Dive Brief:

- As CEO Kevin Plank implements his turnaround strategy at Under Armour, the retailer’s revenue continues to tumble. In the second quarter, the metric was down 11% year over year to $1.4 billion, with North America revenue falling 13%.

- Both wholesale and DTC sales declined meaningfully in the quarter, the latter due in part to lower promotions in Under Armour’s online business. Net income, on the other hand, surged nearly 63% to $170 million, per a company press release.

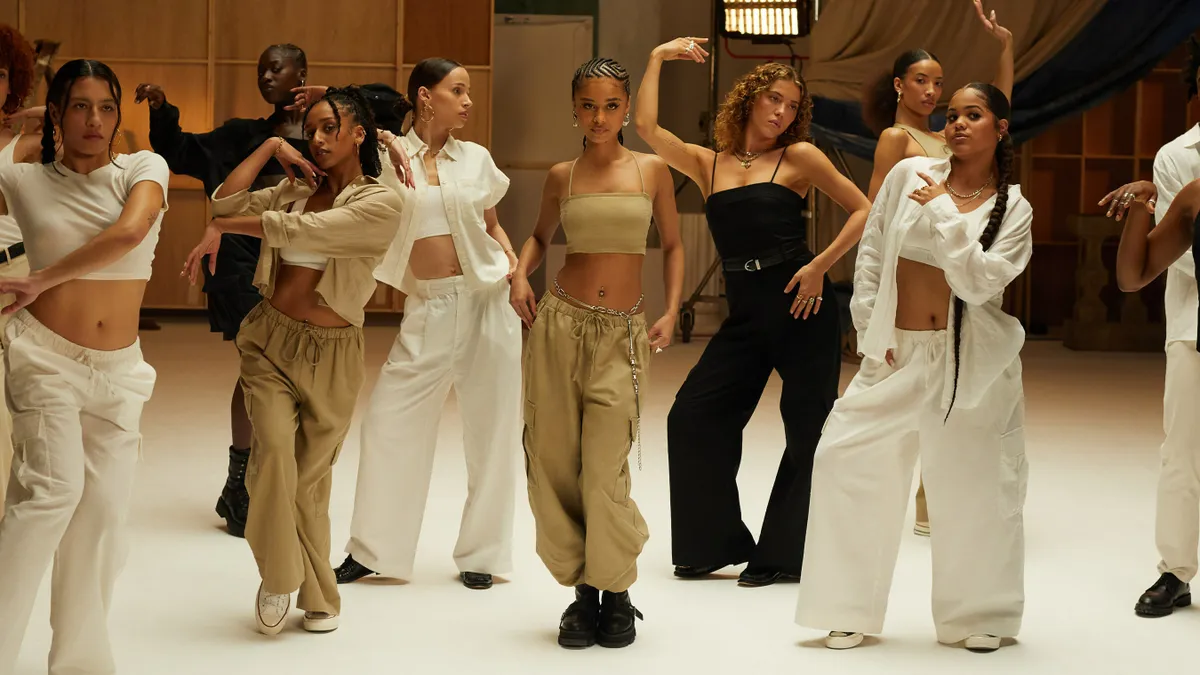

- Much of the brand’s turnaround strategy focuses on repositioning its brand, and Plank said on a call with analysts Thursday that 2025 will not only see improved product, but also the company’s most significant marketing effort to date.

Dive Insight:

Although sales are still dropping at Under Armour, that is partially due to purposeful steps the brand is taking to decrease promotions and (hopefully) create a more premium business as a result.

“This playbook of sacrificing low-quality sales in exchange for a stronger brand position and higher prices is one that we have seen play out at other retailers and, by and large, it can be extremely palatable to investors,” GlobalData Managing Director Neil Saunders said in emailed comments. The question, though, is how much of the declines are purposeful, according to Saunders, who added that Under Armour still has an “extensive amount of work” to do in order to rebuild brand equity.

Part of that journey involves cozying back up to its wholesale partners, with Plank telling analysts the company plans to increase communication with its key retailers and work to earn more shelf space.

“We don’t have as much shelf space as we once had and it’s our job to earn that, season by season,” Plank said.

While that is important, Saunders warned that Under Armour also needs to take a critical eye to how it shows up at wholesale partners, including the likes of Kohl’s, where the brand often shows up poorly.

The other half of the coin is reengaging the consumer. To that end, Plank said Under Armour plans to be “an incredibly loud brand and quiet company” going forward (something the brand has promised before as well), and is gearing up for a big marketing effort next year. The addition of longtime Adidas veteran Eric Liedtke to head up brand strategy in August this year is already driving “tangible, brand-right changes to improve our positioning in the market,” according to Plank, and the company’s product pipeline is “as healthy as I’ve seen it,” he said.

“Without story, you’re just selling shirts and shoes. And the world doesn’t need another capable apparel and footwear brand. The world needs hope and that’s what we think Under Armour can be,” Plank said, adding later: “I don’t believe the consumer’s mad at us, we just have to give them a reason to want to engage with us again.”

The executive rejoined Under Armour in April in a surprise CEO transition and in May announced ayoffs and a vow to reduce SKUs by 25%. Sales have fallen throughout the year as Plank works to reposition the brand with customers.