Dive Brief:

- Amazon is reportedly going after traditional TV advertisers for its Fire TV connected TV platform, according to a report from Digiday that cites unnamed ad buyers.

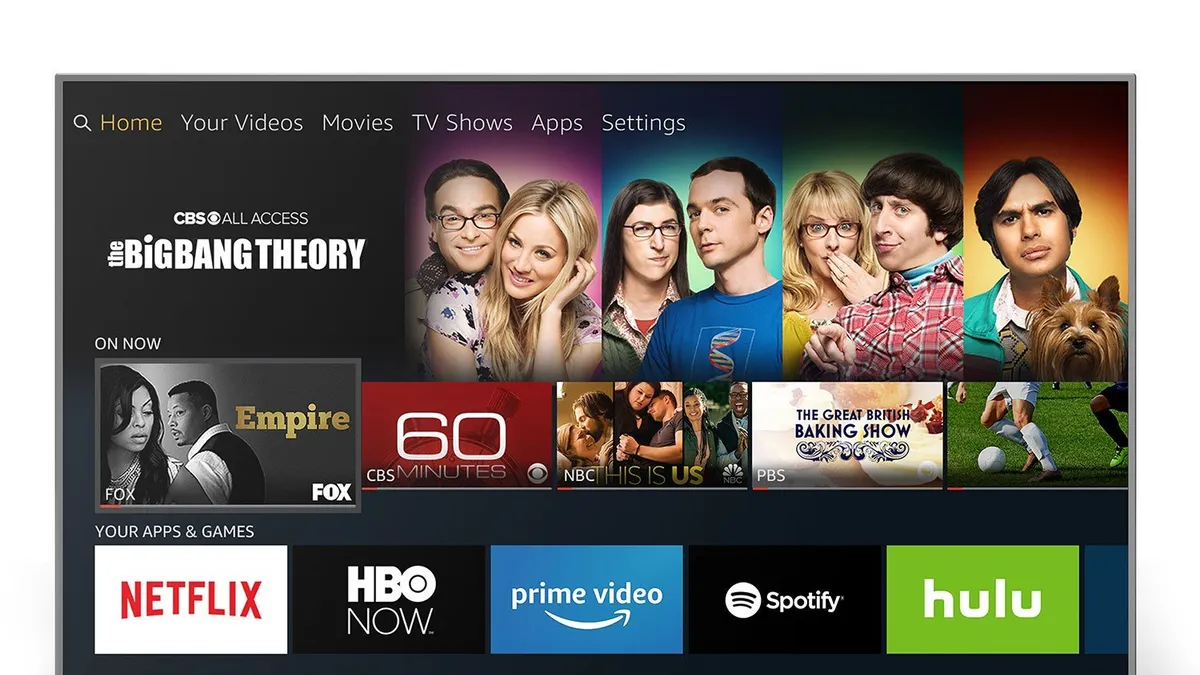

- Fire TV inventory has been bundled with display, which includes banner ads that run on the platform or larger upfront deals that are part of Amazon's "Thursday Night Football" live streaming. Amazon has been pitching Fire TV as a standalone buy recently and asking advertisers how they want to be pitched on the inventory. Currently, Amazon's Fire TV sales pitch focuses on the inventory that the company aggregates across the company's apps.

- The company is also said to be developing a dedicated video ad sales team to sell Fire TV inventory. The same salespeople who handle the company's search and display ad inventory have been pitching Amazon's ad inventory. Amazon is advertising a job position for a senior video advertising solutions specialist, with the role described as being "responsible for driving sales and usage of our video advertising products among TV buyers at ad agencies."

Dive Insight:

Going after TV advertises and building a dedicated video sales staff is more evidence that Amazon is growing its ad business and positioning its Fire TV platform as a connected TV standout. Amazon recently began taking a 30% cut of the ads shown to viewers on Fire TV, following a period when Amazon let publishers sell their own ads and take all the money. The company is also developing its ad technology to manage Fire TV ads and expand its ability to serve ads across the internet via its publisher network with apps and publishers using Amazon ad services.

The news comes as Amazon's Fire TV platform is gaining ground in the growing connected TV ad space. Ad requests on connected TV devices have increased 1,640% year-over-year, reaching nearly 30 billion in November 2018 compared to 1.7 billion the previous year, according to a recent Beachfront study. While Roku accounted for more than 87% of ad requests on connected TV in November 2018, Fire TV ranked No. 2, up from its No. 4 position previously. Fire TV's user base grew from 16% of streaming media players in 2016 to more than 25% in 2018.

While broadcast TV has traditionally been where the big money is spent in advertising, this is changing as digital technology provides new capabilities like targeting and more granular measurability. As a result, advertisers are becoming more interested in investing in connected TV as consumer adoption of smart TVs and set-top boxes is growing, and more are cutting the cord. Ad spend on over-the-top (OTT) TV, or connected TV, is projected to grow 40% to $2 billion in 2018, according to a fall update to Magna's U.S. ad forecasts for the year. Eighty percent of U.S. households will be reachable through OTT this year.

Amazon is aiming to drum up TV advertisers' interest in Fire TV with a fixed-price reserved marketplace. The company has also been more frequently going directly to brands and bypassing agencies, and Amazon is reportedly launching an ad-supported video service for Fire TV device users that is similar to Roku's Roku Channel, which airs old movies and TV shows.

Amazon is also working to make the inventory on Fire TV more appealing. Advertisers will likely want more control over where ads appear and for Amazon to incorporate Nielsen's Digital Ad Ratings that would enable them to ads and where they were delivered, or for Amazon to offer audience guarantees based on third-party measurement, according to Digiday.