Brief:

- Fitbit is testing a rewards program as the maker of wearable fitness trackers debuts four lower-priced devices. The rewards program lets wearers earn points for everyday activities like steps, sleep and active minutes, according to a company announcement.

- Adidas, Blue Apron and music streaming site Deezer are among the brands that are providing rewards to Fitbit customers who participate in the program and reach their activity goals. Fitbit plans to test the program and other software features before starting a paid premium service later this year.

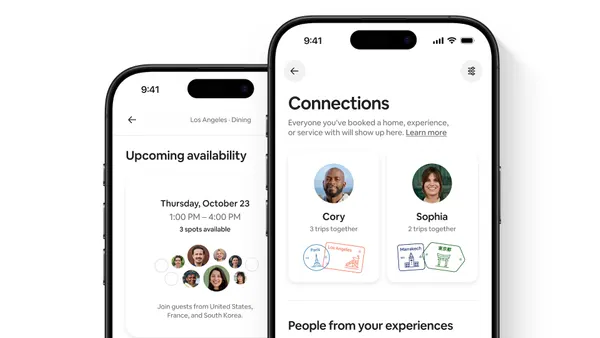

- Fitbit is working on a major redesign of its mobile app to let users personalize their dashboard, better understand their data, discover new content and more easily connect with other people in its social community. Its latest line of devices, including a streamlined smartwatch that takes aim at the popular Apple Watch, will be available in stores and online at North American retailers including Amazon, Best Buy, Kohl's, Target and Walmart.

Insight:

By partnering with brands like Adidas, Blue Apron and Deezer, Fitbit brings rewards program to a new market. Rewards programs help brands collect data about consumers, and Fitbit's partner brands could have access to the type of fitness data that the devices collect. While dozens of apps offer rewards points in exchange for activities that users can redeem for products, services and charitable donations, Fitbit has the name recognition and user base to stand out among rivals and make it a useful partner for these popular brands.

Fitbit's line of four lower-priced wearables may also help the company to boost its market share amid strong competition from market leader Apple and China's Xiaomi and Huawei. Fitbit's new devices include the Versa Lite smartwatch priced at $159.95, less than the $199.95 for a typical Versa. By comparison, the Apple Watch Series 4 ranges in price from $399 to $1,499 depending on features, such as GPS and cellular connectivity.

Researcher International Data Corp. (IDC) estimated this week that Fitbit's shipments of wearables fell 10% to 13.8 million last year, while competitors reported strong growth. The company's market share of 9.4% was less than those for Apple (27.4%), Xiaomi (12.6%) and Huawei (9.6%) at the end of last year. Shipments of wearables jumped 27.5% to 172.2 million in 2018, with much of the growth driven by wireless headphones that work with voice-powered virtual assistants. Smartwatches grew 55.2% in Q4 2018 from a year earlier and made up 34.3% of the wearables market during the quarter, while wrist bands accounted for 30% of the market, per IDC.