Dive Brief:

- TikTok's ad revenue is expected to triple this year to $11.64 billion from $3.88 billion in 2021, surpassing Twitter and Snapchat combined at $5.58 billion and $4.86 billion, respectively, according to a report by Insider Intelligence.

- More than half of the social video app's ad revenue this year is forecast to come from the U.S., bringing in almost $6 billion despite regulatory concerns regarding user data.

- TikTok's worldwide ad revenue may hit $23.58 billion by 2024, per the report, inching the app closer to YouTube's $23.65 billion — a feat that would put both video platforms at around 3% of the global digital ad market. But despite TikTok's impressive growth, it's still relatively small in terms of global digital ad share, with Google boasting a nearly 30% share and Meta at 21%.

Dive Insight:

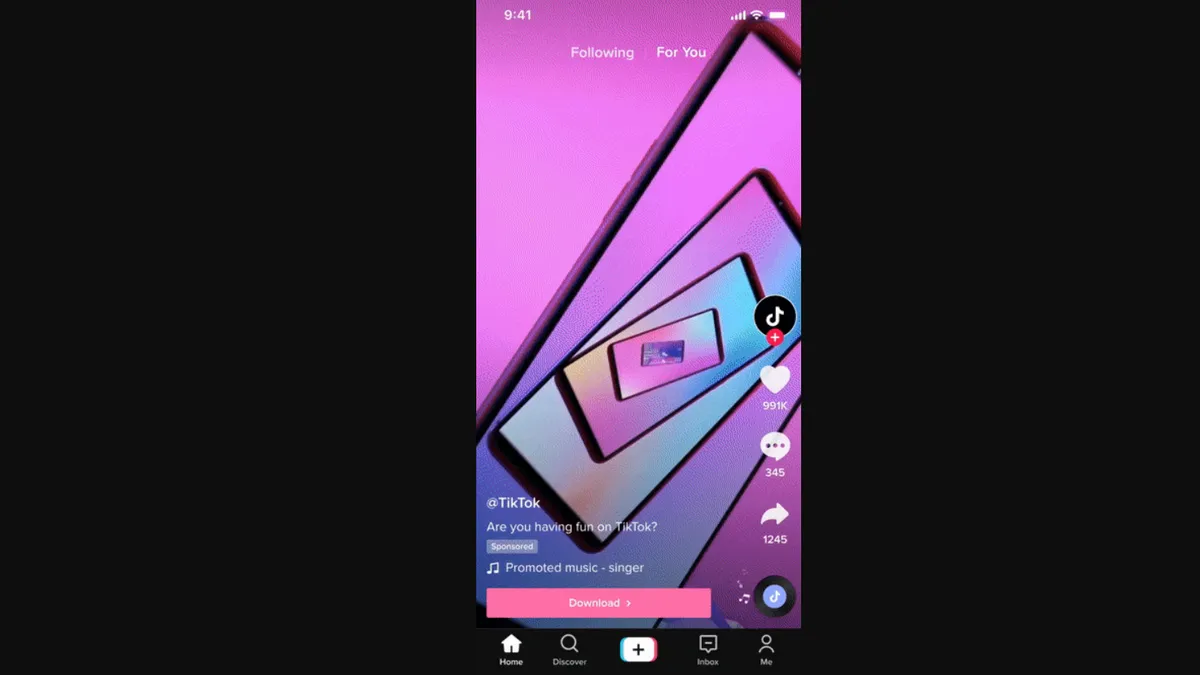

TikTok has skyrocketed in popularity over the past two years, rapidly becoming an important digital platform for the marketing world and a favorite app for many consumers. While it had 508 million monthly active users as of December 2019, TikTok is now one of the world's most popular social media apps at over 1 billion active users. In 2021, it dethroned Google as the most popular web address in the world for the first time.

That popularity among consumers has driven brands to increasingly experiment with the app, including with e-commerce, and further embed TikTok into their marketing strategies.

"It has moved well beyond its roots as a lip-syncing and dancing app; it creates trends and fosters deep connections with creators that keep users engaged, video after video. Advertisers want to reach a passionate, dedicated audience, and TikTok can deliver that," Debra Aho Williamson, Insider Intelligence principal analyst, said in the report.

Skyrocketing interest in the platform among consumers and brands alike is propelling TikTok's ad revenue, which is expected to overshadow Twitter and Snapchat's ad revenue combined, per Insider Intelligence's new report.

While brands clamored to reach users on TikTok last year, the app attempted to cozy up to brands in a push to win marketers' trust and snag a larger share of their budgets. The app in 2021 made significant investments to bolster its standing among marketers by doubling down on privacy, ad measurement and commerce, adding creator tools and launching a TV app that's designed to bring the app to bigger screens in gyms and restaurants through a partnership with Atmosphere.

"Another factor that will drive growth in ad spending is TikTok's unique take on social commerce. It pairs marketers with creators to help content go viral, and that can drive enormous demand for products that advertisers want to promote," Williamson said.