Dive Brief:

- Advertisers appear to be brushing off a bombshell New York Times report published last week that detailed leadership failures at Facebook, according to a report in Ad Age. The Times found that top executives like co-founder and CEO Mark Zuckerberg and COO Sheryl Sandberg put major problems at the company on the sidelines and sometimes even attempted to deflect blame for high-profile scandals over the past 18 months.

- The lack of care over Facebook's behavior from the ad sector stands in stark contrast to growing calls in the industry for digital advertising transparency and brand bravery. Ad Age spoke to several anonymous agency sources that appeared amazed by this discrepancy and who noted that brands have not raised any red flags or eased off their ad spending with Facebook despite continued controversies around data privacy and bad actors manipulating the social network.

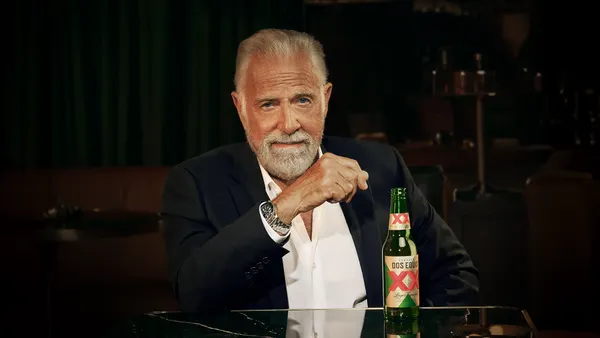

- While most sources spoke to Ad Age anonymously, Anheuser-Busch InBev said in a statement that it's not pulling any advertising from Facebook but is "continuing to watch this closely." Daryl Lee, global CEO of IPG's UM agency, seemed to directly rebuke a source the Times spoke to in a follow-up story measuring advertisers' reaction to its initial report. Publicis Groupe's Chief Growth Officer Rishad Tobaccowala told the Times he believed Facebook had "no morals" in its quest for continued growth. Lee, in a statement to Ad Age, said it's not a question of morals, but whether Facebook can put the proper tools in place to ensure brand safety. IPG and Publicis are rival ad holding groups.

Dive Insight:

Marketers reportedly being unfazed by last week's Times report and the number of scandals that have recently dinged Facebook's reputation raises some important questions for the marketing industry, which has amplified calls for transparency and brand safety in digital advertising but appears unwilling to take any significant action against a platform that has repeatedly failed to meet those demands.

If marketers continue to emphasize the need for transparency and for brands to be a force for societal good, and at the same time continue to spend more money with Facebook, it's possible that they could come across as inauthentic with consumers and lose some of their trust. Per the Ad Age report, some of that scrutiny is already being felt by industry insiders on the agency side. Agencies occasionally compete with Facebook for brand dollars, which potentially helps to explain why they've been more vocal with their frustrations.

The Times report has already driven Facebook to establish more independent oversight and fueled outside conversations that it's potentially time for leadership changes at the social network. Following the report, Facebook announced plans to set up an independent appeals body to monitor posts that might violate the platform's rules, per The Washington Post.

Facebook remains a top player in digital advertising and is forecast by eMarketer to account for 20.6% of the U.S. market this year. The company reported a 33% increase in revenue to $13.73 billion for Q3 2018, but fell short of analyst expectations. The performance was Facebook's lowest percentage increase of revenue growth in the past six years. The company plans to focus more on nascent ad formats like the photo and video collages known as Stories to drive future growth.

Consumers, however, are becoming more concerned about data privacy and security, including how platforms like Facebook are collecting and using their personal data and their ability to protect it. Digital consumption of content across Facebook properties, including the core platform, Messenger, Instagram and WhatsApp, dropped 7% in September, according to Pivotal Research Group. The core platform netted more users, but they used the site less, leading to what analyst Brian Wieser suggested is a 20% decline in consumption per person.