Editor's note: The following is a guest post from Gilad Amitai, COO and co-founder of location intelligence platform Ubimo.

Last year was a good one for location data and technology companies. The market has matured and is on the verge of achieving meaningful scale. This moment in time is the culmination of an upward trend featuring the growing importance of location intelligence (LI) in the marketing industry. A 2017 Dresner Advisory Services study reveals that 94% of marketer respondents place importance in varying degrees on location intelligence in their organizational plans. This shift is reflected by recent projections that the market size will range from $16 billion to $20 billion by 2022.

Here are some notable highlights from the past year that are significant indicators of the space's maturity and growing scale.

Data clouds are investing more in location data integrations and outputs

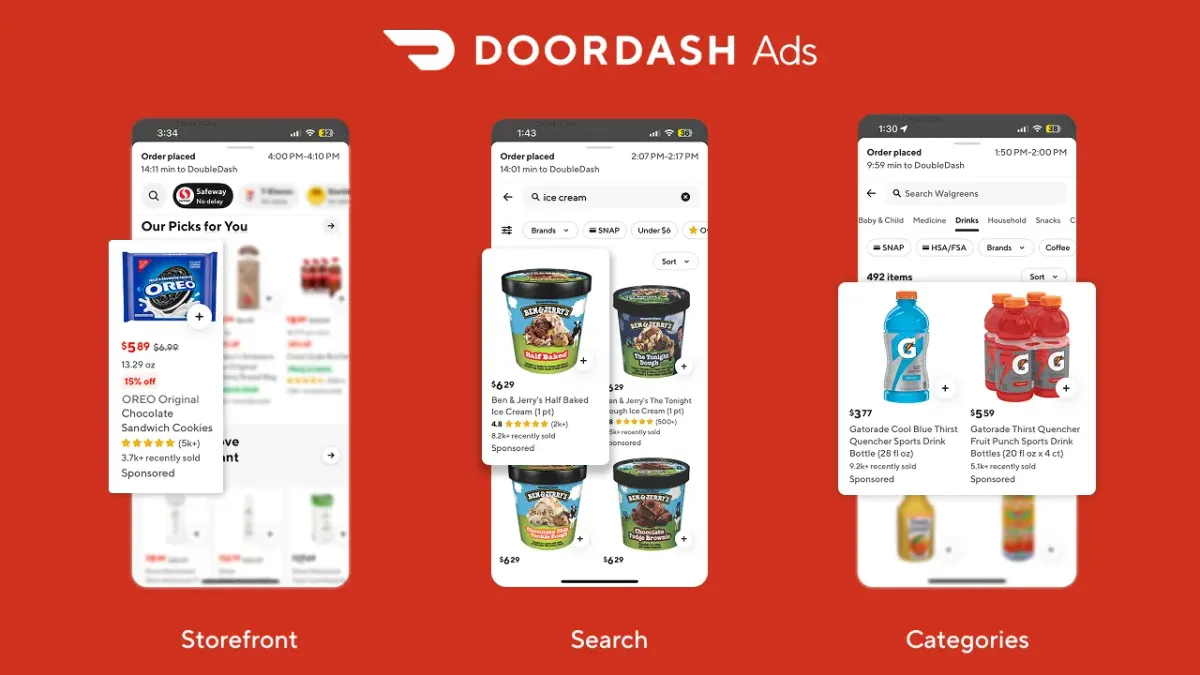

Data clouds are incorporating location data as a core component in their data alliances and data partnership offerings. Most marketing/data clouds are now sending RFIs to location companies and are in different stages of integrating location derived segments to their stacks.

Location data and foot traffic attribution

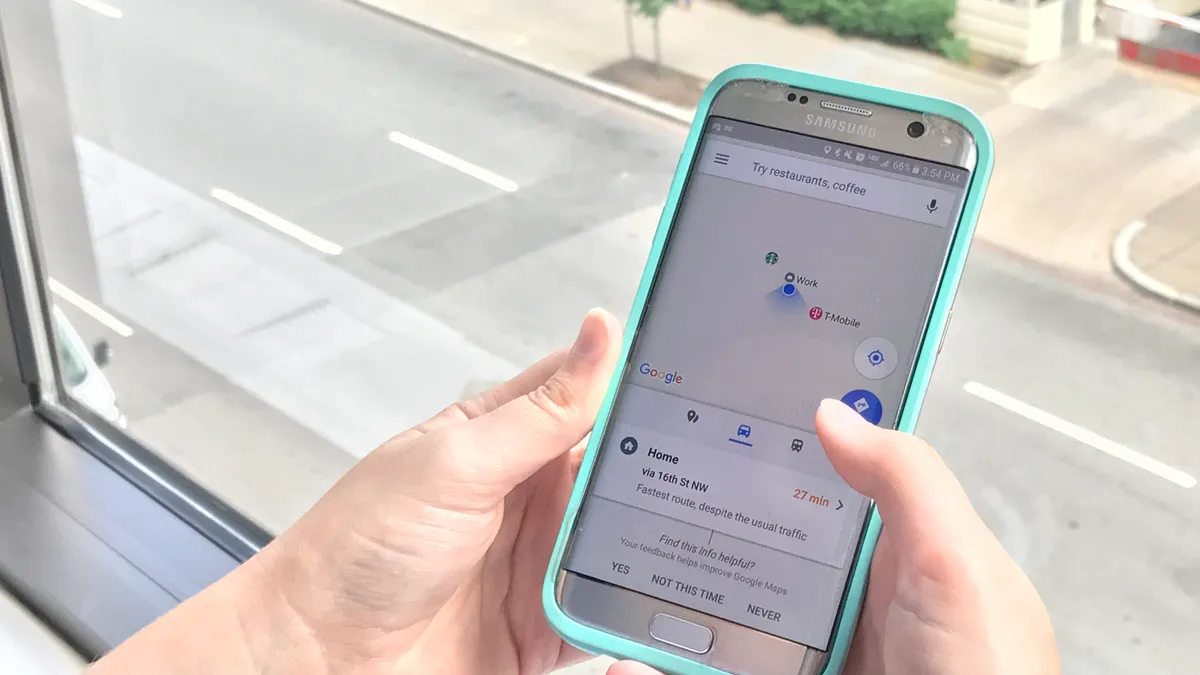

Using location data for foot traffic attribution has been widely adopted and has become a core KPI for measuring retail campaign effectiveness for retailers with a physical location. As location data is being used to establish visits (conversions), more and more companies are using this data in near real time and are building optimization strategies around it. By implementing cross device matching techniques, this metric can now be used also to measure other channels beside mobile. Perhaps the best indicator of this new standard is the acquisition of Placed by Snap, for supposedly $125 million. This acquisition illustrates publishers' recognition of the ever-growing need to demonstrate ROI for advertisers by connecting the digital world to real-world purchases and store visits. Google has also made foot traffic attribution a turnkey solution.

Location data becomes a commodity

As the market generates more and more use cases for leveraging precise location data, which in turn is leading to additional marketing dollars diverted to location data, we are witnessing publishers developing significant monetization models around that data. They are making sure their privacy policies and user permissions are aligned with that monetization strategy. Alongside this trend, we have seen two positive effects that will also continue into next year: commoditization and democratization of the data.

Purchasing location-based audience data sets is no longer a challenge as a handful of vendors offer it in overall high quality and scalable pricing models. We have seen this year at least four new companies focusing just on that area in the location data ecosystem. Two notable events were the LiveRamp acquisition of Arbor (that together with Circulate were acquired for total cash consideration of approximately $140 million), and Auren Hoffman's SafeGraph that raised $16 million in a Series A funding.

Another indicator of this "commoditization" process is the discussion and development of an open SDK that will make it easier for publishers to monetize their data and easily work with multiple partners. The open SDK will hopefully push the industry to even more transparency and standardization.

Standardization of location data

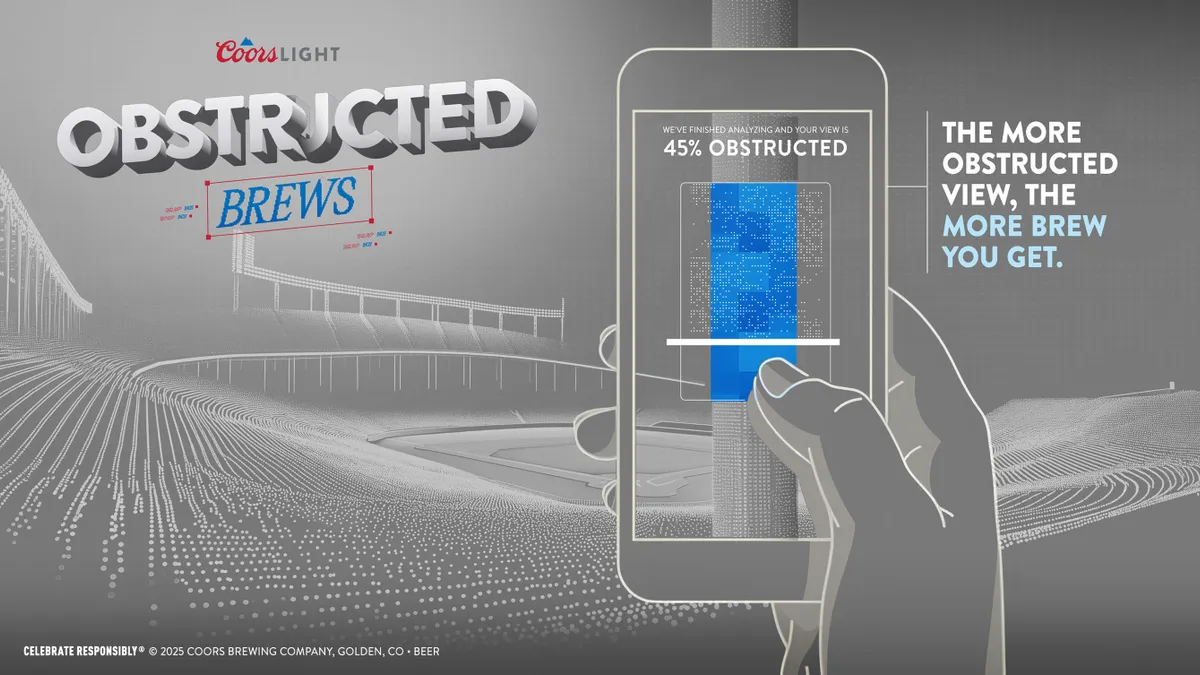

Last year was also a landmark from a standardization perspective and probably the best indications that LI is here to stay and growing are the better regulations and user-friendly initiatives that are being adopted by different players in the ecosystem.

The much-discussed and highly-anticipated iOS 11 change to the blue bar that Apple hoped would give users more control of their data was ultimately not implemented as originally planned. Yet, it still served as a strong indication on where the industry is heading.

Android Vital (toolkit for developers) has implemented more standards around battery saving guidelines that have pushed the industry to become more mindful of when to call the operating systems’ location services for data.

In addition, the MRC and IAB became more assertive in sharing best practices, which will probably lead next year to a MRC accreditation process for the collection of location data. I will not be surprised if we will also see MOAT/IAS/DoubleVerify rolling out some sort of verification and measurement solutions for location data.

As high quality data becomes more commoditized and democratized there will be more focus on the tools that will allow marketers and mainly retailers to use this data as core components of their entire marketing strategies from planning through engagement and measurement of the effectiveness of their efforts.

Next year, we will see the rise of the platforms and a shift from selling data as a service (DaaS) to selling tools and platforms on SaaS models that will empower marketers to leverage the unique insights that location technology and data offers. This will mainly be adopted for non-advertising purposes such as retail analytics; customer journey analysis and other predictive models that will aim to help marketers to better understand their customers. We will also see acceleration in the usage of real-time location intelligence technology and data outside of martech in areas such as real estate, city planning and social studies.