The digital boom of the pandemic is showing signs of slowing, but tech companies are still priming themselves for a future where habits adopted over the period stick around. At its annual Marketing Live event Tuesday, Google addressed the emergence of what it calls “omnibuyers": consumers who more intensively research and browse on their shopping journeys both online and in-store. With these people in mind, the firm is altering core features like search to focus on commerce and visual media, along with prioritizing online video through YouTube Shorts and connected TV.

During the presentation, which was in-person this year after being held virtually earlier in the pandemic, Google executives also appeared critical of how rivals are adjusting to this new economic reality.

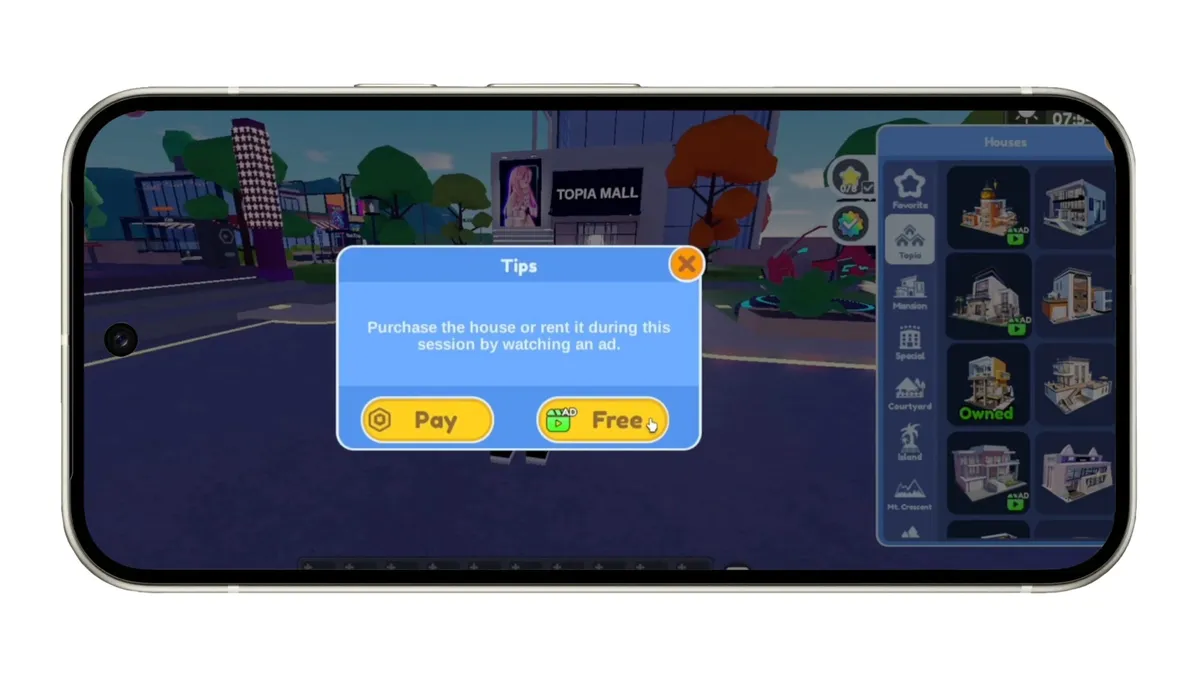

“Let me be clear: It's not about virtual worlds. It's about making the real world better today by bringing in the best of what the digital world has to offer to the real world,” said Chief Business Officer Philipp Schindler in a likely shot across the bow at Meta Platforms, which has touted the metaverse as the next evolution of the internet. Schindler spoke in a pre-recorded segment due to a recent exposure to COVID-19.

Search remains the largest revenue driver for Google, and the company has frequently tweaked how it operates over the years. But the latest Marketing Live made clear that the platform is undergoing a more substantial makeover in the wake of the pandemic.

In April, Google unveiled a “multisearch” functionality that allows users to explore the web using multiple methods, such as taking a picture while asking a question via voice command. Executives said that the way information is consumed is no longer linear. Branching paths require a bigger emphasis on visuals, including when it comes to advertising.

“We're reimagining search to help you explore information in a more visual and browsable way,” said Jerry Dischler, vice president and general manager of ads at Google. “Ten blue links may have made sense in the earlier days of the web, but today, information is exploding and there's more choice than ever before.”

“With a more visual experience, we'll absolutely have more visual ads to make them more useful, inspirational and engaging than ever,” Dischler added later.

Commerce is a big piece of the equation. Later this year, Google will start allowing brands to show “highly visual” shopping ads that display images, pricing and reviews in search results. Businesses that have 3D models of their products will also be able to run augmented reality (AR) ads directly in search so users can test out what furniture looks like in their living room, to use one example. The company cited data from a study it commissioned from Ipsos that found 90% of surveyed U.S. consumers currently use or would consider using AR shopping.

“We believe AR will become the next permanent staple in how shoppers interact with brands and products digitally,” said Google Commerce Chief Bill Ready at the conference.

One last search update on the visuals front related to loyalty: Merchants in the coming months will be able to promote loyalty programs to users exposed to ads on Google, with a “view more” icon explaining potential perks for accruing points. Loyalty sign-ups can be managed through a goals-based Performance Max platform that aims to convert customers across YouTube, display, search, discover, Gmail and maps.

“AI-driven advertising is our future,” said Dischler. “Advertisers that use Performance Max in their account on average see 13% more total incremental conversions, which — especially in today's business environment — is pretty compelling.”

Weathering changes

Fresh bells and whistles for Google search arrive as other aspects of the business flag. Parent Alphabet fell short of Wall Street’s estimates in the first quarter in large part due to YouTube severely underperforming. The platform saw revenue up 14% year-on-year to $6.87 billion, while analysts had forecast growth of around 25%. The rare miss added to a run of earnings that saw streaming and digital video providers crash from earlier pandemic highs.

At Marketing Live, Google continued to highlight YouTube Shorts, a TikTok lookalike that now averages 30 billion daily video views. Starting Tuesday, video action and app campaigns can automatically scale to the fledgling short-form video format. Later this year, YouTube will also introduce tools to better connect product feeds — previously available in in-stream videos — to Shorts campaigns to make them more shoppable, though details were scant. A similar feature is coming to the search function on YouTube as well.

Additionally on the video front, Google Audiences are coming to connected TV (CTV) for display and video 360 campaigns. The offering works across Hulu, Peacock and other CTV apps, speakers said.

Google is shaking up its ad strategy as it girds itself for a more privacy-centric future. Executives cited data that suggest 65% of the world’s population will be covered under modern privacy laws akin to the General Data Protection Regulation by 2023, up from 10% in 2020. Google plans to sunset third-party cookies next year and is working through alternative solutions, such as topics-based targeting, to help marketers keep their footing amid the disruption.

“Measurement must change in a privacy-safe future. That's a good thing, even if it's a bit challenging as we figure it out together,” said Dischler. “Because people care about privacy, we, as an industry, need to rewrite digital advertising for the next chapter.”