Dive Brief:

- To build out its Watch platform, Facebook is shifting focus to audiences that are age 30 and older rather than the teens and younger millennials that the service initially seemed to be targeted at, according to a report in CNBC.

- The social network is reportedly in talks with at least three media companies for video content that will court older consumers, per the report. Facebook has been asking for shows hosted by traditional celebrities as opposed to social media influencers. The company has responded well to talent who are in the 30 to 50 age range, CNBC said.

- Among Watch shows available for advertisers, only 25% are for people in their 20s, with the rest for older audiences, according to a media buyer cited in the CNBC report. An independent analysis by another media company found that only 15% of the top 25 Facebook Watch shows are geared toward teens and young adults.

Dive Insight:

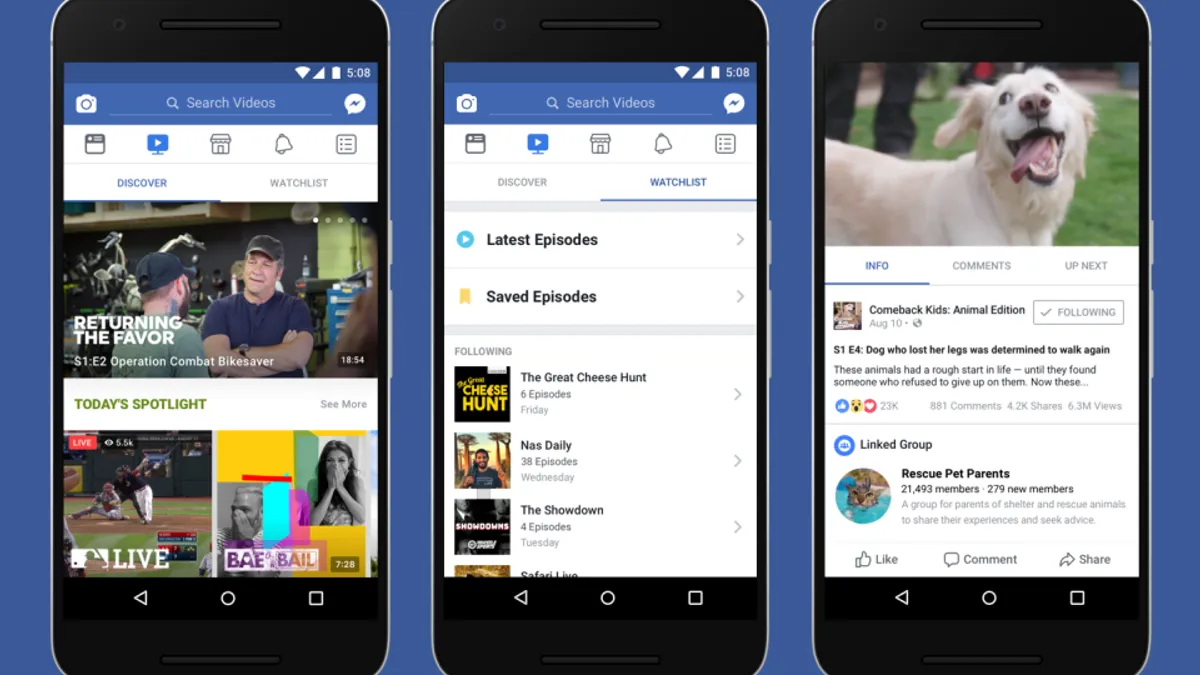

Facebook launched Watch in August 2017 as a bid to build out a potential competitor to both YouTube and Netflix, with a focus on short-form but also premium, well produced digital video content. However, Watch has struggled to gain significant legs in the year-plus since its rollout, putting out only a handful of original programs matching the caliber of something that would run on Netflix and frequently struggling to attract eyeballs on the scale of a platform like YouTube. A lack of interest comes despite Facebook investing $1 billion into buying shows and content for Watch, according to CNBC.

Critically, advertisers and publishers have appeared cool on the service as well, which reported 50 million monthly viewers as of August compared to the 1.8 billion on YouTube and lacks the brand recognition of Google's video offering, per the report. Facebook has said its Watch platform is most often used for "intentional viewing," or pre-planned sessions that last up to five times longer than those in Newsfeed, where engagements are shorter, unplanned but more frequent. Going after older audiences could help Facebook attract fresh viewers and advertisers and turn the service around.

At the same time, that switch in strategy would indicate the broader struggles Facebook has experienced in preserving engagement with key younger audiences that are more frequently flocking to rivals like Snapchat or its own photo-sharing app Instagram, including for video content consumption. Just 28% of teens reported using Facebook in Piper Jaffray's most recent semi-annual survey of the age group, down from more than 40% two years ago.

In its Q3 earnings report, Facebook said it would be expanding video, private messaging and Stories on the platform, as time spent on the Newsfeed is shrinking. Rethinking Watch's target audiences could signal troubles for Facebook, which reported a 33% increase in revenue for a total of $13.73 billion for last quarter, falling short of analyst expectations and marking the company's lowest percentage growth increase in the past six years.

Struggles to monetize Watch come despite marketers' exploding interest in digital video. Video advertising spend is forecast by Forrester to grow from $91 billion this year to $103 billion by 2023. Social video will grow at a 20.8% compounded annual growth rate through 2023, per the researcher, and online video viewership is projected to exceed 200 million in 2018.