Dive Brief:

- Chipotle increased revenue by 38.7% year-over-year, comp sales by 31.2% and digital sales by 10.5% in Q2 2021, according to the company's Tuesday earnings release. Digital sales generated $916.5 million for the chain during the quarter.

- The company's returns should continue to improve as it accelerates its Chipotlane model, CEO Brian Niccol said in the press release. The company plans to open about 200 restaurants this year, and more than 70% of these units will include the digital, order-ahead pickup lane, CFO Jack Hartung said on Tuesday during a call with investors. Chipotlanes open with about 20% higher sales compared to traditional stores, Hartung said.

- The chain's digital sales growth comes despite those sales making up less of its overall sales mix compared to Q1 — 48.5% versus 50%, respectively — as restrictions ease and dine-in business starts to return to pre-pandemic levels. Dining room sales are about 70% of pre-pandemic levels, and Chipotle has continued to maintain about 80% of its digital sales, Niccol said.

Dive Insight:

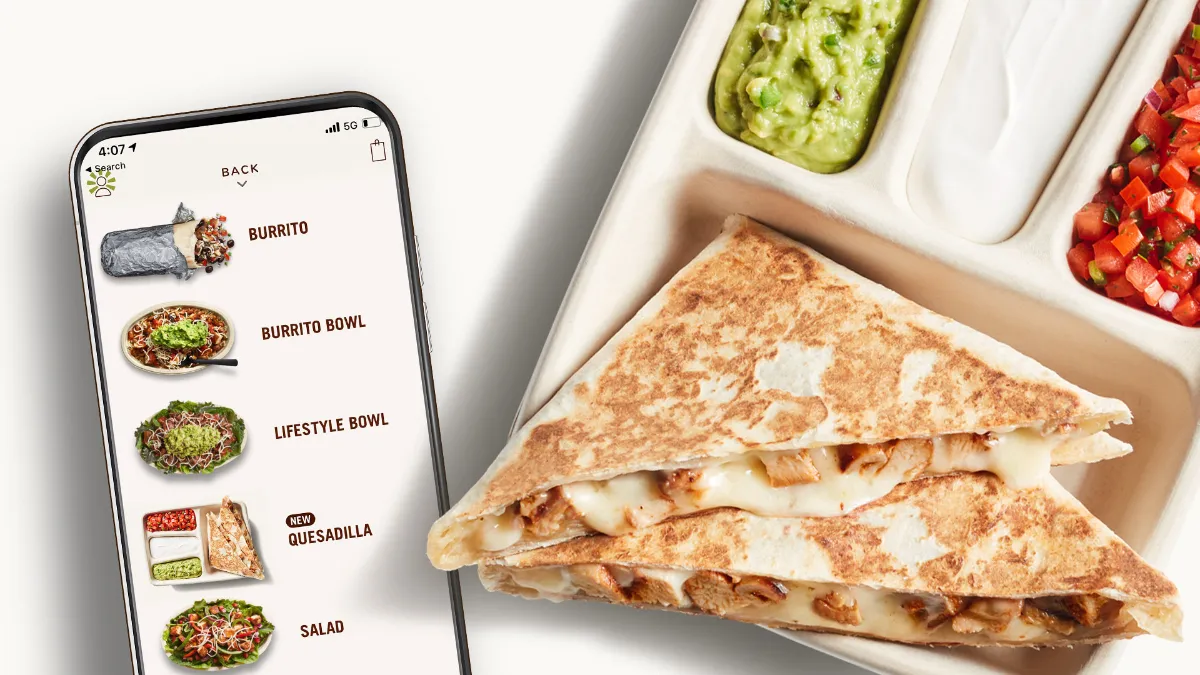

Chipotle's digital presence will likely remain strong as the chain experiments with digital-only product launches, like its quesadilla, and grows its already robust loyalty program, which now includes more than 23 million members.

Notably, Chipotle's profit margins are at their highest levels in years, driven in part by menu price increases and lower promotional activity. The chain may have leverage to make these moves since it created more digital habituation from its consumers during the pandemic. In February, for example, Niccol touted the work Chipotle did in 2020 to make its digital channels more convenient, adding enhancements like unlimited customization, contactless delivery and group ordering.

"We believe our digital sales mix will moderate as capacity restrictions ease and guests feel more comfortable physically ordering and dining in our restaurants," Niccol said. "However, we expect absolute digital sales dollars to find a new equilibrium in 2021 and grow from there. We're encouraged to see that so far in July, we continued to hold on to these digital gains even as in-store recovery has strengthened."

Following strong restaurant-level economics and signifaicnt unit growth — Chipotle has opened 96 new units so far this year — has the company remaining confident that its key growth strategies will allow it to reach 6,000 restaurants in North America with average unit volumes well beyond $3 million, Niccol said. As of the end of Q2 2021, AUVs pushed above $2.5 million, Niccol said on the call.

With about 50% of its sales coming from digital channels, Chipotle is in rare company in the non-pizza space. Wingstop brings in about 60% of its sales through digital channels, for example, while Noodles & Company's digital sales represented about 62% of sales in Q1 2021.

Meanwhile, Chipotle's quick-service peers still hover in the high-single-digit to low-double-digit range on digital sales. Wendy's expects to reach 10% this year, for instance, while Burger King's digital sales were about 8% at the end of Q4 2020. McDonald's expects its digital sales in its markets in the U.S., U.K., Canada, Australia, Germany and France to reach about 20% of its systemwide sales this year as it rolls out its MyMcDonald's loyalty program.

The disparity in digital sales mix between Chipotle and its QSR peers illustrates how much impact the drive-thru has in QSR. Though Chipotle is accelerating the rollout of its Chipotlane drive-thru model, those orders differ from a traditional QSR drive-thru as they're facilitated by a mobile order-ahead functionality. This could contribute to continued high digital sales for the chain. Over the trailing 12 months, Chipotlanes drive about 15% higher digital sales compared to traditional stores, Hartung said.

"Not only are we pleased with the level of digital sales and overall mix, we're also delighted to see that our highest margin transaction, digital pickup orders is gaining traction and we expect this to continue as we add more Chipotlanes and customers experience the value of this occasion," Niccol said.