Brief:

- Starbucks is the most-used proximity mobile payment app in the U.S. and is predicted to remain so, according to a report from eMarketer shared with Mobile Marketer. This year, 23.4 million people ages 14 or older will use the coffeehouse chain's app to make a purchase at a Starbucks location at least once every six months. Proximity mobile payments are made inside a physical store at the point-of-sale.

- More people will use the Starbucks app for proximity payments than Apple Pay (22 million), Google Pay (11.1 million) and Samsung Pay (9.9 million). Samsung Pay is the most widely accepted by merchants, although it has the lowest user adoption rate. Apple Pay is accepted at more than half of U.S. merchants while Google Pay struggles with a low adoption rate by merchants.

- The number of U.S. consumers that use contactless mobile payment will grow 14.5% to 55 million this year, eMarketer estimates. For the first time, more than 25% of U.S. smartphone users ages 14 and older will make a proximity mobile payment at least once every six months.

Insight:

Use of mobile proximity payments is growing at a healthy pace, although eMarketer's numbers make it clear that consumers are not yet relying on their phones to complete everyday purchases beyond their daily coffee fix. The numbers also suggest the proximity payment landscape is likely to change much over the next few years. However, if more retailers offer their own proprietary payment solutions, this could start to eat away at market share for the current leaders in the space. For example, Walmart said late last year that its solution, Walmart Pay, could soon surpass Apply Pay in mobile payment usage.

The fragmentation of the mobile payments landscape continues to be a drag on adoption. The strong adoption of the Starbucks app is partly a reflection of the chain's pervasive presence throughout the country, where it has more than 14,000 locations. Starbucks launched its mobile pay app in 2009, before the arrival of Apple Pay, Google Pay and Samsung Pay.

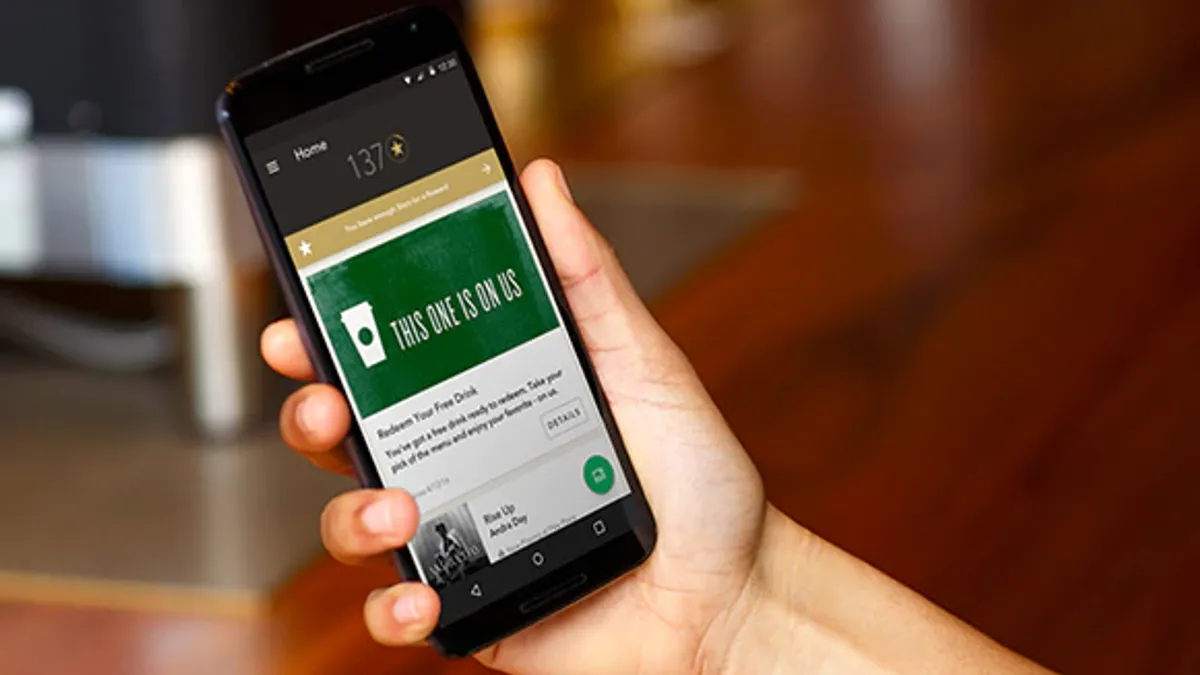

Many Starbucks fans may be inclined to return to the app because of the incentives and loyalty rewards the company offers customers. The company has expanded its app capabilities to drive downloads among a broader group of consumers, even non-loyalty members. This year, it introduced a mobile checkout that doesn't require preloaded money on the app to pay, but that option doesn't earn reward points.

EMarketer's finding confirms another survey by The Manifest that found Starbucks' app is the most popular among several well-known restaurant loyalty rewards apps. About half (48%) of app users surveyed regularly use the Starbucks mobile app, compared to 34% who use the Domino's app and 30% who use the Pizza Hut app.

Contactless payments are growing more popular in the U.S., although the payment method has seen a relatively slow adoption rate compared with areas like urban parts of China that managed to leapfrog ahead from desktop shopping to mobile platforms. Apps like Alipay and Tencent's WeChat messaging platform have contributed to the acceptance of cashless point-of-sale payments. The U.S. has a well established infrastructure to process credit and debit card payments, making them about as quick and convenient as mobile payments for consumers.