Dive Brief:

- Amazon's top-of-search ads, which appear in search results for products, drove 3% of its ad impressions but 35% of clicks and 45% of spend during Q2, marketing agency Merkle said in its Q2 report. Product sales attributed to Sponsored Products ads more than doubled (up 102%) in Q2 from a year earlier, outpacing the 53% gains for its Sponsored Brands ads.

- Brand keywords made up 43% of Sponsored Products sales and 62% of Sponsored Brands sales for Amazon during the period. Sponsored Brands ads spurred a click-through rate (CTR) that was 34% higher than for Sponsored Products ads, while Product Display Ads lagged by 28%, Merkle found.

- Total spending on U.S. paid search ads grew 14% year-over-year in Q2, a slight deceleration from the prior quarter, as ad spend growth on Google dipped slightly to 15% from 16%. Facebook spend, excluding Instagram, rose 8% in Q2 while impressions jumped 25%, the strongest result in the past two years.

Dive Insight:

Amazon has emerged as the most significant rival to the digital advertising "duopoly" of Google and Facebook, which are forecast to command a combined 60% of the U.S. digital ad market this year. Amazon's key advantages over those platforms include its power to reach consumers when they're ready to buy, its vast data on users' product search and purchase history and its ability to fulfill orders through an extensive distribution network.

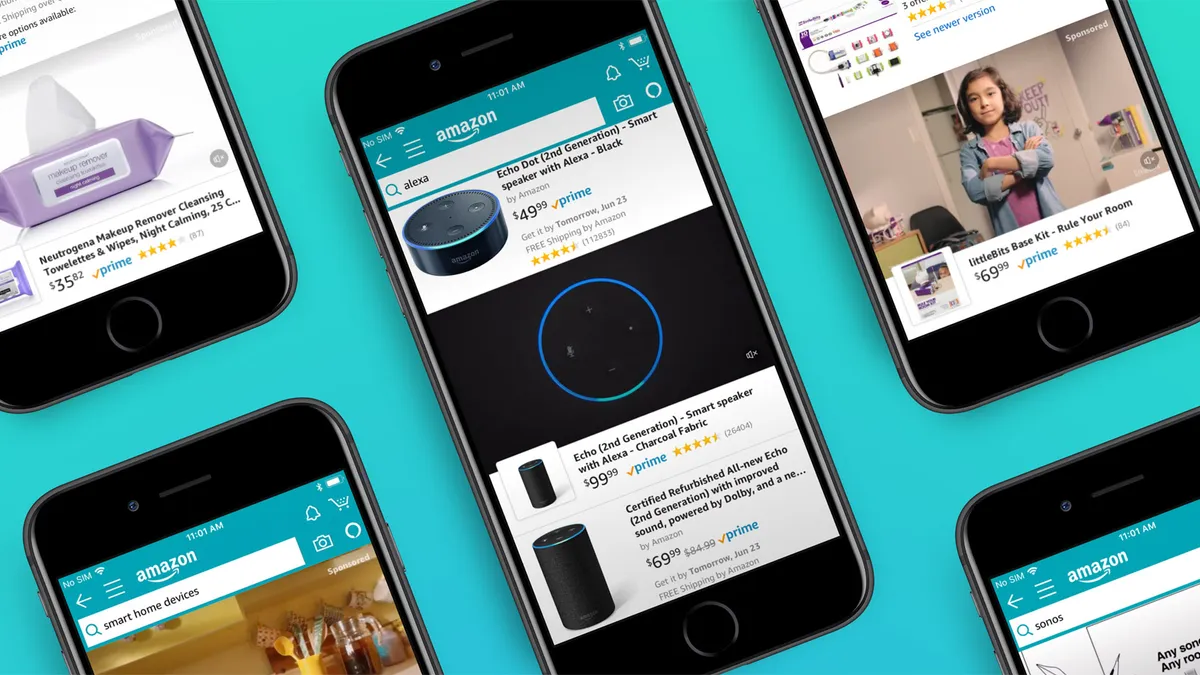

Merkle's latest data show that Amazon Sponsored Products ads, a cost-per-click format that appears on search results pages and product detail pages, are a key driver of direct sales for marketers. Appearing at the top of search results is the most competitive placement for Sponsored Products ads. While the ads generated 3% of ad impressions, they provided strong value with more than half of all sales attributed to the format. In addition to the 102% gain in sales attributed to Sponsored Products format, advertisers saw a 58% gain in clicks while only spending 12% more than a year earlier.

"The increase in sales highlights the significant opportunity Amazon search ads still hold, even for advertisers that have been active for some time," Merkle said in the report. "As the platform has grown and matured, advertisers have been able to develop more sophisticated strategies to improve ROI."

Sponsored Brands ads, which also appear atop product search results on Amazon, generate 34% higher CTR than Sponsored Products ads because of their premium positioning on the page, according to Merkle. However, CTRs began to decline after Amazon in August started placing Sponsored Brands ads in other sections of its pages, such as the left rail and along the bottom of search results. These additional placements make up 57% of Sponsored Brands impressions, but just 12% of spend, per Merkle, indicating that the best placement is still at the top of search results pages.

Product details pages made up 82% of Sponsored Products impressions, but only 40% of clicks in Q2 as these placements generated a lower CTR than Amazon's other Sponsored Products inventory, the analysis revealed. Sponsored Products accounted for 86% of non-display Amazon spend in Q2, a figure that has remained little changed in the past two years. Product Display Ads, which are still restricted to Amazon vendors and aren't available to sellers, account for a small share of spend, while Sponsored Products ads get a significant portion of traffic from product details pages where Product Display Ads generate many of their impressions.

Amazon's ad formats significantly outperform Google Shopping ads, with conversion rates that are 240% higher for Sponsored Products ads and 165% for Sponsored Brands ads. However, Merkle cautioned that direct comparisons between Amazon and Google Shopping are difficult to make because not all Google advertisers are active on Amazon, and vice versa.