Brief:

- Snap's revenue rose 17% to $454 million in Q2 from a year earlier as photo-messaging app Snapchat expanded its user base by the same percentage to 238 million, per a quarterly report released Tuesday.

- Snap experienced a jump in usage during the early days of pandemic lockdowns, leading the company to overestimate Q2 growth. The initial jump in usage "dissipated faster than we anticipated as shelter in place conditions persisted," Snap CFO Derek Andersen said in prepared remarks. Snap's net loss rose 28% to $326 million from a year earlier, and the effects of the pandemic on revenue makes its earlier goal of reaching profitability this year less likely, he said in a conference call with analysts.

- The company is seeing early signs of stronger growth, with revenue up 32% during the first few weeks of Q3 from a year earlier. However, the company estimates growth will moderate to end the quarter at about 20% amid the uncertain business environment, Andersen said.

Insight:

Snap's revenue growth slowed in Q2 from the prior quarter, which isn't surprising considering the pandemic's negative effect on the economy and media spending. The revenue growth was slower than the 44% increase in the prior quarter as the coronavirus pandemic led many advertisers to pause media spending. In addition, the 17% growth in Snapchat's user base was lackluster as an initial surge in usage faded throughout the quarter, as CFO Derek Andersen pointed out in his remarks. Three months ago, Snap had touted strong metrics like a 50% jump in time spent on video and voice calls in late March from a month earlier and higher engagement with advertising.

The slower user growth may indicate that people spent less time on social media as lockdowns eased during the quarter and people resumed former activities outside the home. Snap acknowledged economic challenges from the pandemic, and their effect on media spending and ad creative.

"Many of our advertisers have seen interruptions in their businesses, especially those that rely on in-person interaction with their customers such as restaurants, entertainment venues, transportation services, physical retailers and hospitality providers, among others," Andersen said during the call. "In addition, many advertisers paused spending for periods of time during the quarter in order to swap out their ad creative for messaging that was more appropriate for the given moment."

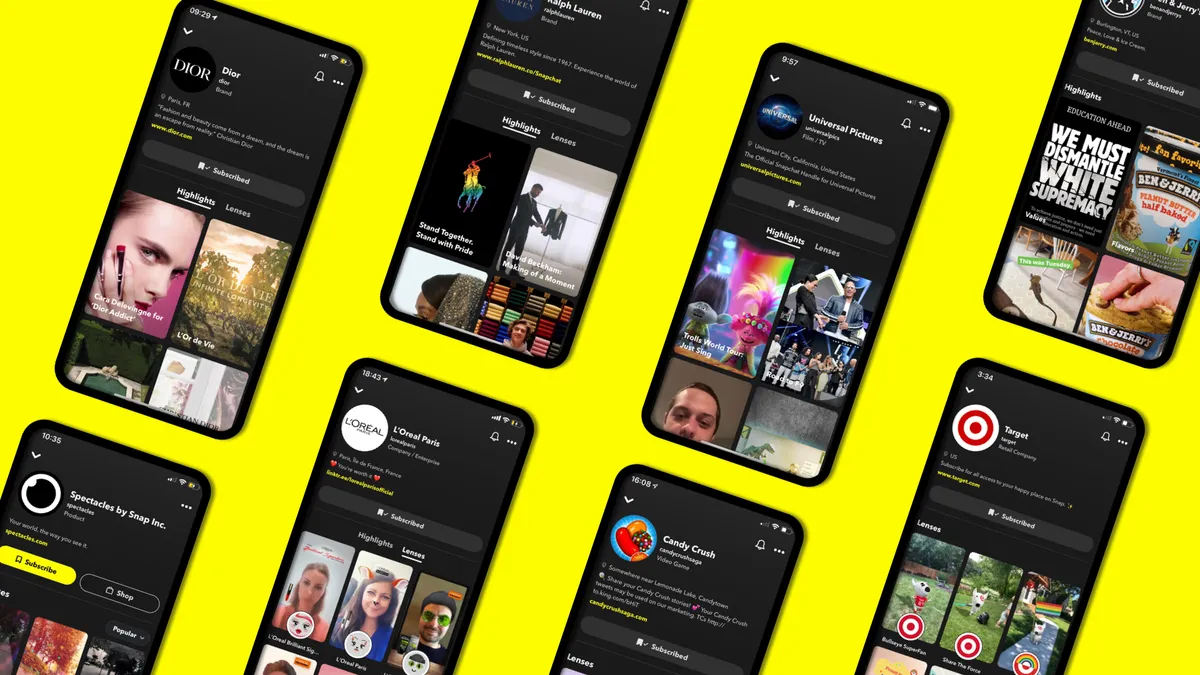

The company could see moderately better growth in Q3 as marketers resume normal advertising, but the uncertain business environment remains a cloud over future earnings. However, Snapchat is encouraging brands to have a larger presence on the app, giving them "permanent homes" by launching brand profile pages. Target, L'Oréal and Ralph Lauren are among the brands that are testing the new feature.

On the earnings call, Chief Business Officer Jeremi Gorman said it was "difficult to ascertain" the impact of the #StopHateForProfit boycott that has targeted Facebook on Snap's revenue, but pointed out that Snapchat has been "designed in a brand-safe, hand-curated way since the beginning," making it more attractive to advertisers.

"The majority of our revenue is VR, which is a segment not broadly participating in the boycott. And with the advent of dynamic ads, the addition of worldwide targeting and more, we're continuing to deliver results for those advertisers, which put us in a strong position to gain and retain those advertisers over time, independent of the boycott," Gorman said.

Snap had a busy second quarter that included a presentation at the Interactive Advertising Bureau's Digital Content NewFronts to showcase its original video programming and the addition of dozens of Snapchat features announced at its yearly Snap Partners Summit. Snap last month said it will start streaming its first shoppable show to give users a way to buy products directly.

During its annual summit last month, Snap introduced a new Camera Kit that lets developers bring Snapchat's AR features into their apps and announced support for miniature software programs called Snap Minis that run inside Snapchat and offer services while people chat. The introduction of Snap Minis means Snapchat can be expanded to handle a wide range of services from other apps including shopping, banking, ticketing, bill payment and ride hailing, among others.