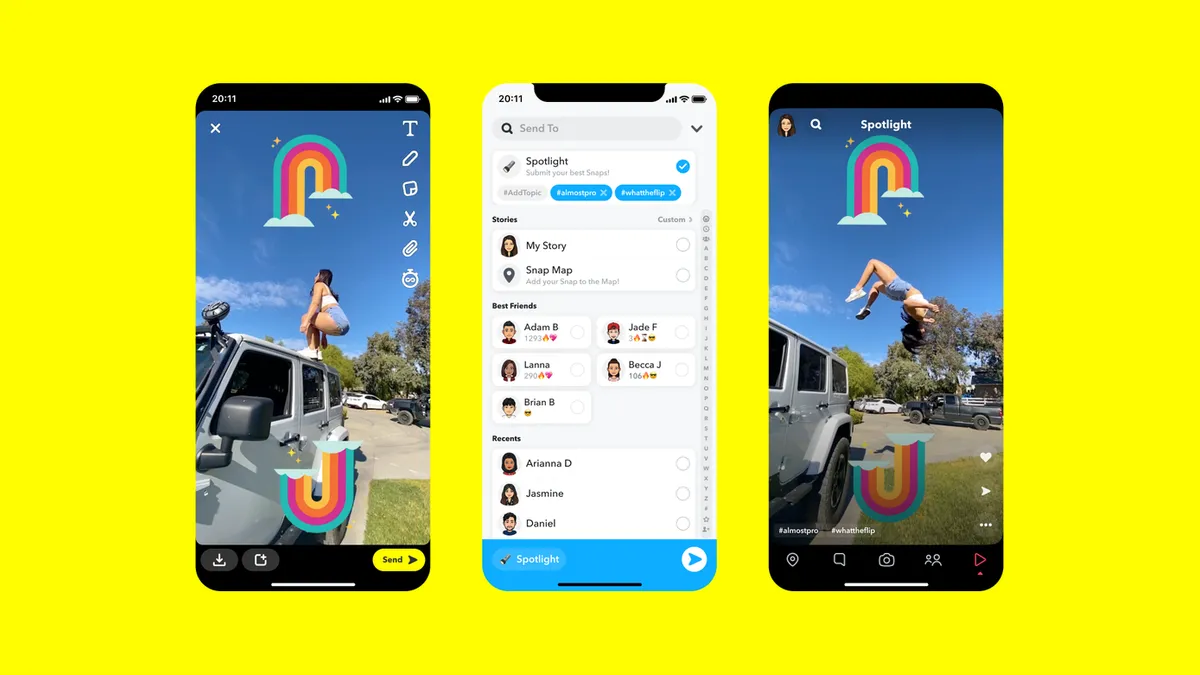

Snapchat this week launched its global expansion of Spotlight, the photo-messaging app's TikTok clone that is set to become a bigger avenue for advertising. With the rollout in India, Mexico and Brazil, parent company Snap seeks to boost the popularity of Spotlight, which had about 100 million monthly active users in January.

That's impressive growth for a feature Snapchat introduced to 11 countries just two months earlier. At that time, the company announced a plan to distribute $1 million a day to video creators as part of its effort to entice them to try the platform's new format. The payout program for top-performing content was intended to expire at the end of 2020, but Snap decided to prolong the offer, spurring an average of 175,000 video submissions a day.

But will Spotlight still be compelling for creators and brands if Snap ends big payouts? For now, it appears to be focused on teeing up longer-term stability.

"While Snapchat hasn't historically been a fertile ground for social media creators, Spotlight was created in hopes of changing that," said Maarten Boon, senior product marketing manager at digital-asset management startup Bynder. "Snapchat's Spotlight is another example of how social media platforms are adapting their features to provide users with the TikTok-like experiences they've been gravitating toward."

Building critical mass

Considering that Snapchat's daily user base — which last year grew 22% to 265 million — sends 5 billion pictures a day through the platform, Spotlight has much more potential for growth in light of this week's expansion to other large countries around the globe.

"There's a simultaneous challenge and opportunity for brands, as there are more ways than ever to connect with audiences with content created specifically for that platform," Bynder's Boon said. "This new approach also requires marketers to overhaul how they traditionally approach video content creation."

Expanding the variety of content to boost viewership is one of the first steps toward opening Spotlight to advertising. Brands are forecast to ramp up their spending on in-app video ads 28% to $18 billion in the U.S. this year as the ad market begins to normalize and demand rebounds more strongly from the pandemic, per researcher eMarketer.

"Our primary goal in launching Spotlight was to build critical mass both in terms of video submissions and audience in a select set of countries so that we could begin to rapidly iterate on content ranking and the overall product experience," Snap CEO Evan Spiegel said in a quarterly earnings call last month.

Spiegel during the call didn't provide a timeline on when Spotlight would start selling advertising in Spotlight, saying the biggest priority at the moment was to boost engagement enough to support the platform's longer-term operations. The creator incentive program doesn't allow for sponsored videos or ones that that sell products or services, though that monetization approach could change if things really begin to catch on with users. Outside of Spotlight, Snapchat offers a variety of video ad formats that range in length and placement throughout sections of the app.

"Fortunately, we've got a lot of demand for vertical video, which is the format we will use to monetize Spotlight," Spiegel said. "Spotlight will be a great way for folks to extend their video campaigns."

Video content is especially popular among younger consumers, with 61% of Gen Zers and millennials saying they watched more videos on social media apps since the pandemic's onset, a survey by Snapchat and Omnicom Media Group found. Fifty-two percent of those respondents said they're using their smartphones to watch more videos on streaming apps and platforms, while an equal percentage said they'll maintain that heightened viewing even after the pandemic, according to the study.

At the same time, there are signs that Snap plans to extend its outreach to advertisers with its February hiring of Doug Frisbie as vice president of global business marketing. He previously held a similar role at archrival Facebook, where he led the social network's small business and vertical marketing.

Responding to TikTok

Snapchat's launch of Spotlight in late 2020 came as U.S. social media companies responded to the growing threat from TikTok. Since 2018, the social video app has been installed more than 2.6 billion times, and last year was one of the top-rated apps in the U.S., per Sensor Tower analytics. To reap some of TikTok's skyrocketing popularity, Facebook-owned Instagram last year debuted a copycat feature called Reels, while Google's YouTube began piloting a feature called Shorts in India. Google this week announced it will roll out a beta launch of Shorts in the U.S.

"Many of the popular consumer trends on TikTok are also popular on Spotlight: dancing videos, prank videos, and challenges," Bynder's Boon said. "Because Spotlight is currently paying out millions of dollars to get people using the app, now is the perfect opportunity for brands to create content that encourages users to interact with them while everything is new and exciting."

In developing a strategy for social video, Boon recommends being open to experimentation and having a system in place to create content quickly as videos begin to trend. It's also important to test content on different social media apps to determine what has the greatest likelihood of going viral based on their respective, oft-finicky algorithms.

"Marketing and creative teams need to let go of the idea of the traditional video creation process," Boon said. "In a world that values authentic and informal content, the polished, 60-second video ad is no longer the final deliverable. Instead, easily repurposable, 'atomic' content is the path forward for brands to create quick, informal videos."