Brief:

-

Amazon reported revenue for its "other" category that mostly comes from ad sales rose 37% to $3 billion in Q2, compared with a 34% yearly jump in the prior quarter, per an announcement. The results were a bright spot for the ecommerce giant, whose streak of quarterly record profits ended with a disappointing 3.6% gain to $2.63 billion. Earnings per share of $5.22 missed estimates of $5.56.

-

The growth in ad sales was faster than the company’s 20% revenue gain to $63.4 billion, which was an improvement from the 17% increase in the prior quarter. However, rising shipping costs, slower growth from its cloud-computing business and a bigger loss in overseas retail operations squeezed profits, The Wall Street Journal reported.

-

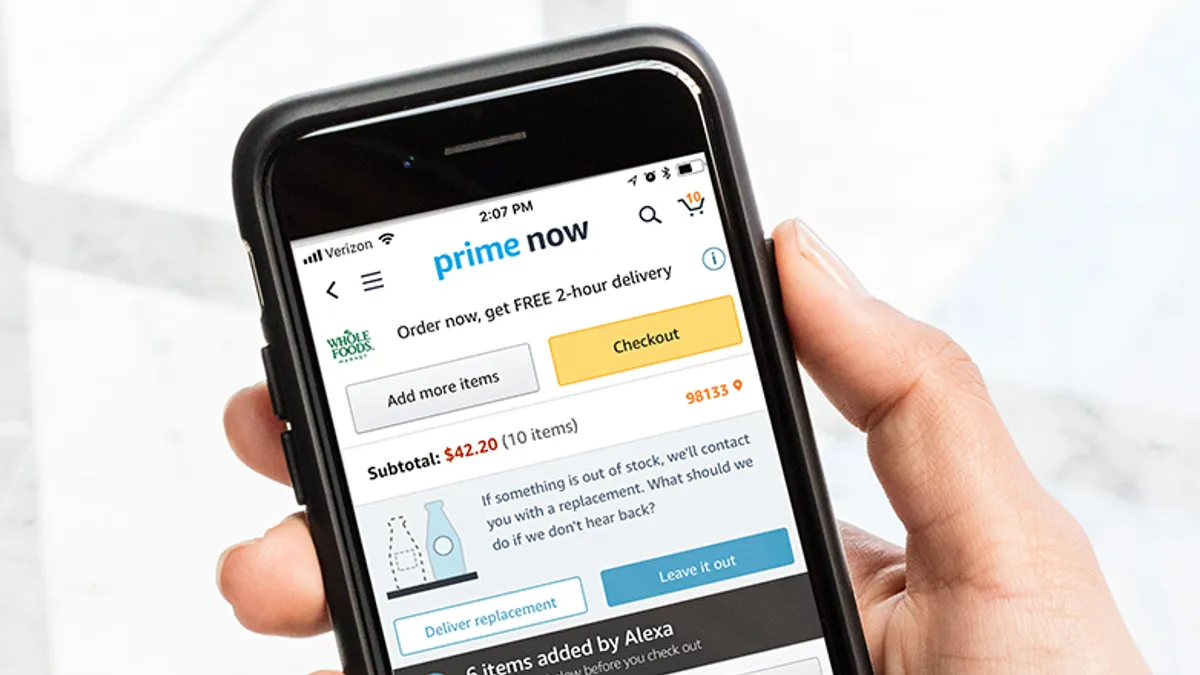

Amazon now offers free, one-day delivery to Prime members on more than 10 million items, Jeff Bezos, Amazon founder and CEO, said in the announcement. Worldwide shipping costs jumped 36% and the company spent $800 million during the quarter to build out its next-day service, CFO Brian Olsavsky said in a call with analysts.

Insight:

Amazon's ad sales growth of 37% in Q2 topped the expansion of more established rivals such as Google, which reported a 15% gain, and Facebook, whose sales advanced by 28%. However, Amazon's ad business is growing off a much smaller base and now appears to be showing signs of maturation. The Q2 increase follows a 34% growth rate for Q1, which had marked a sudden deceleration from the more than 60% gains seen in the prior five quarters, as noted by CNBC. Still, Amazon has emerged as the most significant rival to Google and Facebook, which are forecast to command a combined 60% of the U.S. digital ad market this year.

Marketers are driving solid results from Amazon's various ad products, marketing agency Merkle said in a Q2 report. Amazon's Sponsored Products ads, a cost-per-click format that appears on search results pages and product detail pages, are a key driver of direct sales for marketers. While the ads generated 3% of ad impressions, they provided strong value with more than half of all product sales attributed to the format. Product sales attributed to Sponsored Products ads more than doubled (up 102%) in Q2 from a year earlier, outpacing the 53% gains for Sponsored Brands ads that appear among product search results on Amazon, per Merkle.

Amazon's future ad growth likely will include expanded capabilities for Alexa, the virtual assistant that powers its popular Echo smart speakers. The company started to pitch major brands on piloting a new ad format that would let listeners respond with voice commands to audio spots inserted into the ad-supported version of its Amazon Music streaming platform. Amazon has reached out to Colgate, L'Oréal and Lululemon about participating in the test, an agency executive told Ad Age. Amazon has a 70% share of the U.S. smart speaker market, giving the company access to millions of consumers who are growing more comfortable with voice-powered shopping.

A key risk for Amazon is that its ad sales will bolster complaints that the company is unfair to third-party merchants that sell goods on its site. Bloomberg tech columnist Shira Ovide this month described Amazon's ads as an "additional tax the company imposes on the millions of businesses that sell through its vast digital mall." The company this year tested a pop-up ad feature that pitched its private-label goods on rivals' product pages, highlighting its power over third-party brands.

So far, regulatory agencies appear to looking at other parts of Amazon's ecommerce empire. The European Union this month opened an investigation to determine whether Amazon unfairly uses data collected from third-party sellers who rely on its platform. The U.S. Justice Department this week said it opened a broad antitrust review into whether big technology companies including Amazon unlawfully stifle competition. The Australian Competition and Consumer Commission issued a report saying U.S. tech giants — specifically, Google and Facebook — have too much influence over the country's news and advertising markets, hurting competition.

It remains to be seen if these regulatory agencies examine Amazon's growing ad business in their investigations of the company and tech industry.