Beauty brands were some of the first players to dabble in augmented reality (AR) years ago, quickly ramping up investments to embrace the technology and let consumers digitally sample products. Now, the ongoing coronavirus pandemic has made this type of immersive technology even more vital to some categories' marketing and sales approaches. With many beauty retailers closed temporarily and shoppers still stuck at home, mobile screens have become increasingly central to the way people experience and connect with brands.

AR try-ons of beauty products aren't just a passing fad as more brands adopt the popular technology, and emerging digital platforms give them a bigger variety of software tools through which to reach consumers. Social media company Pinterest this month added a feature to let makeup brands sell directly through virtual try-ons of eyeshadow, a year after introducing a similar feature for lipstick. Lancôme, YSL, Urban Decay and NYX Cosmetics are among the established beauty brands that now let Pinterest users virtually sample their products before buying them through the inspirational app.

"Over the last year, it's become way more functional to have these AR tools, versus just something that's 'kind of cool' and 'nice to have,'" said Tiffany Hogan, principal analyst for beauty and apparel at research firm Kantar. "It's becoming much more worth the investment for brands to either partner with a retailer that has these capabilities or to develop them on their own."

Jumping on the e-commerce surge

Added features on social media apps like Pinterest have helped to take AR mainstream over the past few years, and that trend is expected to continue. The number of social network AR users in the U.S. is forecast to grow 7.2% to about 47 million this year and by another 3% to 48.3 million next year, eMarketer predicted in 2020.

Pinterest's expansion of AR features specifically for beauty brands comes as other digital platforms also integrate the technology to appeal to users who have grown comfortable with immersive tools. Snapchat last month collaborated with Perfect Corp., a developer of AR for beauty brands, to offer similar makeup try-ons in its photo-messaging app. About 75% of Snapchat users play with digital lenses every day, according to the company, and campaigns that include the app's shoppable AR lenses saw a lift in consumer interest that was 2.4 times higher than average during 2020's third quarter — a sign of brands' eagerness to engage with mobile users on their preferred platforms.

"Over the last year, it's become way more functional to have these AR tools, versus just something that's 'kind of cool' and 'nice to have.'"

Tiffany Hogan

Principal analyst for beauty and apparel, Kantar

Google last month also announced an integration with Perfect and ModiFace, which beauty giant L'Oréal acquired almost three years ago, to offer virtual try-ons. The search giant's Google Shopping started showcasing thousands of lipstick and eyeshadow shades from brands including L'Oréal, MAC Cosmetics, Black Opal and Charlotte Tilbury in a move to capitalize on the e-commerce surge during the pandemic.

Augmenting the in-store experience

AR technology not only helps beauty brands reach people at home or on the go, but it also presents an opporutnity to virtually demonstrate products in stores. With many retailers ending their sampling of makeup testers due to pandemic-related safety concerns, digital demonstrations of cosmetics have skyrocketed in popularity as retailers look to continue providing valuable in-store experiences as many struggle to stay afloat.

Ulta Beauty, the chain that was forced to close all its 1,264 stores during the onset of the pandemic, saw a surge in usage for its GlamLab virtual try-on experience that remained even after stores began to reopen. GlamLab started as a photo try-on service developed by beauty technology company GlamSt, which Ulta acquired in 2018 within its broader push into virtual sampling.

"There were 19 million shade matches last year for Ulta's GlamLab tool, which was five times more than the year before," Kantar's Hogan said. "We're seeing more signs in stores that tell people to get out the app to use while in store to help figure out what color you need. You can still shop in-store, still experience Ulta, but you can use the digital tools across channels to make purchase decisions."

Ulta's GlamLab tool is likely to remain a key part of the company's digital sales strategy even as it diversifies into smaller store formats. Target and Ulta in November announced a plan to open more than 100 Ulta-branded shops within Target stores by the middle of 2021.

"Ulta Beauty at Target reflects further evolution in our omnichannel strategy, rooted in unlocking the potential of our physical and digital footprints," Ulta CEO Mary Dillon said in a statement. The partnership with Target gives Ulta more support for same-day fulfillment as the companies compete more directly with e-commerce behemoths like Amazon.

AR for everyone

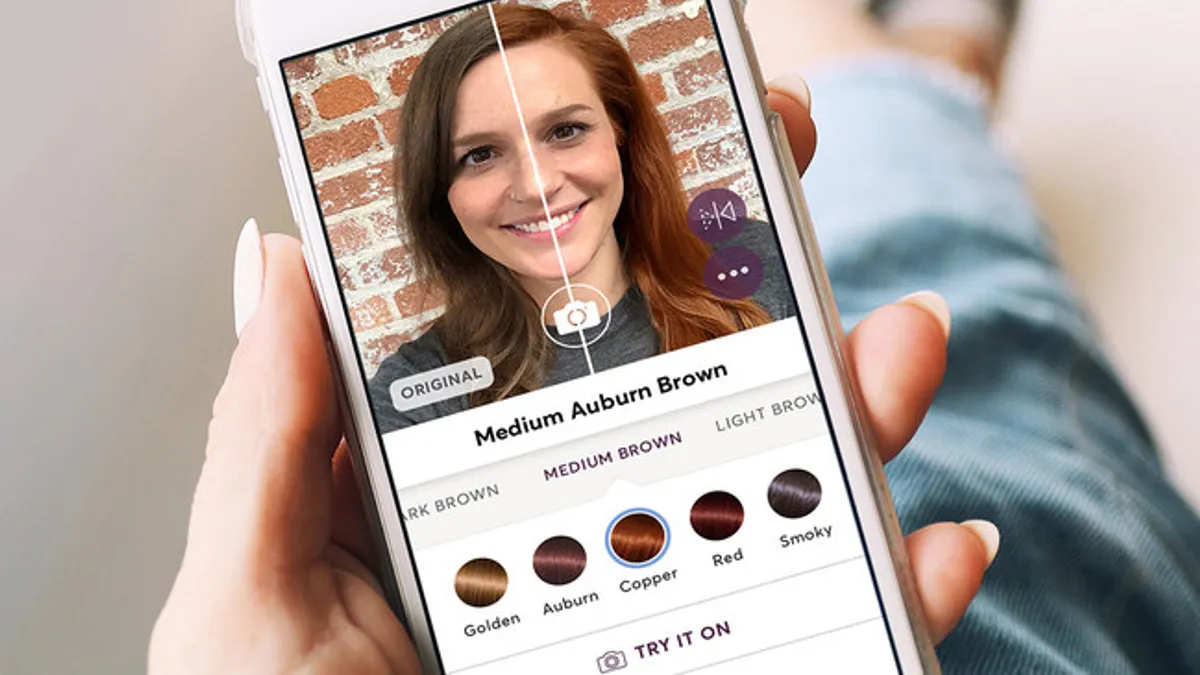

AR applications for beauty marketing have evolved to include hair, nail and contact lenses as brands continue to develop uses for the immersive technology.

L'Oréal's Garnier brand of hair coloring has virtual try-ons of its products in Google Lens, the search company's image-recognition app. Scanning Garnier boxes in stores with the app activates L'Oréal's Modiface platform to simulate the hair color in an AR overlay on a live selfie. The integration of image-recognition and AR could enhance shoppers' in-store experience as they return to brick and mortars and try to limit touching more products than necessary due to coronavirus concerns.

Johnson & Johnson worked with Perfect to let consumers in China virtually test colored contact lenses with AR. The health and beauty products giant created a mini program for its Acuvue brand in the popular messaging app WeChat and social shopping app Taobao, suggesting major CPG companies are taking note of beauty brands' use of digital tech and more heavily investing in the mobile space.

AR experiences have evolved for beauty brands in the past few years, and the pandemic only hastened their adoption as marketers seek creative and engaging ways to reach homebound consumers and supplant the in-store experience. As long as personal safety remains a top concern for consumers, virtual try-ons are likely to grow increasingly advanced with continued investment in immersive technology.