TikTok, often regarded as a video-sharing app most popular among teens, is trying to evolve past that image as it chases more brand dollars and attempts to sustain user growth that has exploded amid the pandemic.

During its second appearance at the Interactive Advertising Bureau's NewFronts Thursday, the ByteDance-owned company pitched advertisers and media buyers on an audience that extends well beyond Gen Z to encompass more than 100 million monthly active users in the U.S. and one whose interests are more eclectic than lip-syncing and dance videos.

"You can't get to the scale that we've reached without reaching almost everybody and having content for everybody," said Nick Tran, TikTok's head of global marketing, during a pre-recorded panel discussion. "[Brands] always talk about trying to reach this younger audience. Even if you're trying to reach an older audience, they're all on the platform, they're all engaging and being entertained by the diversity of content and the diversity of creators that we have."

Executives emphasized that TikTok's video content is not only a form of entertainment, but also a driver of sales. TikTok has invested more heavily in commerce capabilities, recently introducing tie-ups with retailers including Walmart that allow consumers to purchase products without leaving the app. Beyond touting direct sales channels, TikTok has positioned itself as a cultural trendsetter that can create a broader impact on the bottom line.

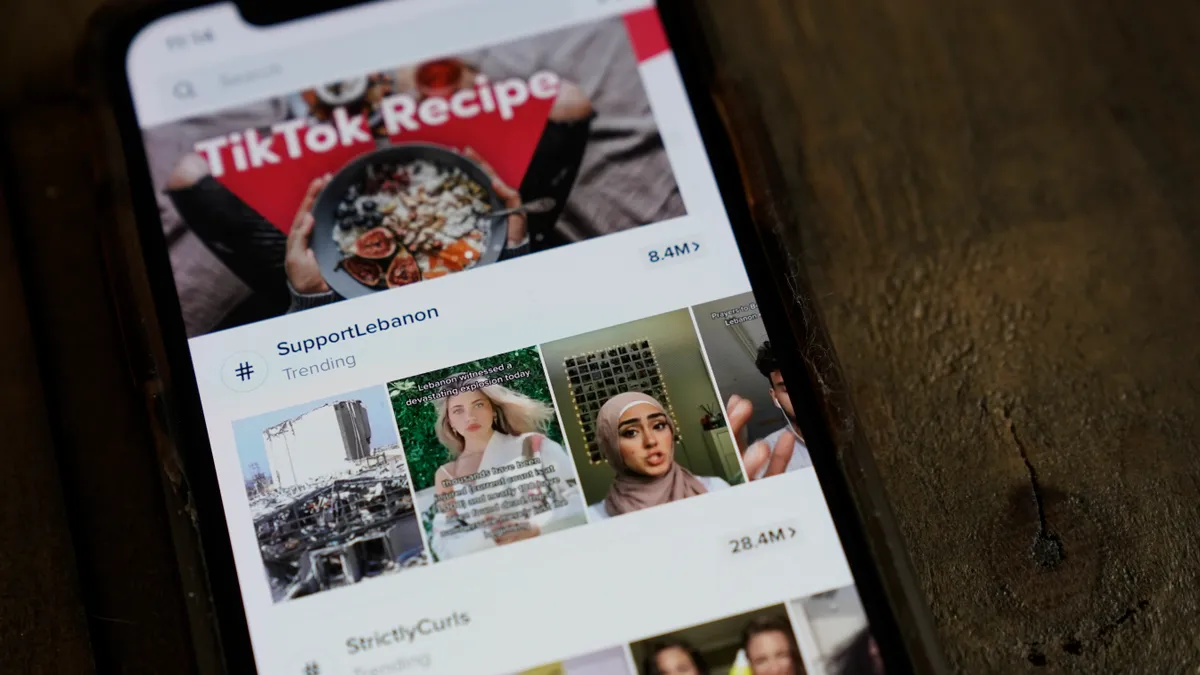

Over the past year, products ranging from American Eagle leggings to Ocean Spray cranberry juice and feta cheese experienced a surge in sales thanks, in part, to viral TikTok videos. During the NewFronts, TikTok said other brands could capture that buzz — encapsulated in an #TikTokMadeMeBuyIt hashtag — by partnering with the creators that prop up its powerful recommendation algorithm.

"TikTok has become home to a new generation of commerce disruptors, collapsing the funnel as we know it by bringing discovery and purchase closer together," said Sandie Hawkins, who was named head of TikTok's U.S. advertising business in January. "We are diligently building the tools in 2021 to further enable and drive community-based commerce."

Separating from the pack

TikTok went to great lengths to separate itself from the social-media pack at the NewFronts, stating its model — a scrolling feed of full-screen, sound-enabled videos — is more closely aligned with Netflix than rivals like Facebook or Twitter, which executives said users merely "check" in on rather than watch. Facebook introduced a TikTok lookalike to Instagram called Reels last August.

Similarly, executives championed a marketing strategy that blends paid and organic media in a way that feels akin to non-sponsored content users would normally come across in their TikTok feed.

"There's an art and a science to advertising, and over the past decade, the industry has really started to move further and further toward the science with more programmatic and data-driven ads. We kind of forgot about the art," Sofia Hernandez, TikTok's head of North American business marketing, said as part of a fireside chat with Hawkins. "TikTok allows brands to lean back into creativity and engagement and they can finally be storytellers again."

While TikTok’s bets on shopping are fledgling, the app claims it's already ahead of key rivals in terms of delivering results, including during a holiday shopping period that saw more consumers gravitate to online channels due to the pandemic. Commerce has been a major theme at the 2021 NewFronts, with other platforms like Amazon and YouTube promoting their ability to link eyeballs to shopping carts.

"Community commerce is very much alive on TikTok," said Hernandez. "Even as a young platform, we far outpaced other platforms in unplanned and impulse purchases during the holidays."

Walmart ran a first-of-its-kind shoppable livestream on TikTok last December as part of its holiday marketing campaign, and re-upped the concept for a beauty category-focused promotion in March. The retailer has expressed interest in acquiring a stake in TikTok, valuing the app's ability to blend content and commerce.

Tuned in

Even as the economy starts to reopen, TikTok expressed confidence that it could preserve pandemic levels of engagement. It cited Kantar survey data that found 88% of U.S. TikTok users intend to spend the same amount or more time on the app over the next six months. Thirty percent of users reported watching TV and other streaming outlets less since joining the platform, per Kantar.

As TikTok attracts a wider range of regular advertisers — McDonald's, Chevy, Gatorade, Disney and L'Oréal were name-checked Thursday — it cautioned partners to change their thinking when developing campaigns for the app.

"Don't make ads, make TikToks" became a mantra for TikTok when it introduced its global marketing platform at the NewFronts last year, and the theme was reinforced at the 2021 show. The mentality extends to commerce, which Hernandez said is a "flywheel" where TikTok's community sits at the center — a break from the traditional path to purchase.

"When brands create content that looks and feels like a TikTok, people tune in and take action," Hernandez said.