Amazon allegedly welcomed “defect” ads on its platform in a bid to juice advertising revenue, according to a recently unredacted portion of the Federal Trade Commission’s antitrust complaint against the e-commerce giant. Defects, an internal Amazon term used to describe junk ads that are irrelevant to the user’s query, created “harm to consumers” by worsening search, a factor Amazon executives acknowledged. The practice also pushed shoppers toward higher-priced goods, the FTC claims.

The allegations cast Amazon’s ad sales segment, one of its fastest-growing areas of business, in a different light. The company’s model of leveraging troves of shopper data to help brands better target their online campaigns has set the standard for retail media, a digital advertising channel that has seen meteoric growth since the pandemic started. Retail media has been championed as a way to make marketing more precise for advertisers and more relevant for consumers, aligning messages closer to the point of purchase through first-party data. The FTC complaint suggests that the quest for faster growth has, if anything, made things worse for consumers and sellers alike. The problem may not be specific to Amazon.

“The news is a lagging indicator of retail media networks’ prioritizing monetization at the expense of customer experience,” said Nikhil Lai, a senior analyst focused on performance marketing at Forrester Research, over email.

A flawed system

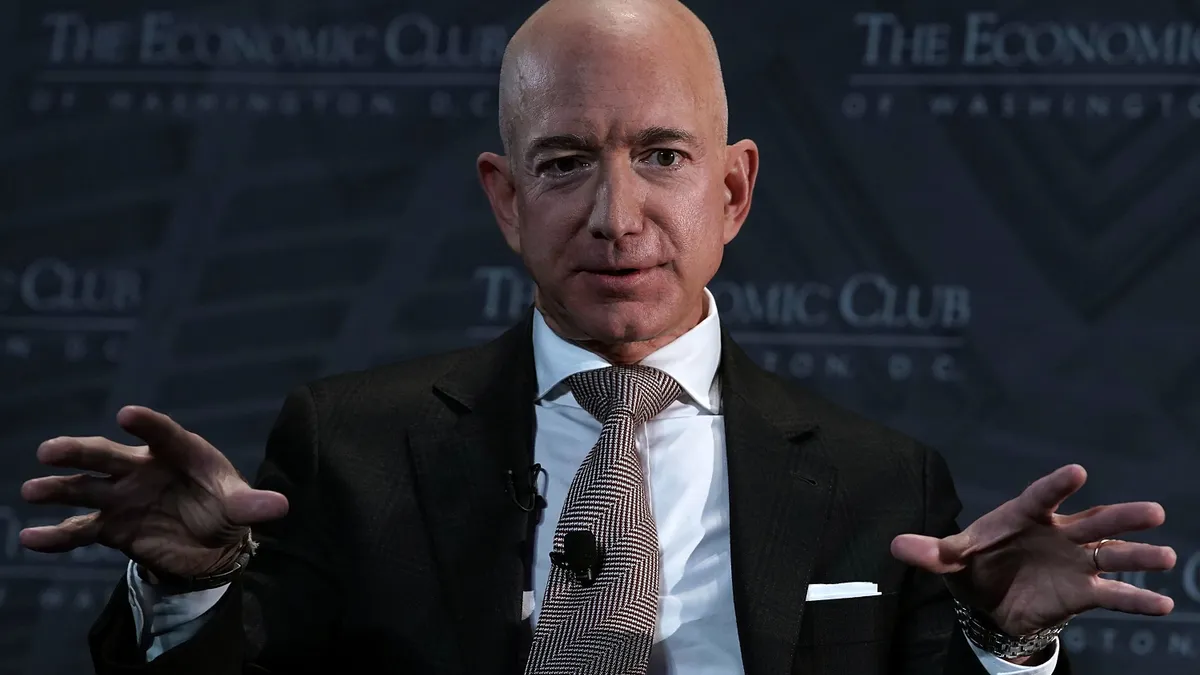

The mandate to “[a]ccept more defects” allegedly came directly from Amazon founder and then-CEO Jeff Bezos, who viewed the move as a way to extract more value from advertising, per the FTC. Bezos stepped down as CEO of Amazon in 2021 to become executive chairman.

The underlying theory behind the decision — that deprecating the ad experience wouldn’t necessarily cut into revenue — has appeared to ring true. Amazon’s ad sales segment was up 26% year-over-year to reach $12 billion in Q3 and has seen a faster rate of growth than key digital rivals. Amazon hosted UnBoxed, its annual showcase for touting new tech bells and whistles for advertisers, last week.

The extent to which Amazon allowed junk ads on its service eventually led the company to implement a “cost of defect” into its ad auction to improve revenue, per the FTC complaint. In a colorful example of a “defect” case highlighted in the lawsuit, a sponsored product unit meant to advertise water bottles instead promoted “Buck urine.”

Some discussions were held at Amazon about implementing guardrails to preserve the consumer experience, but they didn’t meaningfully take hold. Despite the flaws, maximizing profit derived from revenue effectively became “the law” at Amazon, according to an anonymous senior executive quoted in the document. The advertising claims are part of an antitrust lawsuit that was filed against Amazon by the FTC and 17 state attorneys general in September.

“The claim that Amazon leadership directed employees to accept more advertising defects that would degrade the customer experience is grossly misleading and taken out of context, and does not reflect Amazon’s longstanding dedication to continually improving the customer experience,” said Amazon spokesman Tim Doyle in a statement shared over email. Doyle cited Kantar research that found most consumers view Amazon advertising as “relevant and useful, with few negative qualities.”

Staying above board

Amazon began breaking out ad results in its earnings in early 2022, while some other retail media network owners, including Walmart, have followed suit. As retail media networks have proliferated and scaled, they’ve increasingly been viewed as profit drivers in an industry that has otherwise had to contend with a bevy of headwinds ranging from supply chain disruption to inflation in recent years.

“The high-margin operating income retailers generate from ads offsets losses from first-party product and content sales, third-party seller fees, physical store sales and subscription services,” said Forrester’s Lai. “‘Driving up Amazon’s advertising profits,’ to quote the FTC’s complaint, is, along with AWS’ operating income, essential to Amazon’s bottom-line growth.”

Retail media’s maturation has invited questions over whether the channel can operate more above board than digital marketing has in the past. The digital landscape has been mired in transparency, data privacy and measurement issues, many stemming from power consolidating with just a handful of companies, namely Google and Facebook.

A push for retail media standardization has surfaced this year as retailers look to position their platforms as a superior alternative. One of the potential snags in actually realizing industry standardization, according to experts, is the lack of participation from Amazon.