Dive Brief:

- Snap Inc. saw revenue grow 38% year-over-year to hit $1.06 billion in the first quarter of 2022, per an earnings statement. The results missed analyst expectations.

- The Snapchat owner continues to feels the impact of "platform-related headwinds" — namely privacy tweaks made by Apple that affect user tracking — along with supply chain disorder, labor shortages, inflationary pressures and geopolitical unrest stemming from events like the war in Ukraine.

- The company forecast revenue growth between 20% and 25% in the second quarter, which also fell short of Wall Street's targets. Snap's disappointing earnings potentially tee up a tough reporting period for the tech sector, where rivals are grappling with similar challenges.

Dive Insight:

Snap's Q1 report showed macroeconomic factors like rising inflation and operational chaos stemming from the invasion of Ukraine compounding on existing problems. Discussing the results with analysts, Snap CEO and Co-founder Evan Spiegel said that the period "proved more challenging than we had expected."

Social media companies have seen campaign measurement and performance take a hit since Apple made its Identifier for Advertisers (IDFA) — a key way of keeping tabs on iPhone users for advertising purposes — an opt-in feature by default last year. The Q1 results still mark a bit of backslide for Snap, which appeared sturdier through the second half of 2021 despite the IDFA challenges. It beat Wall Street expectations and reported its first-ever net profit in the fourth quarter.

Snap is working on first-party data solutions that will help advertisers better navigate the IDFA headwinds. Getting partners to sign on still sounds like a work-in-progress.

"The first step was to drive broad availability of these solutions, which we've largely achieved," Chief Business Officer Jeremi Gorman said on the analyst call. "Now we are working toward achieving broad utilization of and full confidence in these measurement solutions."

This year is clearly primed for further disruption, as Snap offered a cautious forecast for Q2. Rivals like Meta are could display the same pinch when they release earnings later this month.

In terms of strengths, Snap emphasized continued traction for bets in augmented reality (AR), a core part of its positioning as a "camera company." Executives said over 250 million users engage with AR features on a daily basis while content creators have built more than 2.5 million Lenses. Users played with Lenses more than twice as much in Q1 compared to the year-ago period. Snap's daily active users increased 18% YoY, or by 52 million, to reach 332 million.

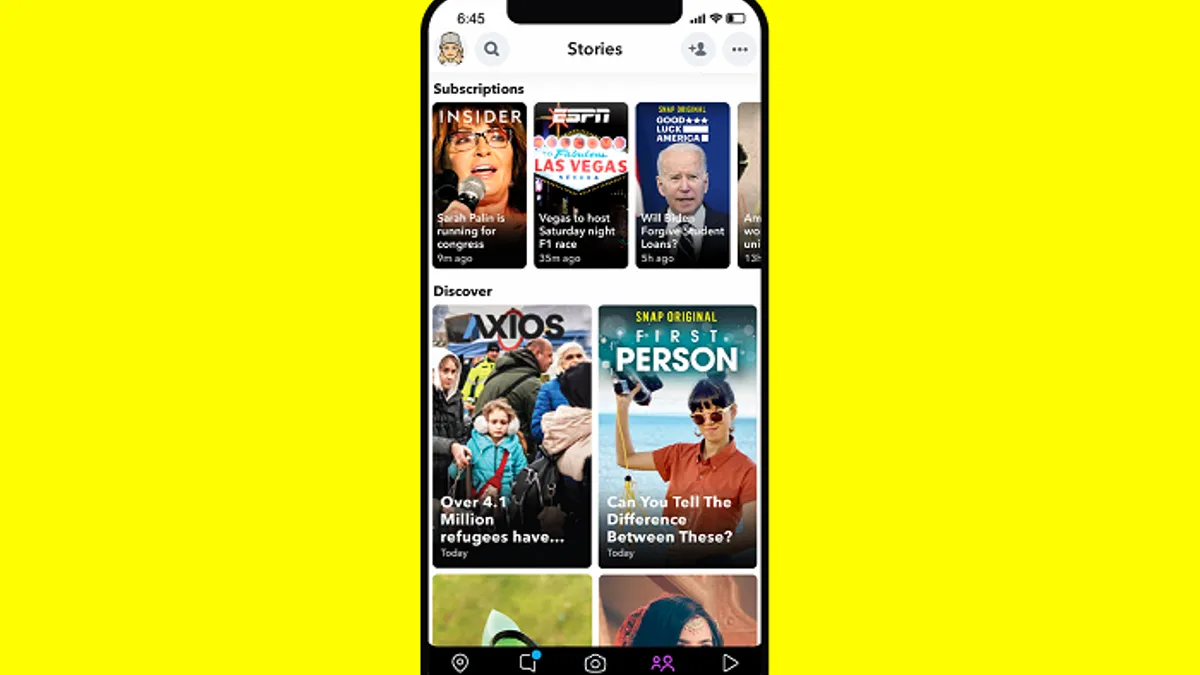

Video remains the largest driver of Snap's ad revenue growth. Spotlight, a TikTok lookalike, has shown promise and intersects with other areas like AR. Spotlight posts applying creative tools or Lenses were up 350% YoY in Q1, according to Snap.

As Snap builds out its capabilities in AR, video and other fields, it's focused on deepening relationships with advertisers and agencies. Snap has partnerships in place with a number of ad holding groups, including one centered on performance media with Dentsu and an AR Lab for social commerce products with WPP. Both relationships formed last year.

In turn, Snap's upfront advertising commitments for 2022 are already more than 60% higher compared to its total commitments last year, Gorman said on the analyst call. That could provide some stability during an otherwise bumpy period. Snap plans to host its Partner Summit later in April, as well as present at the Interactive Advertising Bureau's NewFronts in May.