Brief:

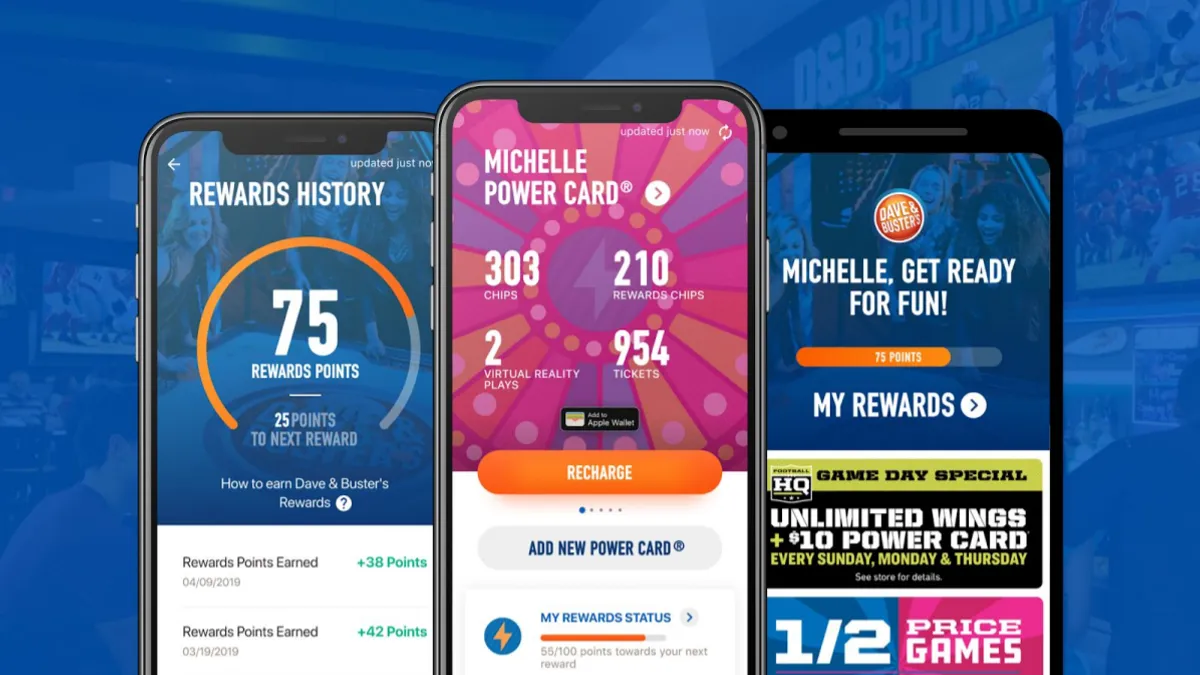

- Dave & Buster's introduced a mobile app to handle in-store transactions and to let customers manage their loyalty rewards. The chain of bar and restaurant arcades worked with developer Stuzo to create the app, per an announcement shared with Mobile Marketer.

- The Dave & Buster's app uses the near-field communications (NFC) chip found in most newer models of smartphones to handle contactless transactions. That means customers can play video games and other attractions in its arcades with a smartphone tap instead of swiping a plastic card.

- The app also lets customers earn and manage rewards points they accumulate from purchases. The Dave & Buster's app is free to download from Apple's App Store or Google Play, and is available for the Apple Watch, per its announcement.

Insight:

With digital wallets becoming more popular among smartphone users, Dave & Buster's aims to keep apace with tech-savvy consumers who are growing increasingly comfortable using their mobile devices for contactless payments and other transactions. The chain's app frees customers from the burden of holding another plastic card, while letting them accumulate rewards points that could encourage return visits to its more than 130 locations nationwide.

Annual spending per digital wallet in the U.S. will almost double to about $6,400 by 2024 from $3,350 currently, according to Juniper Research, which means restaurants like Dave & Buster's need to adapt to this changing consumer behavior.

Dave & Buster's is joining the major restaurant brands that have a mobile app for contactless transactions and loyalty programs. Starbucks popularized contactless payment methods for its U.S. customers, offering millions of people their first experience with in-store payments through a smartphone or wearable device. Despite growing competition from payment platforms like Apple Pay, Starbucks Pay is still growing strongly, researcher eMarketer found. The coffee chain's success demonstrates that store chains can successfully set up a proprietary payment system that gives them more control over purchase data to glean customer insights.

Smartphones are making loyalty programs more convenient for customers, giving them a chance to see their progress in accumulating points or cash-back rewards. The percentage of U.S. consumers who said a mobile-enabled loyalty program makes them visit a store or buy more frequently rose to 61% this year from 52% in 2016, a 3Cinteractive survey found. Among the more recent successes, Chipotle Mexican Grill boosted downloads of its mobile app nearly fivefold with the nationwide rollout of a loyalty program that used Venmo to give cash back to customers.