Brief:

- Snap's estimated ad revenue was cut 36% to $662.1 million in a revised forecast from researcher eMarketer, which in March had predicted the owner of Snapchat would reach $1.03 billion in U.S. sales this year. Automated ad buying has pushed down prices for Snapchat's inventory, even as more marketers are placing ads on the image-messaging platform.

- The revised estimate means that Snap's U.S. ad revenue will grow 19% this year, compared with an increase of 86% in 2017. Looking ahead, eMarketer forecasts sales growth of 39% to $920.5 million for 2019 and a 31% gain to $1.2 billion by 2020 as more advertisers bid up prices on Snapchat.

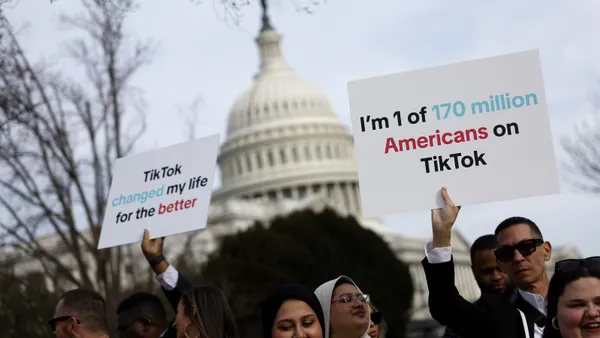

- Snapchat's user base this year will expand 7% to 84.8 million in the United States, outpacing the growth of Facebook and Twitter at 0.9%, eMarketer forecast. Facebook-owned Instagram, whose co-founders this week quit the company, will see a 13% gain in users, per the forecast.

Insight:

The report offers some potentially good news for Snapchat, which is attracting more advertisers thanks to several changes in the past year. Whether such growth will continue will depend on how well those ads do. Lower prices for ads are certainly attractive to marketers but if Snap is sacrificing profits to win over brands, that could spell trouble down the road.

Snap has had a rocky year as the company has sought to expand its user base by redesigning the Snapchat app — a move that alienated many core users — and shifting toward programmatic ad buying, which uses software to automate the process of bidding for digital ad placements in real time. The shift to programmatic ad buying cut the prices for Snapchat's ad inventory, making the platform more accessible to a wider group of advertisers who may not have considered running a campaign on the image-messaging app. Some advertisers have produced strong ROI on Snapchat, while others are skeptical of the platform because of concerns about measurement and targeting abilities, compared with more established rivals like Facebook, as eMarketer principal analyst Debra Aho Williamson noted.

Snapchat needs to boost user engagement to maintain the interest of advertisers who are seeking a viable alternative to the so-called duopoly of Facebook and Google, which together control 58% of the U.S. digital ad spending. Amazon has emerged as the third-biggest ad platform with an estimated 4% share of U.S. digital ad revenue this year. Snapchat has 0.6% of the digital ad market, and 0.9% of the mobile ad market in the United States, per eMarketer. Snapchat's key strength is in reaching younger audiences, including teenagers who use the app to chat with friends and share Stories, which string together several images in a single post that disappears after 24 hours.

Faced with a slowing growth rate, Snap has worked to build up its content by partnering with media companies and more social influencers, while developing additional revenue streams from social commerce. Snap this week announced a visual search function that allows users to use Snapchat's camera to search for and buy products on Amazon. Because of Amazon's affiliate marketing program, the feature could be a new source of revenue for Snap, if it proves popular with users.

Snap has undertaken other initiatives that aim to make Snapchat more popular with users, publishers, influencers and advertisers. The company this month partnered with 25 media companies to create daily content for its public Our Stories feature that collects in-app posts from users in a nearby community. Snapchat also has tried to expand its appeal among marketers with new features such as native commerce capabilities that let influencers earn money from products sold through their posts. Snap last year added self-service features like its Ad Manager tool to open its platform to a wider group of advertisers.