The gaming industry has been at the epicenter of billion-dollar dealmaking this year as game publishers seek to increase their scale amid tight competition in the high-growth category of digital entertainment. Marketers can expect to have a bigger role in the industry as those publishers work to diversify their revenue with advertising sales.

Game developer Take-Two Interactive started the year with a bang by agreeing to buy mobile gaming company Zynga for $12.7 billion, bringing together the makers of Grand Theft Auto and FarmVille under one roof. Not to be outdone, software giant Microsoft a week later agreed to buy Activision Blizzard, whose hit games include Call of Duty and Warcraft, for $68.7 billion.

The dealmaking streak across the industry continued when Epic Games, maker of popular online game Fortnite, announced its plan to buy Bandcamp, the online store that lets recording artists sell music directly to fans. The acquisition was notable because Bandcamp isn't a game developer, and would be part of Epic's broader effort to foster online communities around digital entertainment.

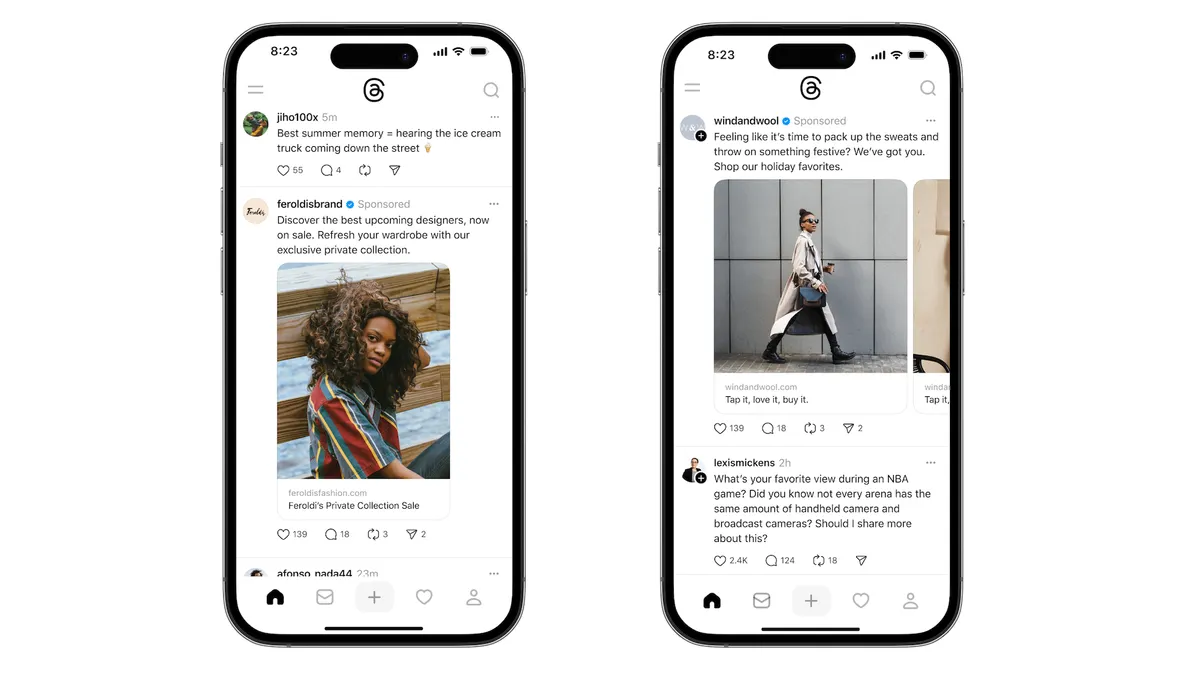

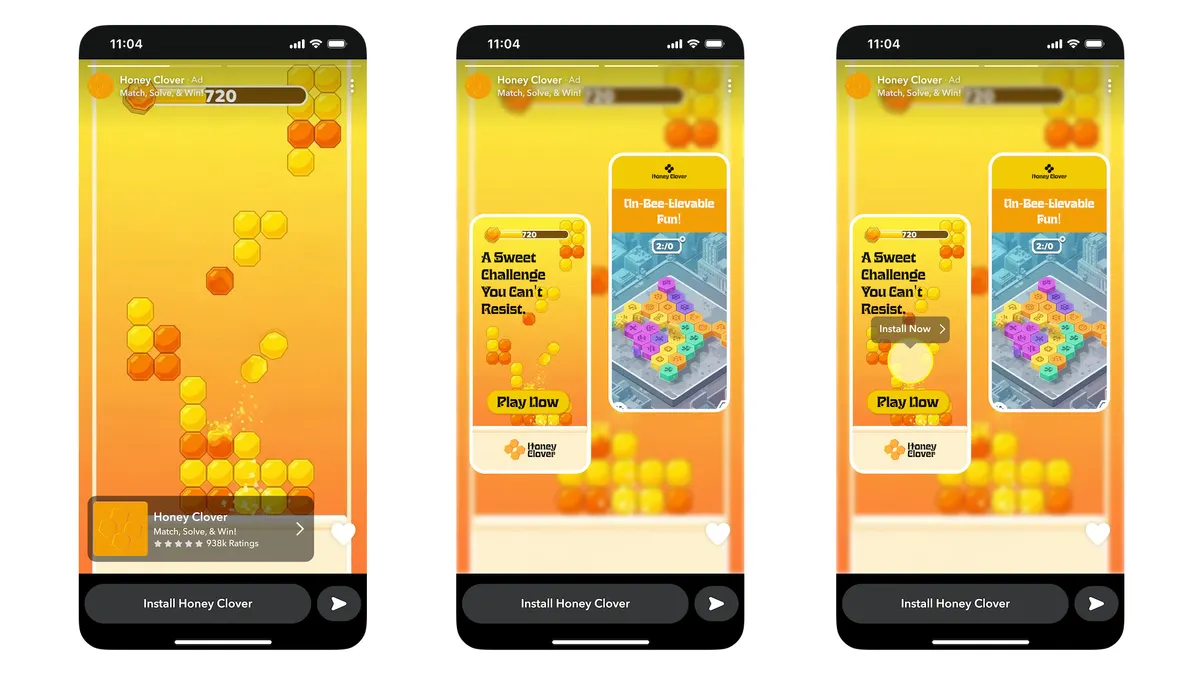

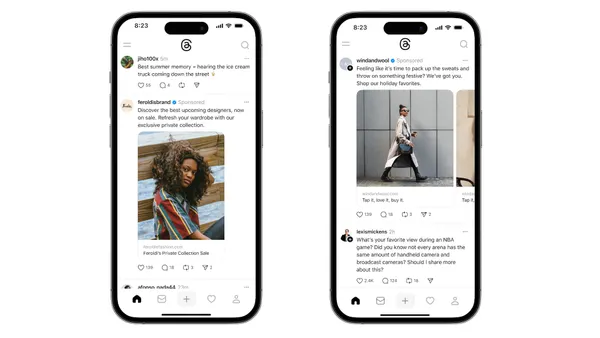

Amid the consolidation of the gaming industry, marketers are seeking ways to reach the growing number of consumers whose time spent with electronic media increasingly includes video games. Mobile games are especially suitable for advertising because they have a broad audience, are brand-safe, have "natural" breaks in gameplay and often have an insular economy that lets consumers trade virtual currencies for in-game rewards, according to mobile ad platform Tapjoy. Marketers can ask gamers to view ads in exchange for digital valuables.

"There's a large opportunity for marketing in terms of the amount of time spent gaming," Stephen Upstone, CEO of digital ad platform LoopMe, said in a phone interview. "It's also important to remember that those audiences that are engaging in gaming — it's not just young men. It's very broad, especially when you look at mobile gaming, with the most common users being adults with families."

Changing consumer behaviors

The pandemic's onset was a watershed for the gaming industry with its profound effect on the way people entertained themselves while stuck at home during early lockdowns. Some consumers played mobile games for the first time, while many more expanded their gameplay.

Almost two-thirds (63%) of consumers worldwide said they had increased their gameplay time, and the percentages were higher in regions most affected by COVID-19, LoopMe and researcher IDC found in a survey. The findings indicate that an estimated 75% of the gains in mobile gaming activity would last as part of the "new normal" in people's behaviors.

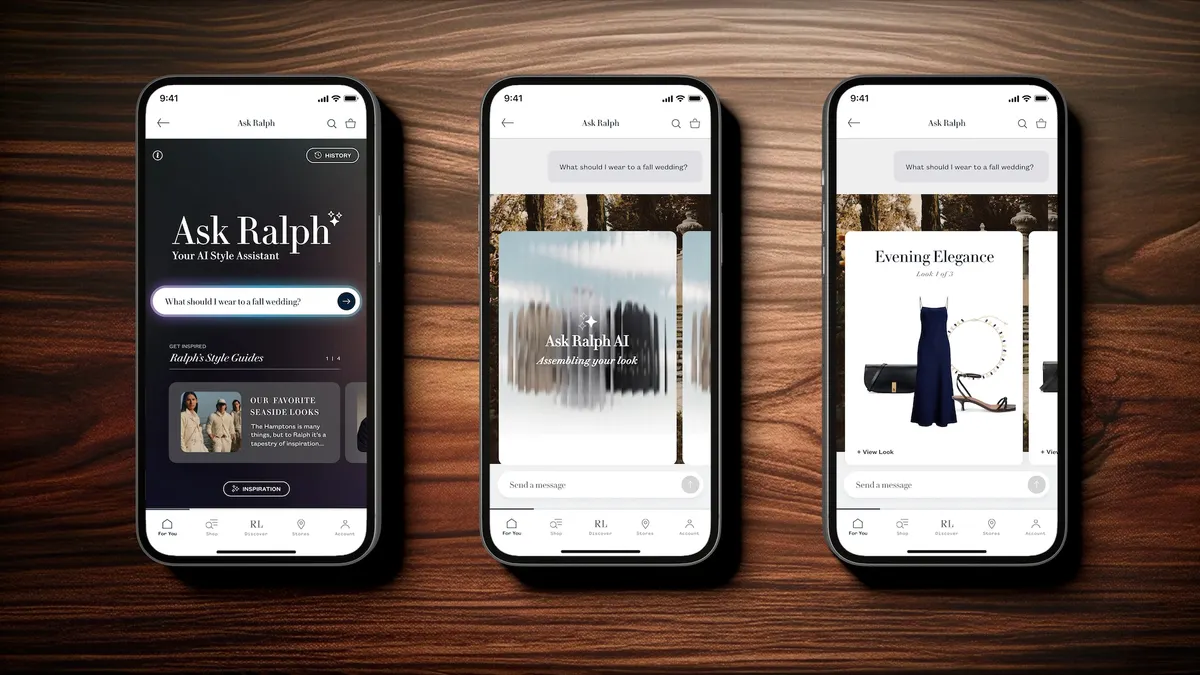

Beyond the greater time spent with gaming, what is also of note is the quality of the engagement and experience, Upstone said. "Games create a great brand advertising platform."

"When these big companies look at their opportunity to grow, gaming and advertising will be a central part of that strategy."

Stephen Upstone

CEO, LoopMe

Comparing games with other ad-supported platforms like social media, which make up one of the biggest segments of digital advertising, suggests a proportionate opportunity for growth as game publishers ramp up their media sales efforts, the executive noted.

"About every CMO would probably have an intimate, personal relationship with Facebook or another big social network, but game companies did not invest in people to help them talk to marketers and advertisers and their agencies," Upstone said.

There are signs suggesting game publishers are seeking greater awareness among brand advertisers and their agencies. The Interactive Advertising Bureau (IAB) this month released the schedule for its first PlayFronts, a series of sales presentations around gaming echoing TV's upfront sales season and the Newfronts for digital media.

Microsoft's growing ad business

While Microsoft has expanded its stable of game publishers over the years — including its $7.5 billion acquisition of Bethesda, whose hit franchises include Fallout and The Elder Scrolls, in 2020 — the company also generates billions in advertising sales among its various digital properties including LinkedIn, Bing, MSN and streaming video through its Xbox game console.

Microsoft's ad sales last year exceeded $10 billion, making the company the fourth-biggest advertising platform in the U.S. after Google (which includes video site YouTube), Facebook and Amazon. Microsoft makes more money from advertising than social media companies including Snap and Pinterest.

Following the deal with AT&T to buy Xandr, the telecom company's programmatic ad marketplace, Microsoft is positioning itself to expand its advertising business. That includes the possibility of selling more ads in mobile games created by Activision Blizzard. Similar principles apply to the expansion of metaverse environments that will allow for more digital interaction between brands and people's computer-generated avatars.

"When these big companies look at their opportunity to grow, gaming and advertising will be a central part of that strategy," LoopMe's Upstone said.