Dive Brief:

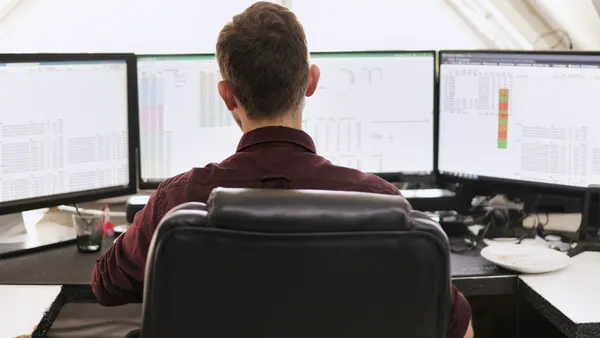

- Walmart's shift to bring its digital advertising services in-house is experiencing some technical glitches, causing frustration among advertisers, Ad Age reported. The retailer confirmed some of the delays in serving campaigns to Ad Age via a spokesperson.

- Walmart ended its work with WPP's Triad unit earlier this year. The agency had been handling ad campaigns on the retailer's platforms, but those duties migrated to the internal Walmart Media Group in a model akin to how Amazon handles ad sales. The Ad Age report suggests that issues are surfacing beyond some expected bumps in the transition period.

- An anonymous agency executive expressed concerns to Ad Age that Walmart may not have as much ad inventory as it claimed at the start of 2019. The executive bemoaned the tier system for Walmart advertisers, with staff and resources allocated based on their committing to a certain level of ad spend. In Walmart tiers, for example, lower-spending advertisers won't have the opportunity to custom-brand pages where their products are featured. That approach isn't unusual, according to Ad Age. Most of the story's sources also acknowledged that these pain points may be temporary for Walmart and are unlikely to lead to bad blood in the long term.

Dive Insight:

Walmart is hitting some technical and logistical snags as it looks to establish a digital advertising business that's run largely internally and can compete with the likes of heavyweights like Amazon.

While Walmart's 4,700 physical stores accommodate 300 million shoppers every month, its digital advertising operations are just starting to take off. The company is leaning into the ability to meld a vast pool of first-party physical retail data with shopper data from its e-commerce site and other owned properties like Jet, Bonobos and the streaming service Vudu.

That's an attractive pitch to advertisers — and one Walmart has made more directly in recent months — but the company will need to ensure it has the technical muscle and inventory to accommodate a high demand and keep advertisers happy and away from a growing number competitors also grow their media networks.

In April, Walmart acquired the cloud-based ad serving platform Polymorph Labs to support its building an ad platform and network for online properties. In-housing advertising is a key part of Walmart's battle with Amazon for greater market share, accompanying other moves such as a partnership with Alphabet's Waymo for grocery pickup, a deeper alignment with Microsoft for AI and a goal to turn Vudu into an Amazon Prime Video alternative. For its part, Amazon's 2017 purchase of Whole Foods gave the online retail giant its own chain of retail outlets to draw shopper insights from.

While in-housing ad operations may look like a smart move, and falls in line with industry trends, it's rarely simple. A report last month by the Association of National Advertisers found a variety of difficulties in taking advertising duties in-house. Sixty-three percent of those surveyed reported challenges in keeping in-house agency talent energized, 44% struggled to attract top talent and 37% said they have problems applying key marketing processes.

Triad, who named Walmart among its largest clients, enforced non-compete clauses in its employees' contracts, according to a previous Ad Age report. This means that the hundreds of people at Triad working on the Walmart account — arguably the people who best knew Walmart's needs and capabilities — are unavailable to the retailer. In May, The Wall Street Journal also reported that Target, a chief Walmart rival, was in prelminary talks to buy Triad.