It’s been nearly a decade since National Beverage Corp.’s LaCroix ignited a consumer craze around sparkling water, spurring a rush of investments in the category from larger beverage rivals. Bubly, PepsiCo’s answer to LaCroix that launched in 2018, has hung around where others floundred, and now aims to shake up a sector that has seen some of its excitement wane.

The brand on March 25 will roll out a new product lineup that caters to consumers who view current sparkling water offerings as too steep a trade-off from the sweetness of soda — and a bit boring to boot. Bubly Burst, which boasts zero added sugars and 10 calories or less depending on the flavor, comes in six variants. Names like peach mango, tropical punch and triple berry are available in tall, 16.9-ounce single-serve bottles made of recycled plastic material known as PET.

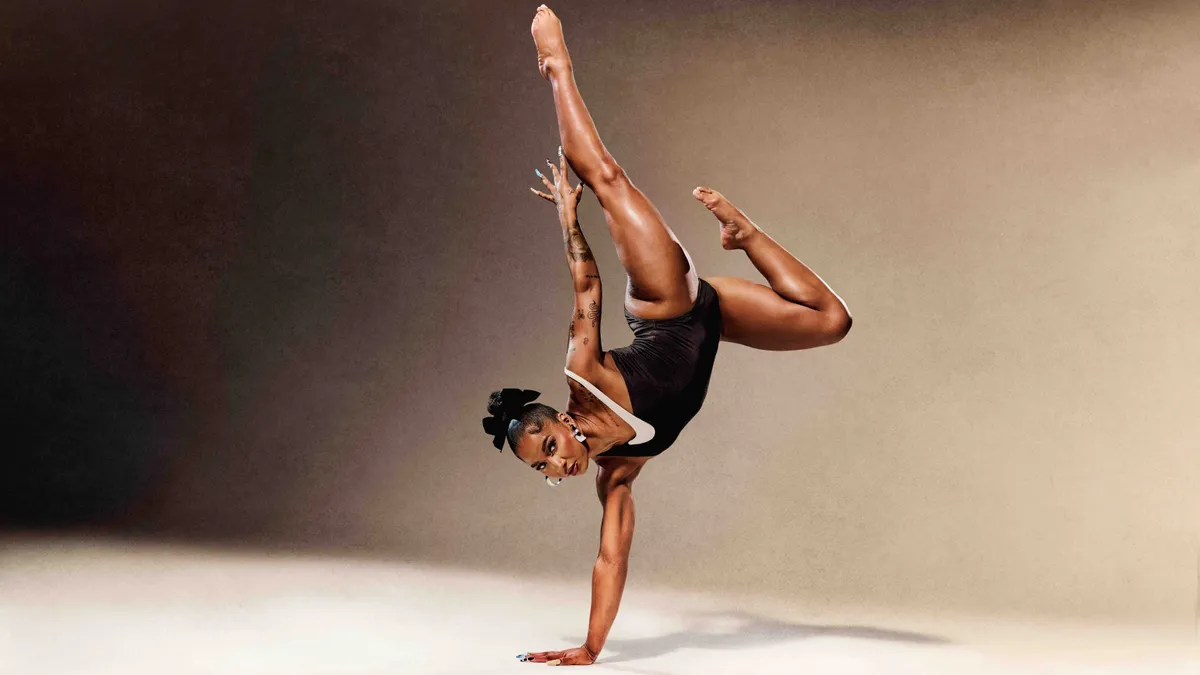

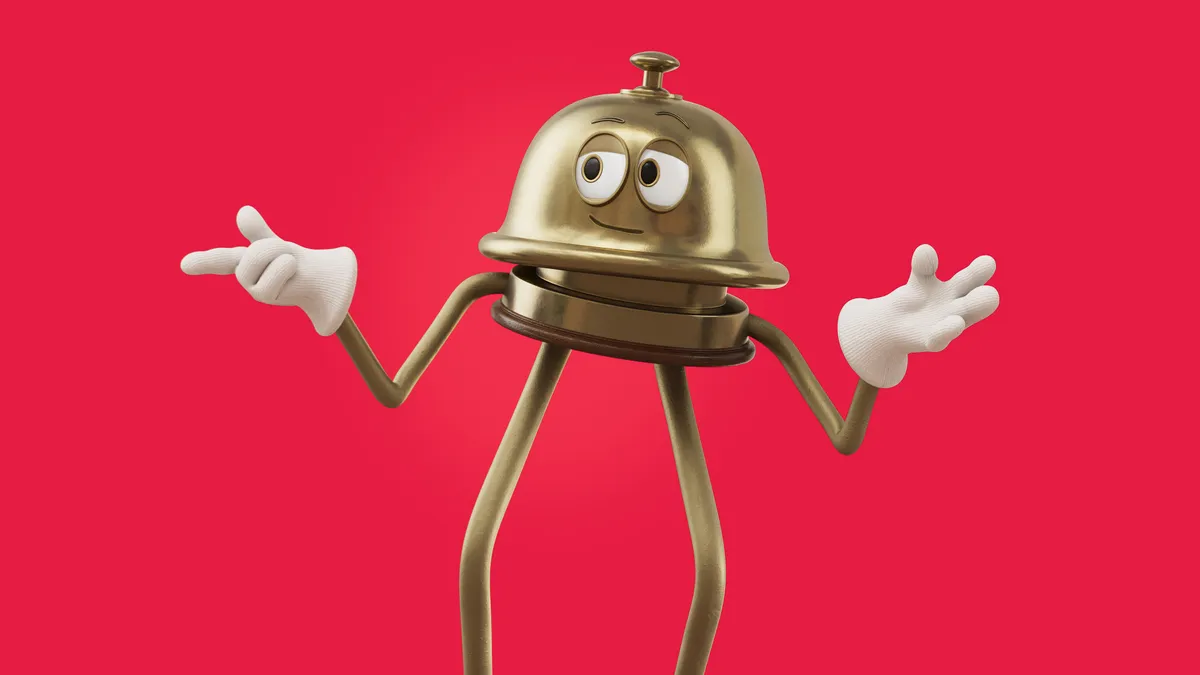

The brand extension lands with a bouncy ad campaign running on social, digital, TV and out-of-home that unites what executives called the Bubly family. Burst and the core sparkling water line come together in energetic creative that makes the product the lead character. Agency ODD developed the TV spot while Direct Focus handled production duties.

PepsiCo executives view Bubly as a potentially major growth driver as shoppers seek healthier purchases without sacrificing a sense of indulgence.

“I firmly believe Bubly could be our next billion-dollar brand if we really get after it in the right way,” said Todd Kaplan, CMO of Pepsi and sparkling water, in an interview. “Bubly Burst is a great tool to do so and really expand the brand.”

Kaplan was responsible for getting Bubly off the ground in his prior role overseeing marketing for PepsiCo’s water portfolio. Bubly, which was projected to rake in $100 million in its first year on the market, was introduced around the 2018 Oscars ceremony and later ran a campaign for the Super Bowl punning on a similarity with crooner Michael Bublé’s name. Kaplan eventually shifted to Pepsi, which was handed PepsiCo’s sparkling water duties in 2022. Bubly today leads the sparkling water pack in terms of both brand awareness and preference, according to Kantar’s 2023 Brand Mind Share report.

But consumer habits continue to shift, with more people seeking what Kaplan described as “subtly sweetened” drinks. An internal analysis by the brand estimated about 20 million consumers now prefer a sweetened sparkling water beverage choice, hence the development of Burst, which contains 1% real fruit juice.

“The people who are looking for this, honestly, it doesn’t just cut one demographic or cohort,” said Kaplan. “They’re not willing to make the trade-off from a soda all the way down to a sparkling water. This gets a little half-step closer.”

All in the family

Kaplan attributed Bubly’s success to a personality that differs from what the executive perceives as staid sparkling water competitors with “private-label type executions.” Bubly packaging emphasizes bright colors and smiley face iconography meant to inspire the bubbly feeling referenced in the product’s name.

That sunny disposition is reinforced through the brand’s social media presence, which shows Bubly cans interacting in dollhouse-like setups. A Bubly campaign from January centered on a novelty button that used LTE technology to deliver Bubly to consumers abstaining from alcohol for the month as part of Dry January.

Bubly Burst looks to firm up a positioning around fun without rewriting the marketing playbook. Caps are topped with sayings like “thirsty work” while the bottles are printed with light-hearted copy (the watermelon lime flavor has a text bubble reading “your partner in lime.”) Pineapple tangerine and cherry lemonade round out the lineup.

“It’s the same visual identity. We didn’t want to launch a new brand, we didn’t want to buy a brand,” said Kaplan. “It’s a little bit more of an elevated, more loud version of Bubly.”

Fine-tuning innovation

PepsiCo has been more active in launching brands and refreshing old ones to stay relevant with choosy consumer groups like Gen Z. The company last year bowed Starry, a lemon-lime replacement for flagging Sierra Mist. Starry ran its first Super Bowl campaign in February with a commercial featuring on-the-rise rapper Ice Spice. Such efforts are the result of stronger alignment between PepsiCo’s research and development, product and marketing teams, according to Kaplan.

“When we created and launched Bubly ... that was a very new muscle for us, as PepsiCo: to create brands, launch brands from within,” said Kaplan. “Since then, we’ve gotten that muscle fine-tuned.”

A bigger focus on innovation comes as chief rival Coca-Cola also ramps up new releases, reigniting the Cola Wars back-and-forth that has long underpinned the trajectories of the two companies. Coke in February added the first permanent addition to its soda portfolio in three years with Coca-Cola Spiced, a raspberry-flavored cola. Coke and Pepsi are both dedicating more marketing resources to zero-sugar and better-for-you beverages as shoppers steer away from full-sugar options, with Bubly Burst fitting neatly into that strategy.

“A lot of our growth is going to come from new spaces that are emerging in the beverage space, as well as going a bit deeper in the spaces where we do play,” said Kaplan.