It's no secret that Amazon's advertising business has boomed in recent years as marketers have found ways to tie their brands into the company's massive e-commerce operation. A lingering question has been how Amazon will develop brand awareness tools to layer on top of its more purely performance-minded ones and win more dollars away from Google and Facebook.

At its first-ever AdCon conference last week, Amazon's brand-building strategy for marketers became a little clearer. The invite-only Seattle show, which was closed to press, was Amazon's first to be focused on brands versus ad agencies, according to CNBC, which first reported on the gathering. Across two days, marketers heard case studies from companies that have successfully tapped into the platform (including the mattress disruptor Tuft & Needle), participated in breakout sessions and heard from senior Amazon Advertising executives. AdCon drew roughly 400 attendees, per CNBC, with a mix of players both new and more experienced, according to presenters.

"I think the program that the Amazon Advertising team put together allowed them to kind of speak to both audiences effectively whether you're just starting out or trying to grow your business," Byron Kerr, head of e-commerce at Tuft & Needle, told Marketing Dive.

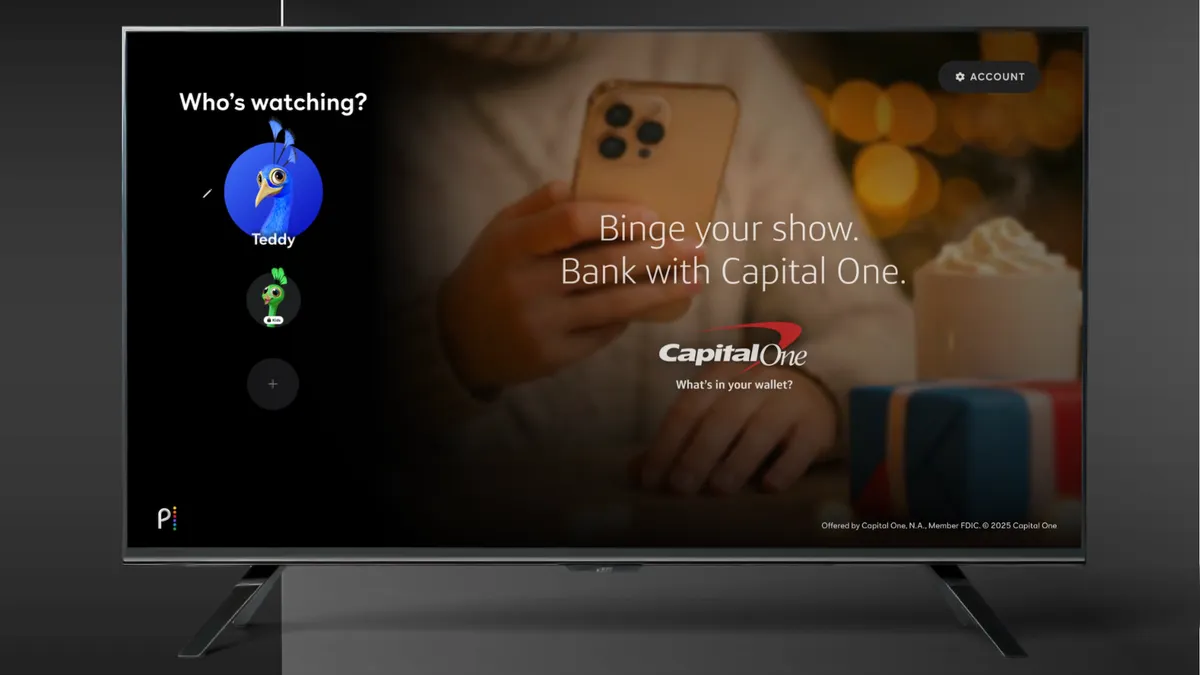

Even as Amazon used the opportunity to prop up its advertising growth trajectory — the business segment delivered more than $10 billion in annual revenue last year, per CNBC — AdCon frequently returned to how the platform is looking to diversify its appeal beyond pure performance marketing. It's an evolution the disruptive giant looks to accomplish through a bigger pitch on ad formats like video in search and over-the-top (OTT) television.

"One thing that was pretty evident in all the discussions was to kind of look at your ad strategy holistically from the top of the funnel all the way down to the bottom, [and] thinking about how you build a brand on Amazon and not just leverage advertising to grow sales," Kerr said.

The main event

Amazon is not new to the advertising events business. As CNBC notes, the company last year put together an agency-focused get-together called Rev2018. It's held much larger conferences around its cloud business as well.

But by targeting AdCon at brands, Amazon is following rivals who are also pushing harder to stake out a bigger claim in a digital advertising market that's desperate for new entrants. Target earlier this year rebranded its media network as Roundel, promoting the division for the first time at the NewFronts. More recently at Advertising Week New York, Roundel executives spoke on early partnerships with marketers like Procter & Gamble.

Walmart has made similar moves, having made its NewFronts debut in the spring. Just a few weeks later, the retailer also hosted an event called 5260, its first directly pitching brands — P&G, Coca-Cola and Unilever reportedly attended — on a burgeoning ad business supported by its e-commerce site and properties like the streaming service Vudu.

AdCon in some ways showed off the third-party ecosystem growing around Amazon's ad business, a type of micro-economy that's supported Facebook and Google for years. Tech companies like Teikametrics, which provides services to Amazon sellers, and Kenshoo sponsored the event.

"As one of Amazon's leading technology partners, working with over 500 brands and agencies to help them automate, optimize and scale their Amazon Advertising campaigns, we were proud to support AdCon and share best practices and industry insights with both emerging and established advertisers," a Kenshoo spokesperson said in a statement emailed to Marketing Dive.

Looking forward

Amazon will likely continue to host events like AdCon as its partner system and ad revenue continue to expand. Amazon is projected to command 8% of total global digital ad spend by 2023, according to Juniper Research.

For now, the new Seattle show keyed into where the company could be focusing its efforts heading into 2020 and beyond.

"They're obviously launching a lot of new initiatives in the OTT space — how do you tap into that? — and video as well, that's a huge opportunity,” Tuft & Needle's Kerr said.

From a purely organizational standpoint, AdCon hit most of the marks, per Kerr, providing access to leadership and also actionable takeaways.

"The program that they put together was pretty in-depth," he said. "As the ad platform grows and they start to launch new tools and opportunities for brands to invest in, obviously showcasing those in future programs and events would be helpful and impactful."