Brief:

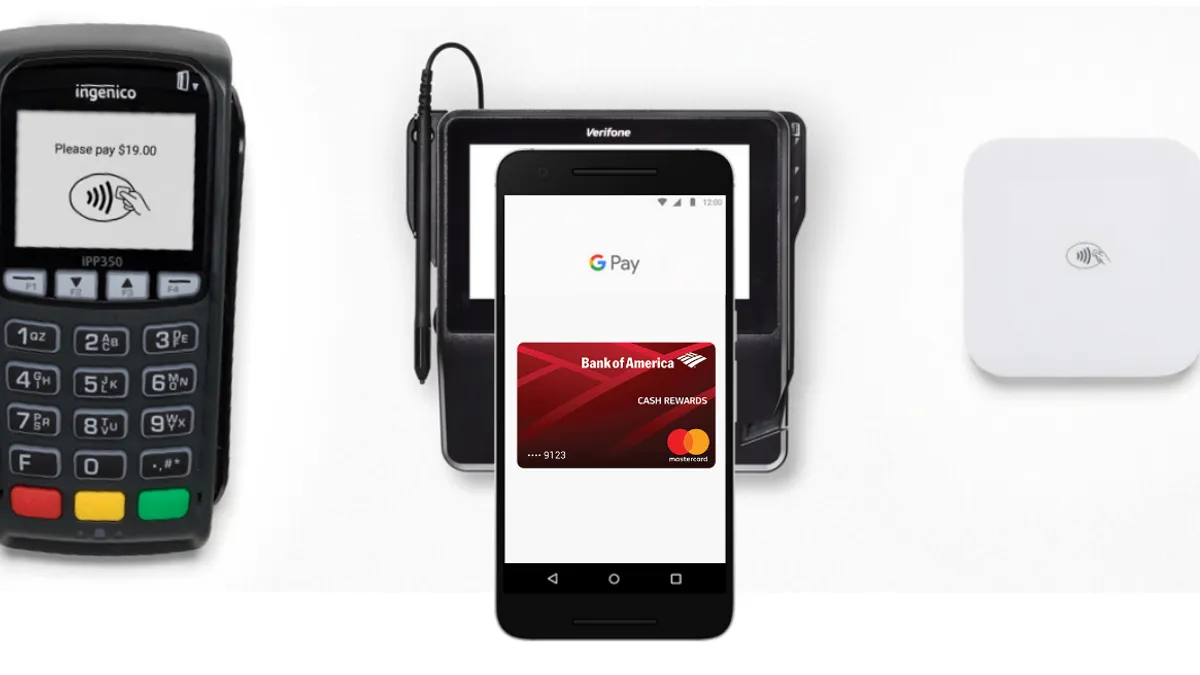

- The Google Pay app has launched as a replacement for Android Pay and is part of Google's effort to unite its various payment platforms under a single brand. Google Pay can be used for transactions at checkout counters with a smartphone and to scan at mass transit systems in cities such as London; Portland, Oregon; and Kiev, Ukraine, according to CNBC.

- As part of the redesign, the Google Pay home screen shows the user's recent purchases and nearby stores that accept the payment service, per TechCrunch. The list of stores is personalized based on the person's previous purchase history. Users can also add their individual store loyalty cards to the app.

- I n the coming months, users of the app in U.S. and U.K. will be able to send cash to each other using "Google Pay Send," which is a redesigned version of the Google Wallet app. The tech giant is working on a plan to let users buy goods online through websites or using Google Assistant. New users can download the Google Pay app now, but existing Android Pay users will receive an update in the coming days.

Insight:

The previously announced Google Pay is the search giant's latest attempt to gain a foothold in mobile payments and combines services that were previously available separately via Android Pay and Google Wallet. Adding peer-to-peer payments to Google's in-store payment app is an added convenience for mobile users who don't want to rely on third-party apps like PayPal's Venmo, bank-supported Zelle or Google Wallet to make digital payments to friends or in participating stores. Money can be sent more directly, keeping users within Google's ecosystem and helping to reduce friction by minimizing the number of accounts users need for mobile transactions.

The tech giant has made numerous attempts over the years to get deeper into the digital payments space, starting in 2006 with Google Checkout, which didn't take off among many online merchants. Android Pay launched in 2015, but the service met the same resistance that all mobile payment methods have encountered — at least in the U.S. The ease of paying with cash or debit and credit cards has hindered the growth of mobile payments, but trends show that contactless transactions are steadily becoming more popular around the world and in the U.S., especially among younger consumers who are more accustomed to using mobile devices like smartphones for personal computing.

With the launch of Google Pay, the search giant aims to convert the hundreds of millions of consumer accounts with registered card credentials, including those on Google Play, Assistant and YouTube, into Google Pay accounts, according to PYMTS.com. Building a more widely used platform is likely to be a challenge for Google as it faces growing competition in the mobile payments market from Apple's rival platform Apple Pay, along with Venmo, Square Cash, Zelle and others.