Dive Brief:

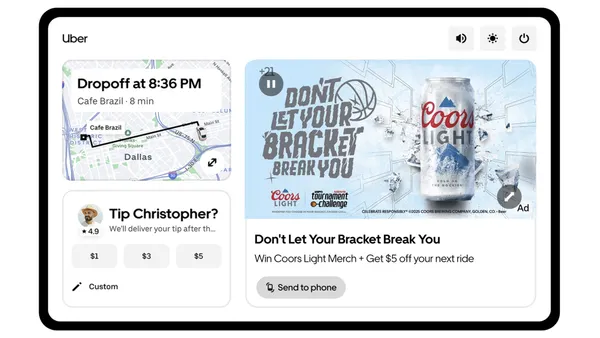

- Connected TV (CTV) advertising makes up 49% of video ad impressions served to viewers as more consumers shift their media consumption to on-demand devices, according to a report that video ad-tech platform Extreme Reach shared with Marketing Dive. The firm observed a 60% jump in CTV ad impressions in Q1 from a year earlier.

- The growth in CTV ad impressions is encroaching on mobile devices, whose share of video ad impressions dipped to 25%, the lowest in two years. Six-second ad impressions are negligible, per Extreme Reach.

- CTV ads are unskippable, which helps them score completion rates of 97%. Unskippable ads are reversing a multiyear trend toward shorter ad formats, with 30-second spots growing 20% to make up 69% of all video ads in Q1. Thirty-second ads overtook 15-second spots in Q4 to become the most common ad length, per Extreme Reach.

Dive Insight:

Extreme Reach's study of ad impressions indicates the significant effect that CTV is having on consumers' media consumption habits and the marketers that want to reach them. The percentage of U.S. households with a CTV device grew to 68% in 2018 from 63% a year earlier, Nielsen found. Smart TVs saw the biggest jump among CTV devices, growing to 41% of households from 32% during that period. Newer models of smart TVs have better user interfaces and operating systems than they used to, helping to support more apps and streaming services like Netflix and Hulu, per researcher eMarketer. In conjunction with the rise in cord-cutting and OTT services, CTV has become a key playing field for marketers to battle for viewers' attention, as the Extreme Reach study suggests.

A trend toward longer ad lengths on CTV bodes well for creatives who have fretted that six-second ads are too short to deliver a compelling brand message. YouTube even removed non-skippable, 30-second ads last year to avoid annoying intrusions on viewing time. Instead, the platform has pushed non-skippable, six-second "bumper ads" because most of its viewership occurs on mobile devices, where the average attention span is much shorter than that of TV. However, Google has said for the past two years that CTV is its biggest source of viewership growth on YouTube.

Improved targeting that can tell the difference between a CTV and a mobile device likely will change how video ads are delivered. Smart TV company Vizio and several media and technology companies in March formed Project OAR (Open Addressable Ready), a consortium to develop new standards for addressable advertising for CTV. Similarly, Roku last month started offering a new analytics and planning tool that pinpoints audiences not reached with TV ads that can be targeted on its OTT platform.

The reported growth of CTV advertising and the decline of mobile video impressions pours some water on the status of mobile video advertising, which other reports have suggested is dominant and growing. However, mobile ad revenue hit $69.9 billion in 2018, making up 65% of total digital ad revenue and representing a 40% jump from 2017's $50.1 billion mark, as nearly three-quarters of internet time is spent on mobile, per the IAB's Internet Advertising Revenue Report. Together, the reports suggest that marketers must balance their media mix between mobile, CTV and other formats.

The Extreme Reach report reinforces several other studies about the growth of CTV advertising. Impressions on CTV campaigns last year made up 28% of total impressions on Innovid video campaigns, for a 17% year-on-year increase from 2017. Likewise, ad requests across CTV devices have increased 1,640% year-over-year, per data from independent video supply monetization firm Beachfront cited by Broadcasting + Cable. CTV ad requests reached nearly 30 billion in November 2018 compared to 1.7 billion the previous year.