Agencies will face a myriad of issues and opportunities — often with significant overlap between the two — in the months ahead, including staffing, a possible leadership crisis, ongoing growth for in-house agencies and retail media networks, and the rise of the metaverse, according to a pair of fresh reports from Forrester Research provided to Marketing Dive.

While the hangover from the pandemic will continue into 2022 for agencies, one bright spot could be how many of the adjustments made over the past two years become more entrenched and therefore less of an everyday hurdle.

"The pandemic accelerated consumer behavioral changes, and that rapid change forced brands to pivot," said Emily Collins, vice president and research director at Forrester. "What we have found is brands and agencies are going to lean into the changes they made during that time … Marketers are going to continue to innovate and fulfill needs."

The Great Resignation

Forrester's "Predictions 2022: Agencies" report asserts staffing will be a concern throughout the year. The report estimates the industry is currently facing an acute staff shortage of perhaps 50,000 people globally. This shortfall is a result of several factors, including the rise of remote work, the gig economy, layoffs and the so-called Great Resignation resulting from people's shifting post-pandemic priorities.

"What we're seeing play out is a combination of [industry] reorganization and a shifting of employees' priorities," said Jay Pattisall, principal analyst at Forrester. "With so many people leaving the industry, there will be long-term issues that will need to be addressed."

Perhaps most significantly, there could be a coming leadership crisis, Pattisall said. As industry leaders retire or leave, the danger is there will not be enough people with experience to fill those roles.

"Left unchecked, we could have a situation where if there's a big gap in leadership, it could metastasize into a larger issue for the industry," Pattisall said.

Right now, the gap in talent has not yet reached a crisis, particularly as agencies are able to use technology to help fill the holes. One of Forrester's predictions, in fact, is that agencies will embrace Big Tech partner programs such as Google Marketing Platform or Facebook Business Partners to take over some of the work that was previously completed by people.

"It is a short-term solution for filling the capacity gap because platforms are able to do a certain amount of tasks that were previously assigned to junior staff," Pattisall said.

Finding a lifeline

In addition, Forrester predicts in-house agencies will begin taking a larger role in setting and creating their companies' marketing campaigns. According to Forrester's research, 77% of in-house agencies reported that the number of projects increased during the pandemic, and 75% of in-house department leaders said their departments had expanded their capabilities. The trend does not appear to be slowing; according to Forrester's August 2021 CMO Pulse Survey, 44% of CMOs said they plan to move more marketing in house over the next year, which will expand their in-house teams.

The momentum behind in-housing will force agencies to adapt their business models and client offerings. For instance, the line between "consultancy" and "agency" will further blur as consultants build their creative capabilities — such as when Accenture acquired Droga5 — and traditional agencies develop more data-driven capabilities.

"This [shift to business consulting] makes agencies' work less of a commodity and gives them a lifeline into the fee-for-services model," Pattisall said.

As a result, agencies will have to determine new compensation models, finding ways to monetize the outputs of people working with technology platforms through a "human plus technology" talent equation.

"If they're going to [use more] automation, they will figure out how to be compensated for it," Pattisall said. "They'll need to shift in the way tech is accounted for as it is used by people."

A tsunami of shoppable video ads

Agencies will also look to demonstrate their creativity in direct-to-consumer e-commerce channels, including retail media. In a separate report, "Predictions 2022: Media and Advertising," Forrester projects revenue from the retail media category will reach $50 billion as more retailers develop networks and more brands feel they need to be a part of them.

"These retail media networks have the first- and zero-party data that brands are hungry for," Collins said. "This is another opportunity for agencies to help brands."

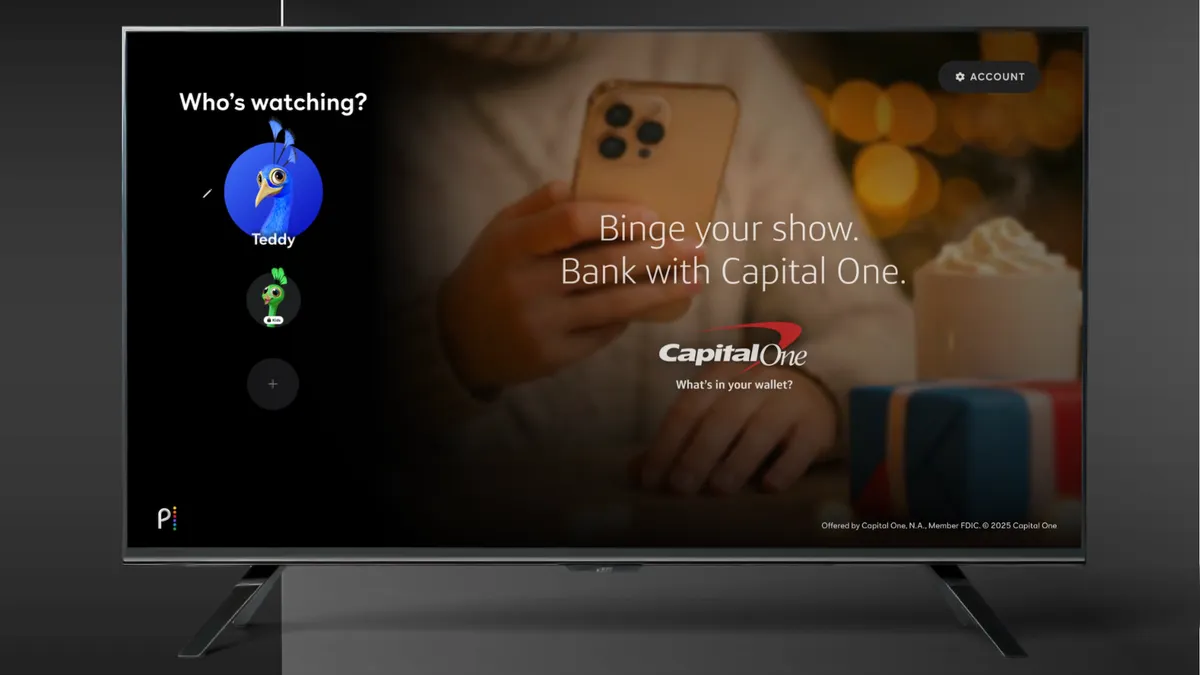

Such assistance may be necessary as shoppable video ads become more common. Already, Amazon has a capability that enables consumers to add products from video ads to their Alexa shopping lists. YouTube has launched video action campaigns that allow viewers to send a website link in an ad to their phones, and Forrester predicts a "tsunami" of shoppable advertising as other ad-supported providers like Tubi and Pluto get into the game.

"The pandemic has made this possible," Collins said. "We were already tracking a compression of the consumer lifecycle from awareness to purchase. Then we entered the pandemic, and it sped things up."

The move toward these new channels will not be without its hiccups, however. Access to consumer data will continue to be an issue in 2022, Collins said. Though marketers have gotten a reprieve from the elimination of cookies as a targeting method, the day is still coming when they will have to find alternatives. In 2022, Forrester predicts brands will flock to AI-powered methods and those that use myriad inputs to determine targets.

"There isn't going to be a singular solution," Collins said. "Marketers need to be thinking about multiple solutions that are more than pure audience-based solutions."

That variety of inputs will become more important as the metaverse rises, opening up the possibility of new virtual experiences. Though there are still several issues to sort out (including interoperability among separate platforms and experiences), the buzz around the metaverse will continue to attract marketers' attention and some experimental dollars.

"By and large, consumers aren't ready for the metaverse," Collins said. "So this is an opportunity to tap into it and test it."