The accelerated convergence of traditional and digital media loomed large over the IAB's Digital Content NewFronts in New York City last week, which not only drew the usual suspects like Google's YouTube and Hulu, but also some surprising newcomers, including big-box retailers Target and Walmart.

Driving the collision of so many previously siloed worlds has been the meteoric rise of connected TV (CTV) and over-the-top streaming (OTT), which has set up a tense battle between the digitally native companies that popularized those channels and old guard media networks that are trying to win a bigger piece of the digital pie and make their current offerings data-driven and addressable.

"All of these big linear television players now are also selling or are trying to sell digital audience targets as part of their portfolio of offerings," Scott McDonald, president and CEO at the Advertising Research Foundation (ARF), told Marketing Dive in an interview.

A new reality

The NewFronts weren't always this way. The show, which debuted in 2012 as a compliment to the long-running linear TV upfronts season, was created for an era when digital was still relatively new and not yet the dominant force for commanding ad spend that it is today. As the channel has steadily risen to the top of most marketers' priority lists, the initially two-week affair has shrunk to just one, with a far smaller selection of publishers. A notable aspect of the NewFronts this year was indeed not just who was presenting, but also the absences. Disney — which is the majority owner of Hulu — pulled out at the last-minute to host its first-ever combined upfronts presentation that encompasses digital and traditional media offerings. Such moves could become more common as companies try to simplify how they sell their inventory across a profliterating number of distribution networks and devices, McDonald said.

Trailing these developments is the question of how the NewFronts will preserve relevance as digital is enshrined as the standard and traditional media brands, including Disney and NBCUniversal, move faster to adopt streaming and introduce digital ad innovations, like shoppable formats, as part of their upfronts pitches. The answer is that the NewFronts are starting to look a lot more like the upfronts through a focus on topics like ad frequency and measurement, heralding a new era of digital maturity. At the same time, digital publishers are digging their heels in harder against the traditional networks to ensure they can retain the dollars that are at greater risk of being siphoned off by the ad industry’s old guard.

"The digital companies that are more exclusively digital are going to be pushing the concept of the NewFronts as being more valuable, while traditional TV advertising companies are going to be focusing more on the upfronts," Mike Menkes, SVP, Analytic Partners, told Marketing Dive. "The Disneys and the NBCs are leaning into their view of the world and basically trying to prove that their side works better than the other."

Drawing a line

If digital publishers are starting to adopt more TV-like tactics in how they pitch their services to advertisers, they certainly don't want to be compared to the networks that designed those tactics decades ago. YouTube and Hulu, which typically put on some of the biggest NewFronts shows, took an arguably more aggressive tone when differentiating from their linear competitors this year.

"People just aren't watching TV like they used to," Allan Thygesen, president of Americas, Google, said at YouTube's Brandcast. "YouTube reaches more 18-to-49-year-olds in an average week than all cable TV networks combined."

A common refrain at the show was how younger age segments like millennials and Gen Z are leading the cord-cutting trend as they favor the on-demand convenience of CTV and OTT providers. Peter Naylor, Hulu's head of advertising sales, called out how many of the big broadcast and cable networks are seeing double-digit ratings declines and retain a median viewer age of 53 compared to the streamer’s median user age of 31.

"Nearly 30 million people under the age of 35 are now cordless," Randy Freer, chief executive at Hulu, said to kick off a celeb-studded show in Madison Square Garden. "That's roughly 40% of young adults in the U.S. 2018 was the first year that more households subscribed to a streaming service than traditional pay TV."

Recent research contextualizes how ad dollars are following those eyeballs. Revenue from digital video advertising grew from $11.9 billion in 2017 to $16.3 billion last year, marking a 37% leap that surpassed all other formats, according to a new report by the IAB. OTT TV is one of the top drivers of growth and a tool brands can use to navigate a "'consumer first' playing field," the trade organization's CEO Randall Rothenberg said in comments.

"Digital keeps moving in the direction of trying to create a market that is more like the upfront market, because there are a lot of advantages to sellers..."

Scott McDonald

CEO and President, Advertising Research Foundation

Beyond audience reach, YouTube put a brighter spotlight on its creators and the flexibility they're afforded. The company previously tried to create a stronger stable of subscription-based premium content, but at the NewFronts announced that it will later this year make all of its originals ad-supported, which helps explain the shots across the bow at TV.

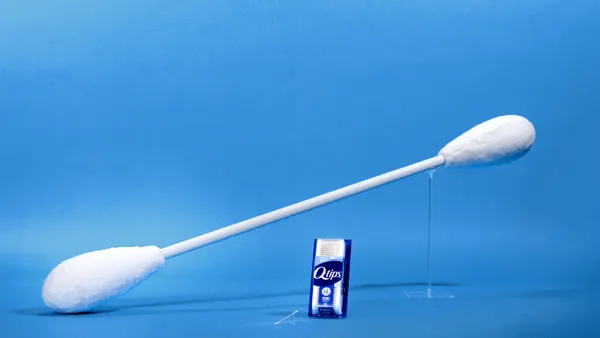

"Instead of having TV producers tell me what to do or what to say or what to look like, I got to do that myself," Simone Giertz, a popular YouTube creator who designs wacky inventions, said during the Brandcast in Radio City Music Hall. She said that television is a "cookie-cutter environment" compared to the more open forum of the video service.

"I got to make videos of things I don't think any executive would ever approve of," Giertz said.

Digital woes cast a shadow

Giertz's talk, intended to highlight the strengths of YouTube compared to TV, also shed light on a crucial area where the NewFronts need to continue to evolve: ensuring digital is a brand safe, transparent channel. The lack of oversight for platforms focused on user-generated content like YouTube has led to several brand safety crises in recent months, and a number of NewFronts presenters promised better security as a sell to advertisers in attendance.

"The big [NewFronts] theme for me was fixing these bigger issues we're seeing, especially in the OTT and digital space," Rachel Bien, SVP of integrated strategy and digital investment at Zenith, told Marketing Dive on the last day of the show. "It was almost a call to action to a community, not just for advertisers, but also for themselves."

Not all of the talks had a message of unity. Target and Walmart made veiled swipes at the major digital platforms, with the former promising that its rebranded media network Roundel would safeguard data privacy and "a brand-positive environment." The creator network Studio 71, which built its business on YouTube, touted a proprietary brand safety solution called Context, which now has the ability to scan for inappropriate links and comments — areas that have recently landed YouTube in hot water. Top executives from Google's video platform touched on the brand safety subject, albeit briefly.

"Let me be very clear, living up to our responsibility is my number one priority. And we are making significant progress," YouTube CEO Susan Wojcicki said at Brandcast. "My leadership team and I, along with thousands of people at YouTube, are laser-focused on this."

Measurement and frequency

But promising brand safety is only one part of the equation for publishers, and not something that acts as a large revenue driver or particularly sexy pitch to brands. Measurement and frequency were the other two big topics tying together the NewFronts this year, according to Zenith's Bien. They could be more powerful differentiators from the networks.

"The business is really maturing and growing up, and that means you have to have big boy tools and big boy responsibilities."

Reza Izad

CEO, Studio 71

Hulu reinforced its commitment to keep ad pods capped at 90 seconds and limit how often creative assets are shown to users daily. The company also announced that it plans to eventually drive half of its revenue from "nondisruptive and nontraditional" advertising, recognizing the commercial fatigue that many viewers experience on TV. Other companies, including Walmart's Vudu and Studio 71, showed off shoppable ads and transactional solutions to prove that video marketing on their platforms produces results traditional TV spots can't.

"We think these are a big idea," Ben Simon, head of video sales at Vudu, said of shoppable ads. "We think we're at day zero."

Such offerings could serve as a more concrete value proposition than digital has been able to provide in the past and a bigger hook for ad dollars as brands race to to make their TV strategies addressable.

"Digital keeps moving in the direction of trying to create a market that is more like the upfront market, because there are a lot of advantages to sellers in that they're able to get financial commitments well in advance," the ARF's McDonald said.

Growing up

Pitching outcome-focused solutions and ad innovations might take greater priority at the NewFronts as the networks catch up to the leading edge of digital. NBCUniversal, for example, recently debuted ShoppableTV, a platform that lets viewers purchase products that appear on-screen on channels like NBC, E! and Bravo.

Digital publishers will ultimately need to be more cognizant of the potential headaches brands and agencies face in navigating an increasingly complex market with problems they don't necessarily encounter at the upfronts. Consolidation may be the word of the day for digital media, but coveted channels like CTV remain highly fragmented and lacking in the bedrock standards that linear television provides.

"The market is maturing and you have a consolidation of video buying at the top level of the agencies," Studio 71's Izad told Marketing Dive at the show.

"They're buying in TV-like ways where there are rate cards, upfront commitments and volume commitments," Izad said. "The business is really maturing and growing up, and that means you have to have big boy tools and big boy responsibilities."