the uncertainty could stem from a fear of alienating certain consumer groups — climate change remains a highly politicized issue — or due to near-term supply chain disruptions that have roiled fourth-quarter planning.

"I think they are just trying to get product out," said Kronthal-Sacco. "I don't know what the conversation will be."

Upward trajectory

Looking past the short-term obstacles, it's harder to ignore the business case for sustainability. Valuable young demographics care more deeply about fighting climate change, and will reject brands they view as out of line with their social values. Nearly a third of Gen Zers and 28% of millennials have taken an action, like donating or volunteering, to tackle climate change in the past year, according to Pew Research.

"You have the younger users who are differentially concerned and will age and have greater purchasing power," said Kronthal-Sacco. "They're also, from a manufacturer and retailer standpoint, the future consumer.

"Both those dynamics happening, I think, will catalyze the sustainable agenda in CPG," she added.

Sustainability-marketed products have also adapted well to channels that are climbing in significance for marketers. Last year, the e-commerce share for sustainability-marketed products among CPGs grew 65% versus that of 2019, 7 points higher than the gains notched by conventionally marketed counterparts, IRI and NYU Stern found. Online shopping presents opportunities to offer more detail on why a brand is sustainable as compared to the more limited space on physical packaging and shopper marketing placements around crowded store shelves.

"Even if you're not communicating it on a pack, there's so much real estate to communicate that in their description of the product," said Kronthal-Sacco.

Marketplaces are recognizing that more brands view sustainability as a key differentiator. Amazon last fall launched a program where products that achieve one or more of 19 different sustainability certifications will receive a special label on their page. Sustainability-marketed products performed better online than in store in 75% of the categories examined by IRI and NYU Stern.

"Again, it's not just for consumers who are interested in ethical consumption, but also for the manufacturers and retailers," said Kronthal-Sacco of the sustainable agenda. "The retailers, in general, are quite concerned and have seen increased demand by consumers to help them pick a more sustainable choice."