Brief:

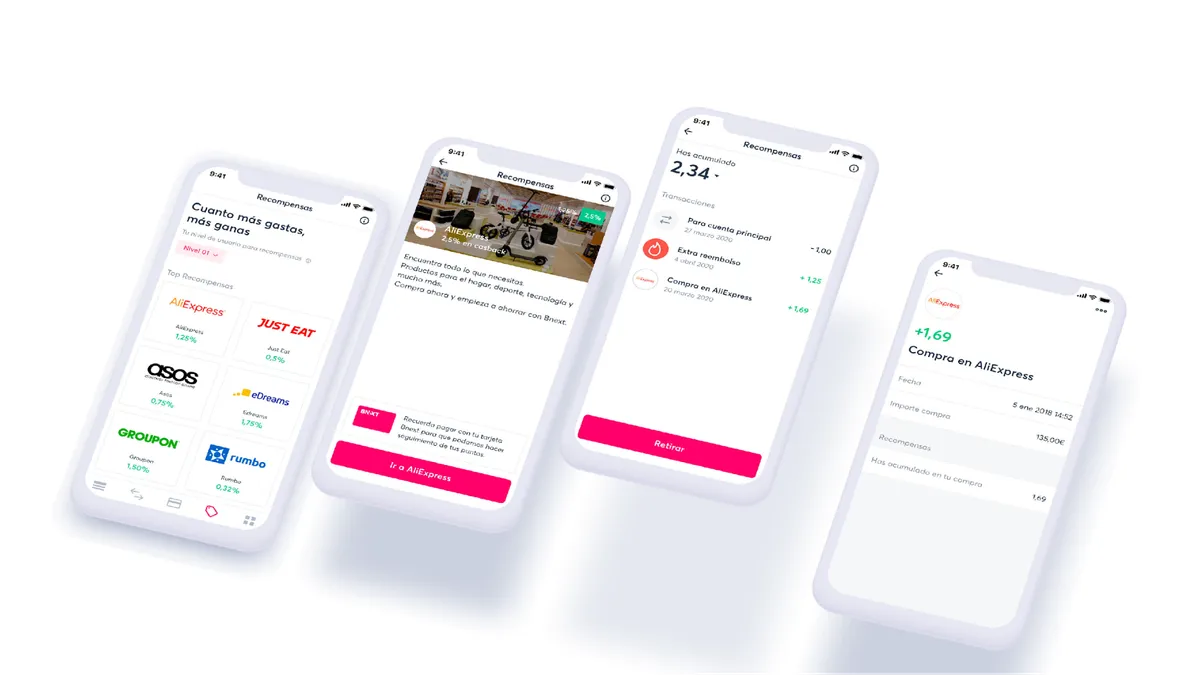

- Bnext, the mobile-first banking app started in Spain, launched a loyalty rewards program that includes brands such as AliExpress, Nike, ASOS, Sephora, Groupon and Just Eat, according to materials shared with Mobile Marketer.

- The program lets Bnext customers save money while shopping from select retailers, per an announcement. Bnext lets app users customize their shopping preferences to receive more cash back and upgrade service to get better offers. Bnext also is available in Mexico, where the startup is establishing a foothold for an expansion into Latin America.

- The rewards program is powered by Button, which has driven more than $3 billion in spending since it launched in 2014, and has raised more than $64 million in venture financing, the announcement details.

Insight:

Bnext's rewards program aims to drive sales for retailers by making it easier for customers to shop directly in its mobile app as part of a more seamless experience. Those brands have an opportunity to connect with Bnext's customers when they're most ready to shop. As TechCrunch notes, the integration avoids the clunky process of redirecting Bnext's 400,000 customers to third-party cashback sites that transfer rewards back into a bank account. Bnext has cashback levels that start at 1% and go up to 5% for its premium subscription, giving customers greater incentives to spend more frequently and remain loyal to the brand.

For Bnext, the program aims to provide mobile users with a more seamless customer experience (CX) that has become a key differentiator for financial brands. In the U.S., traditional and direct banks in recent years haven't seen much improvement in their CX ratings, according to Forrester research, which has warned of the potential negative implications for financial services brands. Meanwhile, the coronavirus pandemic has magnified the importance of digital banking as many consumers have used mobile apps to manage their finances while stuck at home.

Spain has seen a profusion in startup digital banks in the past few years among tech-savvy young adults who are more comfortable managing their money with mobile apps. Their experience likely mirrors trends in the U.S., where consumers are more likely than the general global population to belong to a broader range of loyalty programs, per a survey by payments consulting firm Mercator Advisory Group.

Mobile devices can make loyalty programs more convenient for consumers, while letting them track program points and see their progress toward earning rewards. As Bnext grows its customer base, its cashback rewards program is likely to have greater relevance for the company and its marketing partners.