Dive Brief:

- Pinterest reported a 23% increase in year-over-year revenue for a total of $740 million in the first quarter, according to its latest earnings report. The gains, which beat analyst estimates, were attributed to investments in shoppability and artificial intelligence (AI).

- The number of global monthly active users (MAUs) grew 12% YoY to 518 million. Clicks to advertisers more than doubled, attributed in part to the completed rollout of direct links to lower funnel ad formats, per comments made during an earnings call.

- In Q1, Pinterest saw its fastest revenue and user growth since 2021. The results, described by CEO Bill Ready as a “milestone quarter,” comes as Gen Z continues to flock to the platform, with the cohort now amounting to over 40% of its users and representing its fastest-growing demographic.

Dive Insight:

Pinterest continued its upward trajectory in Q1, accelerating global MAUs for the seventh consecutive quarter and nearly doubling its 12% YoY revenue growth rate from Q4 2023. The strong results, which follow similar recent earnings successes from Meta and Snap, signals healthy advertiser demand. Particularly, investments in AI and shoppability have led to greater advertiser returns and increased access to performance budgets, according to CEO Ready.

“We’re executing with tremendous clarity and focus, shipping new products and experiences that users want, and in doing so, we’re finding our best product market fit in years,” the exec said in a statement.

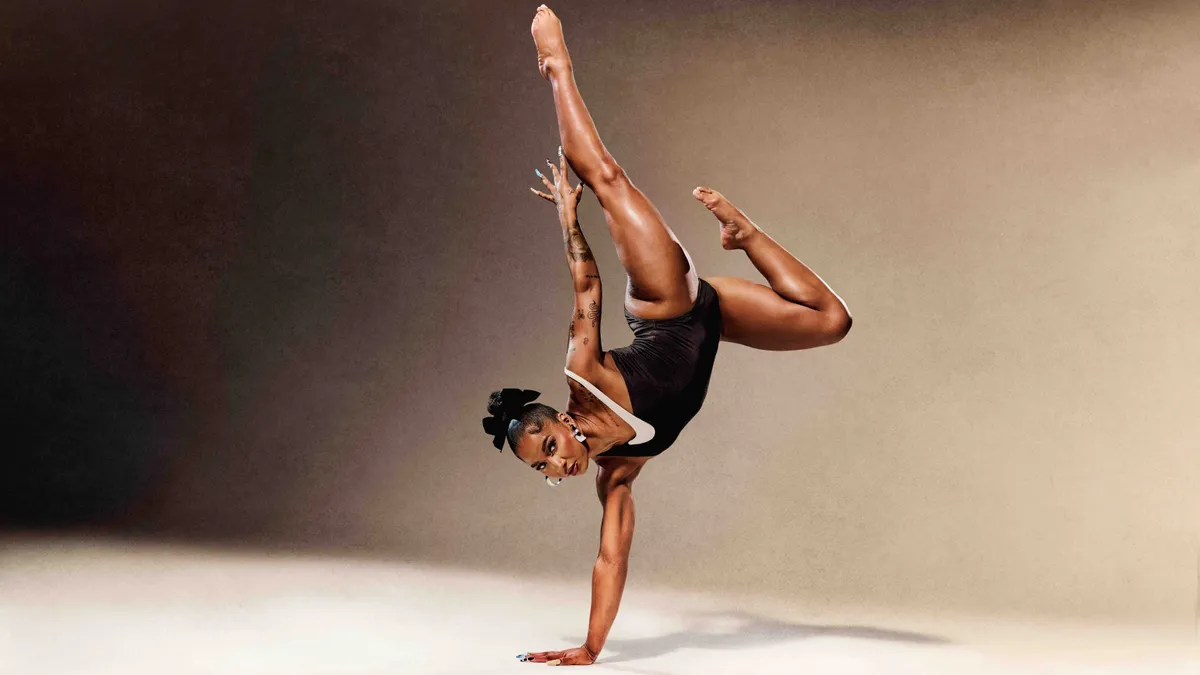

Pinterest is like many players in the digital space who are betting on AI as a way forward. In an earnings call with analysts, Ready discussed past efforts like the adoption of large language models (LLMs) and “next-gen” AI that have helped boosts saves, clicks and conversions through enhanced relevance and personalization for users. The platform’s AI-powered collages feature, a shoppable curation tool that allows users to cut out images and components from a Pin, or virtual bookmark, to piece together content, was a focal point. Users are roughly three-times more likely to save collage Pins — a significant portion of those containing clickable products — over other content.

Shoppable content continues to be a major focus for Pinterest as it positions itself as more than an inspiration hub. During the period, Pinterest brought its Shop the Look feature to video Pins, allowing users who click on a video Pin to access a carousel that will appear with shoppable Pins matching items in the video. The move builds on how the platform is integrating more shoppable content into its core surfaces including home feed, search and related items.

Shoring up value for advertisers was also a focus during the period, particularly via lower funnel solutions. Among highlights is the completed rollout of direct links to Pinterest's lower funnel ad formats, which now make up 97% of its lower funnel revenue, up from 80% in the prior quarter. Direct links is a feature that takes users to an advertiser's product or purchase page. First launched at the end of Q3 2023, they have helped Pinterest capture more ad spend — up to 5% of total ad budgets — from some of its “largest, most sophisticated advertisers,” Ready explained on the earnings call.

Notably, the platform again accelerated clicks to advertisers this quarter after more than doubling clicks YoY in Q4, while ad impressions, which includes ad load and total impressions — for both organic and paid impressions — grew 38%. The company in future quarters plans to introduce a dynamic solution set that will allow advertisers to use generative AI to optimize creative for their ads. Additionally, it will introduce row ad bidding, which will automatically optimize campaigns in real time to prioritize the users and products that drive the highest returns.

While Pinterest mostly sees a sunny outlook, areas of improvement remain. Despite surpassing over half a billion global MAUs, and growing its users across all geographic regions during the period, the majority of its growth stems from lower revenue markets. The U.S. and Canada, where the vast majority of Pinterest’s income comes from, saw the lowest YoY growth in monthly active users at 3%, representing a key area for improvement.

Other discussion highlights included an update on efforts to scale budding third-party demand. These include partnerships with Amazon Ads in the U.S., which is currently live across all of Pinterest’s main surfaces in the region, and Google Ads Manager, which went live in February in unmonetized international markets. While it’s still early, the latter “is also progressing nicely,” according to Ready.

Pinterest expects Q2 revenue to be in the range of $835 million to $850 million, representing 18%-20% YoY growth.