Dive Brief:

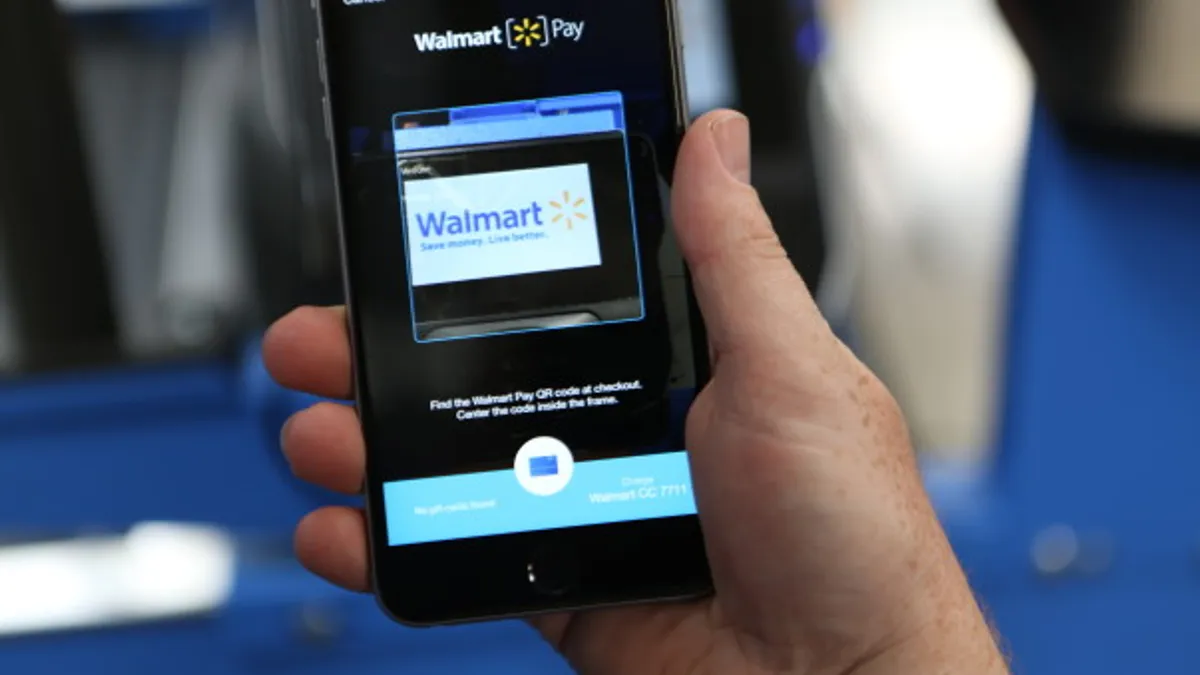

- Walmart, the biggest discount chain in the U.S. with more than 4,600 stores, added a feature to its mobile payment application to let people immediately start using store branded credit cards, according to a blog post by the company. The Walmart Pay electronic wallet now gives nearly instant access to Walmart credit cards at all store locations and online after customers are approved — even before a plastic card arrives by mail.

- Walmart Pay works with any iOS or Android device in stores and with any credit, debit, prepaid or Walmart gift card that users upload to the mobile app. The Bentonville, Arkansas-based company cited a study that found that Walmart Pay is the third-most frequently used mobile wallet in the U.S., behind Samsung Pay and Apple Pay, but ahead of Android Pay.

- The company rolled out its mobile pay app in early 2016. Walmart’s credit cards offer 3% cash back on online purchases, 2% on purchases from Murphy USA and Walmart gas stations and 1% cash back on all other purchases.

Dive Insight:

Walmart is embracing the ways in which today’s consumers want to shop, expanding beyond its focus on squeezing out distribution costs in an effort to offer low prices. That strategy worked for more than 30 years, but other retailers are demonstrating that shoppers don’t have to waste time roaming endless aisles in search of deals, a key part of how Walmart transformed the cost structure of retailing.

Walmart Pay’s new ability to offer instant credit cards comes as analysts and studies say more incentives are needed to boost the usage of mobile wallets. A survey in March found that consumers who were offered incentives use mobile payments inside stores an average of 4.6x in a one-week period compared with 3.1x for people who didn’t receive those incentives. Incentivized in-app purchases were greater at 4x a week, compared with 2.4x without them, according to the study by Auriemma Consulting Group. Mobile pay users, according to the study, are a “highly covetable demographic,” consisting mostly of employed, affluent and college-educated consumers.

For Walmart, coupling its branded credit card with its payment app is likely to provide the retailer with valuable data about its most loyal customers so that it can optimize its marketing efforts to them.

This latest move exemplifies Walmart's push for a more convenient shopping experience — like adding in-store pickup and free shipping on many items. Now, customers can access funds almost instantly without the hassle of waiting for a card in the mail. This feature seeks to meet consumers where they already are and offer a seamless payment process that will likely save customers time.