Brands have needed a better way to get in front of customers at the point of purchase over the last few years as third-party cookies began depreciating and as consumers increasingly shopped online during the COVID-19 pandemic.

Companies started buying ad space on retailers’ digital platforms, and purchasing the retailers’ first-party data — data that customers willingly give a brand — to reach their audiences

When a retailer gets into this ad-selling business, it’s known as a retail media network. Companies such as Kroger and Walmart — and, of course, Amazon — have had skin in the retail media game for some time now, and others are getting into it as well. According to AdWeek, 74% of brands have dedicated budgets for retail media networks in 2022.

In October, 7-Eleven officially announced its entrance into retail media with its new Gulp Media Network — the first retail media network to hit the convenience store industry, Marissa Jarratt, executive vice president and chief marketing officer; and Mario Mijares, vice president of loyalty and analytics for 7-Eleven, said in a recent interview.

Making the jump into retail media not only makes sense for 7-Eleven, but is a necessary step, said Jordan Berke, founder and CEO of Tomorrow Retail Consulting. He noted that many of the new programs 7-Eleven is developing require investment that needs to be paid for, and having a “thriving” media business is the best way to reach that alternative income source.

“If you look at all the other ways a retailer like 7-Eleven could make money, this is the biggest share of the pie,” he said.

Personalization and fandom

Gulp Media was built over the past year to complement 7-Eleven’s existing suite of data-driven insights, which already includes its shopper analytics platform, proprietary customer research panel and experience-based Lab Stores. It came in response to a need 7-Eleven saw within the “immediate consumption market,” — also known as impulse purchasing — Jarratt and Mijares said.

“We know retail fragmentation is already complicating things for our CPG vendors — and the immediate consumption market is even more fragmented,” they said.

While building a team to run a retail media network can be difficult — Walmart poached Instacart’s top ad executive in October 2021 — 7-Eleven didn’t seek out new employees. Instead it formed the Gulp team from within its marketing department, tapping those “with a wide breadth of experiences” Jarratt and Mijares said.

CPG brands getting involved in 7-Eleven’s retail media network will be using the retailer's customer loyalty data to reach their target consumers across the convenience channel. 7-Eleven’s approach to how this is done can be summarized in one word.

“Personalization,” Jarratt and Mijares said. “Not only does Gulp Media look at both demographic, geographic and attitudinal signals, but it can also add signals for what shoppers have purchased.”

As of now, 7-Eleven is focused on connecting its customer database with third-party advertisers through display, social and connected TV ads, Jarratt and Mijares said. They also said they plan to explore in-store media “in the near future,” and know that tapping into fuel pumps is a “big opportunity” — although they declined to share updates on that front.

While Jarratt and Mijares also did not elaborate on specific media campaigns 7-Eleven has worked on with its CPG partners, they noted that tapping into “fandoms and cultural relevance” — especially in sports — is helping build Gulp Media.

“This ultimately translates to accelerating our loyalty program by providing customers with increased transactional and experiential value,” they said.

If 7-Eleven is using this strategy to grow its loyalty program, that would, in turn, provide CPG partners with more first-party customer data.

“We’re just scratching the surface on fandoms and cultural relevance across the brand, and we have our sights set on more collaborations in the worlds of fashion, sports, music, gaming and more in the coming months,” Jarratt and Mijares said.

Three key ingredients

Berke is “bullish and optimistic” that 7-Eleven’s retail media network will be successful. In fact, he sees it dominating.

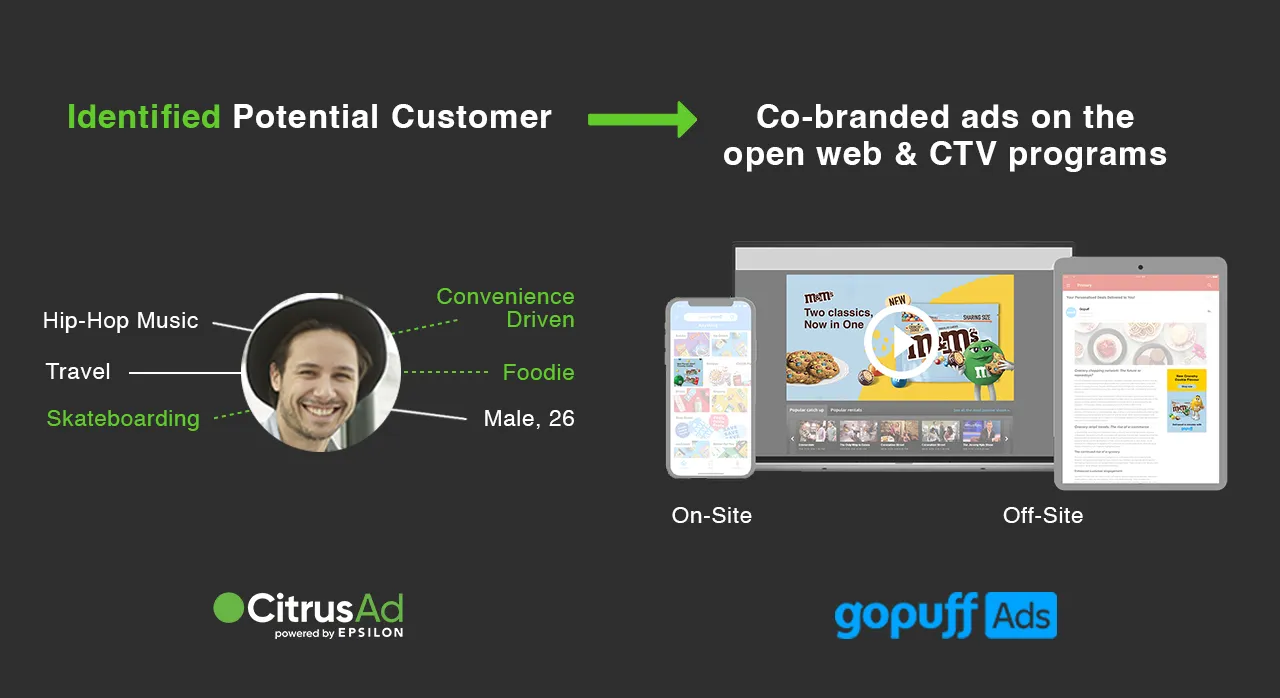

“Even though Gopuff has had the [retail media] aspiration, we think that 7-Eleven is just going to completely roll over Gopuff and create the most compelling convenience omni-media network in the country,” he said.

He notes three “ingredients” a retailer needs when buildings its media network. The first is reach, which 7-Eleven has plenty of as the world’s largest c-store chain, possessing the largest-scale convenience loyalty program.

7-Eleven’s massive loyalty program — which has more than 80 million members, Jarratt and Mijares said — also provides the retailer with the second ingredient Berke said is necessary for building a retail media network: data.

The company’s immense customer data collection can help potential advertisers target all sorts of specific consumers, ranging from energy drink fans who don’t drink coffee to tobacco users trying to quit, Berke said.

“The fact that they have such a large audience of loyalty members gives 7-Eleven the ability to provide targeting for advertisers,” he said. “As a retailer, having that personal data that can be used to segment [customers] is huge.”

The third ingredient — and the most difficult one to attain — is trust from their advertisers, Berke said. He noted that trust could be a “real difference maker” for 7-Eleven, and that they already have an advantage over other retail media competitors because of their sales- and service-focused culture due to being a franchisee-based organization.

“They have, in some ways, this business-to-business culture that Walmart never had, that Kroger never had, that Target doesn't have,” he said. “They're coming into the third pillar of building a great retail media network with already some cultural advantages that, I think, are going give them a great boost when they sit down with their first advertiser.”

Connecting physical and digital

Building a successful retail media network isn’t easy, even for the world’s largest c-store retailer.

As 7-Eleven works to establish what a retail media network looks like for c-stores and the immediate consumption market, its biggest challenge at the moment lies in bridging the gap between digital and physical.

“While a lot of retail media today is focused on e-commerce — specifically sponsored search and banner ads — we are focused on driving people to brick-and-mortar stores,” Jarratt and Mijares said.

Berke agrees that connecting its physical and digital assets will be one of 7-Eleven’s biggest challenges — specifically, ensuring they can present ads in stores while simultaneously engaging users online.

Additionally, he foresees 7-Eleven being challenged by learning what advertisers need and how they need to be supported compared to its suppliers — who may be the same groups of people.

“Most of [7-Eleven’s] advertisers will be suppliers,” he said. “But when you service them as an advertiser, it's a very different mindset — a different relationship — than it is as a supplier.”

A third and final challenge 7-Eleven may face, Berke said, is getting the franchisees excited about Gulp Media. This can be achieved through showing how various components of 7-Eleven’s shopping experience, such as a digital menu or mobile checkout platform, create more media opportunities.

“Educating them, inspiring them, showing them the potential of introducing new assets in stores,” he said. “They’re going to need to get [franchisees] to come along on the journey.”

The big picture

Besides the fuel component, the fact that c-stores rely so heavily on impulse purchases lets them measure “a different type of consumer behavior compared to other retailers,” Jarratt and Mijares said. Beyond that, c-stores’ inclination to offer smaller-sized items may play to the industry’s advantage.

“The smaller packaging that is commonly found in convenience stores makes for a low-commitment purchase for customers — which, in turn, makes c-stores the ideal place to test innovations before scaling and expanding distribution to larger pack sizes and larger format retailers,” Jarratt and Mijares said.

Berke agrees about the smaller packaging, adding that the fact that c-stores operate “in the now” compared to competitors whose consumers visit on more of a planned basis — such as big-box retailers and grocery stores — can play in the segment’s favor.

“[C-stores ] are all about the immediate consumption,” he said. “And so as an advertiser, I can be driving some really high margins because customers are going to be responding in the next two hours when they see [an ad].”

When asked if c-stores regardless of size and scale should consider getting into retail media, Berke didn’t just answer yes — he said “they have to.”

The first step to doing so is understanding the business differences between media and retail; learning the type of investment it requires; and building the “muscle” to manage and grow the eventual network, Berke said. Once those are done and established, it’s about finding what differentiates your brand.

“You've got to figure out a way to become meaningful and have enough reach, data and trust to be able to compete,” he said. “You need to go and move and build that muscle, because if three years from now you still don't don't have traction, you're probably going to struggle to be meaningful in that space.”