In-housing agency functions has continued to be a hot topic in marketing as brands eye a post-pandemic world and the return to more regular operations. AB InBev's Draftline, which the Budweiser marketer unveiled in 2019, has been the rare in-house shop to expand its employee base during the global health crisis — a move executives say has proved critical to staying on top of fast-moving consumer trends in e-commerce and digital content.

"With the internal team, you're really able to adapt to changing needs," said Tracy Stallard, global vice president of Draftline. "If you work on that set of capabilities with an external agency set-up, it's very hard, because you probably have a different agency that does performance marketing than does your equity-based marketing. You've got to be juggling and playing a bit of telephone."

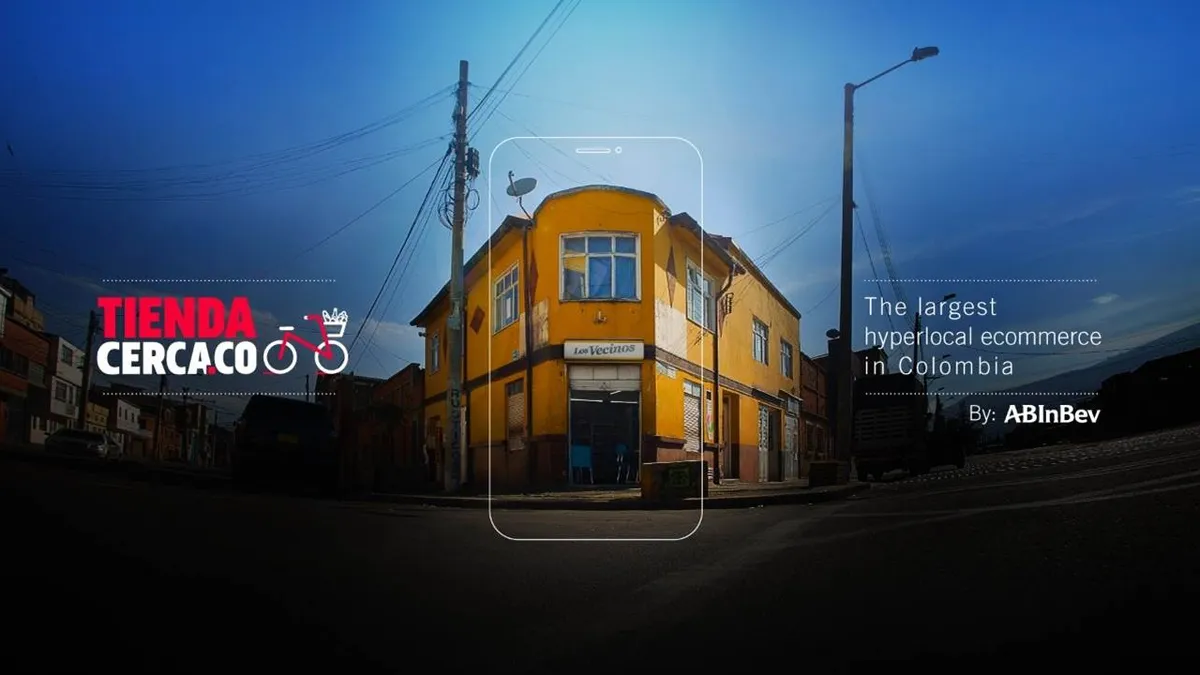

Beyond enabling more agility for InBev's operations, Draftline has earned recognition for its creative output. The unit last week secured its first Grand Prix at Cannes Lions for a campaign promoting Latin America-focused delivery service Tienda Cerca that was submitted in the Innovations category. The effort supporting local businesses through e-commerce marked the fourth Grand Prix win in InBev's history.

Such successful case studies may spur more marketers to make the jump to in-housing — Stallard said she’s seen more peers adopt a Draftline-like approach — but the executive cautioned that many companies do not establish the type of concrete strategic goals necessary to make the model work and subsequently end up paying the price in the long run. Across its decision-making, Draftline centers on bringing content and media closer together and sharpening data-driven creative functions.

"What we really saw was this big opportunity on linking consumer understanding to what we do from a content and media standpoint. There are some companies who, very candidly, do in-housing for price-driven reasons," said Stallard, who chairs the World Federation of Advertisers' in-housing committee. "That's a little bit of why you saw some agencies close shop at the end of last year; they couldn't carry the overhead on their books."

Deeper understanding

At the outset of the pandemic, Draftline was tapped for a social listening and analytics network that could keep employees abreast of emergent cultural trends, with weekly emails to members of InBev's commercial business. Striking the proper tone became a must for InBev brands, including in gauging whether consumers in a given region were bored living under lockdown or desperate for relief in the form of services like restaurant vouchers or access to clean drinking water.

"There were two distinct advantages that we had: Advantage number one was we were focused on consumer understanding, which I always think of as the who and what," Stallard said. "The second thing that we found that was really exciting was this proximity to the business and how we can focus on not just delivering advertising solutions, but delivering consumer solutions that happen to advertise the brand."

Having a closer ear to the ground on consumer insights led to concepts like Draftline producing InBev's first music show, a YouTube livestreaming concert series that promoted the rollout of the Brahma brand's Duplo Malte beverage in Brazil, among other labels. The event catering to homebound audiences generated 675 million views last year and marked InBev's most successful product launch in the country, according to Stallard. The activation is indicative of how blue-chip marketers like InBev are rethinking their approach to paid media as consumers spend more time in ad-free or ad-light streaming environments.

"It was not really an ad, it was more of an entertainment platform, but a great way to build and sell that innovation that we were trying to bring to market," Stallard said. "The permanent [pandemic-related] change for us is definitely rethinking how advertising works."

DTC shift

Another pandemic sea change Draftline helped guide InBev through is the shift to e-commerce and direct-to-consumer (DTC) outlets, which have significantly impacted alcohol sales along with the larger grocery category. Tienda Cerca, for instance, created a hyper-local e-commerce tool to connect consumers to retailers shaken by COVID-19. More than 60,000 stores registered for the platform within three months of going live, while the platform page itself drew more 10 million visits within 60 days.

"If you're more of an equity marketer like we are, and you come from CPG land, this is like mad science," Stallard said of the DTC boom. "This is where the importance of Draftline seeing content and media together really makes a big difference."

Digital channels have historically been a smaller piece of InBev's strategy — though it has a major presence on delivery apps like Drizly — but Stallard sees COVID-driven buying habits sticking around amid a U.S. reopening. The change could increasingly affect marketing execution and the prominence of mobile and digital tactics, a steep change in thinking for brands historically known for their anthemic TV ads.

"From the marketing side, it was a whole mind shift in that we not only needed to build equity communications, we also needed to think about how we drive direct purchase through our marketing communications," Stallard said. "Only the team in China was using QR codes before last year and now everyone's using QR codes."

In-house outlook

Reports early in the pandemic indicated that some marketers were chilling their in-housing ambitions due to operational disruptions related to COVID-19. Draftline, if anything, could grow more important to InBev as the operator of hundreds of brands in dozens of global markets tries to adjust to a patchwork reopening and new experiments in areas like e-commerce.

"What we're seeing is our team is getting much better at testing," Stallard said. "I have the media-buying team sitting next to the creative development team and when they start seeing what's working and what's not, they get into an iterative process."

In the same way that InBev doesn't view Draftline as a purely cost-focused initiative, it also doesn't treat the shop as a catch-all for replacing third-party marketing services providers. Instead, InBev is searching for external agencies that are laser-focused on a particular marketing specialty to support its broader platforms, according to Stallard.

"We prefer to continue to work with our external partners, but on the things that they're really, really strong at," Stallard said. "Draftline sort of acts as this connective tissue through everything that we're doing in the business, helping us link marketing and sales and helping us think about how in-store and bars and restaurants link to the DTC business."