Brief:

-

Snapchat, the image-messaging app with 178 million users, is considering whether to force its audience to watch three seconds of commercials before letting people tap through to requested content, an unnamed source told Advertising Age. The skip feature would be similar to one on Google’s YouTube, whose TrueView ads run for five seconds before letting viewers skip ahead.

-

Snapchat's sales team is pushing for the change to its ad format in order to appeal to more brands and boost revenue. Snapchat currently lets viewers skip past video ads with a quick screen tap, but that has led to average viewing times for ads of about a second, an advertiser told Ad Age. Parent company Snap hasn’t released data on average viewing times for ads.

-

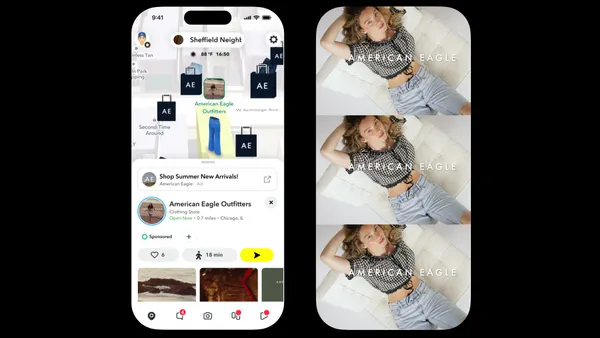

It’s not clear where the required-viewing ads may appear in the app, which has separate sections for personal messages or professionally produced content. A possible start date for testing the format is also unknown.

Insight:

If a three-second viewing requirement is added to Snapchat, it would be another sign that digital platforms are acquiescing to marketers' demands for greater transparency into the impact of their online ad buys. The three-second rule for ads would mean a more intrusive experience for consumers, but also that ads would be more likely to be seen and measurable.

According to the guidelines set by the Media Rating Council, a video ad must be visible for at least two seconds to be considered "viewable." Snapchat, earlier this year, started working with Moat to provide a viewability to score to some advertisers, alhtough it wasn't clear what this would be based on. The latest news around the three-second rule suggests advertisers are demanding even greater transparency into viewability.

Facebook faces similar challenges as users scroll past ads that autoplay in their News Feeds, leading to average view times of less than two seconds for many brands, Advertising Age reported in October. Facebook last month started to test pre-roll video ads in Watch shows after years of resisting the ad format. It instead marketed mid-roll ads — spots that interrupt a video — to monetize video.

Snap may eventually decide that the three-second rule is better suited for ads appearing in videos from the company’s professional media partners rather than personal video messages among friends. Snapchat’s Discover section showcases content from publishers and TV networks like Hearst, Time, 21st Century Fox and Turner, but there are signs of trouble for content producers. CNN last month canceled its daily Snapchat show “The Update” that premiered in August. The cable news channel realized there wasn’t a clear enough path to make money, people familiar with the situation told The Wall Street Journal.

Snap is similar to other social media companies in initially showing disdain for intrusive video advertising, only to reconsider that stance after going public, when the demands of advertisers and investors weigh on their decision-making. Snap co-founder and CEO Evan Spiegel in 2015 famously said the company wanted to avoid being “creepy” in using personal data for ad targeting, but a year ago the company began to enable targeting using Oracle Data Cloud data about offline purchases.

Wall Street analysts have gradually scaled back their estimates for Snap’s annual revenue to $871.3 million from $1 billion six months ago as the company struggled to boost ad sales. Snap said during its Q3 earnings call that 80% of Snap ad impression were delivered programmatically in the period, indicating how automation efforts had gained traction last year, but added automated ad sales also pushed down ad prices, reducing CPMs more than 60% year-over-year. The number of advertisers spending in Snap’s auction increased almost 5x in 2017. The company is expected to report Q4 earnings on February 6.